Manage your daily accounting, reconcile accounts, and generate reports in full compliance with FTA & IFRS standards.

Businesses Onboarded

Transactions Processed

Excellent Customer Reviews

Run your books, manage cash flow, and stay compliant, all from one dashboard.

Record transactions with full account mapping and project tagging for organized, audit-ready books.

Access updated P&L and balance sheets each morning with transaction-level details for better analysis.

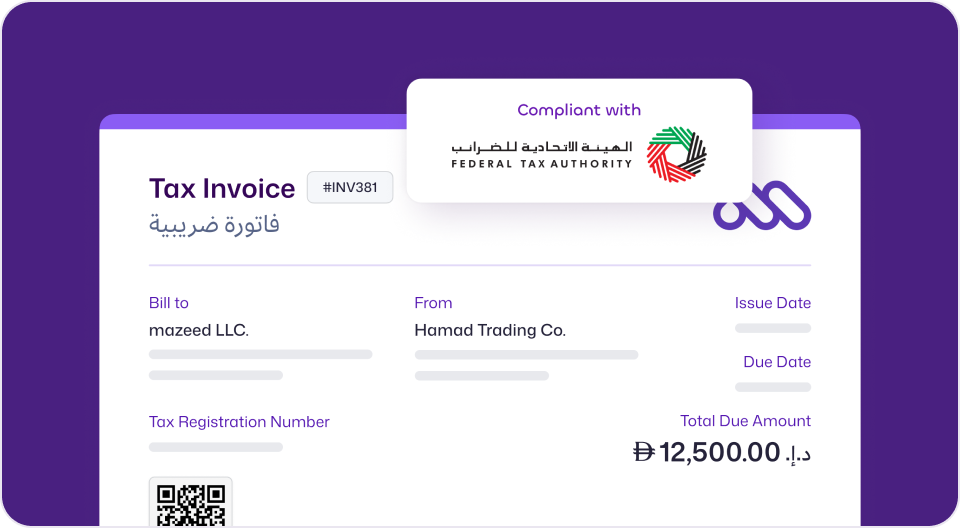

Quickly match your recorded payments and receipts to keep books error-free.

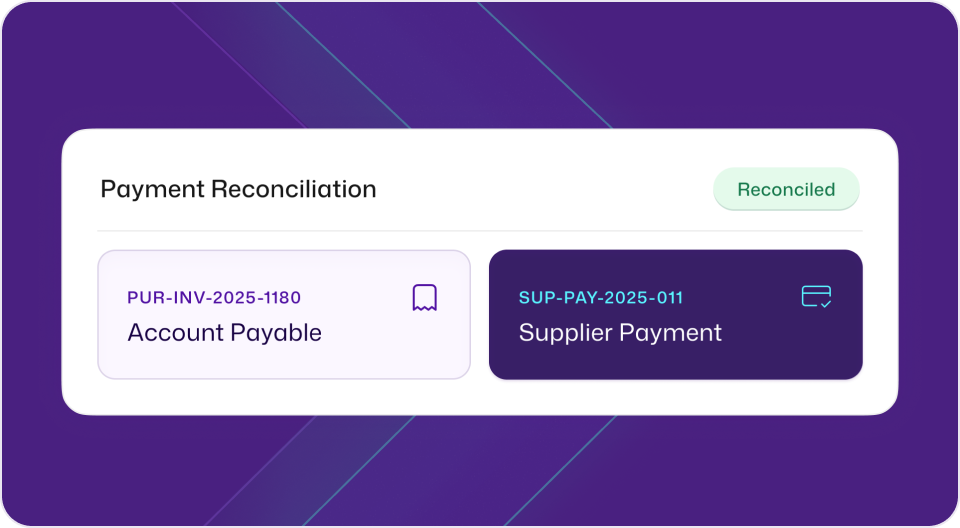

Generate monthly statements with VAT and Corporate Tax breakdowns, formatted for accountant review or audits.

Manage finances with ease and stay tax ready.

Streamline bank imports and transaction matching to save hours each week.

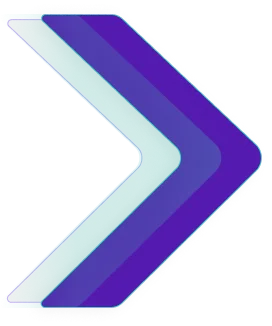

Generate FTA-ready reports with proper tax tracking and 7-year archives.

Track cash flow and expenses by project to make better decisions.

Generate real-time accounting reports in seconds and understand your financial position without any complexity.

Effortless invoicing for freelancers and micro-businesses.

Simple compliance and billing tools for small companies.

Advanced tools for SMEs with e-commerce and inventory.

Complete finance solutions for larger businesses.

Effortless invoicing for freelancers and micro-businesses.

Simple compliance and billing tools for small companies.

Advanced tools for SMEs with multicurrency and inventory.

Complete finance solutions for larger businesses.

If you’re just getting started and only need invoicing and basic sales module features, the Starter (Free) plan is ideal. For growing businesses needing additional users, expense tracking, and integrations, choose Essential. For businesses with advanced needs like inventory, cost centres,and full ERP features, go for Advance. If you have multiple branches or custom requirements or need expert support, the Enterprise plan is best.

Yes, the Starter plan is completely free (0 AED/month), and you can start a free trial of the higher-tier plans for 14 days before committing.

No credit card is required to start the free trial. You can explore the platform risk-free and upgrade when ready.

The free trial of paid plans lasts for 14 days, allowing you full access to features before choosing a paid plan or remaining on the Free plan.

The listed prices are shown exclusive of local VAT. Taxes will be calculated and added at checkout according to your region’s rules.

We accept major credit/debit cards, and other regionally supported payment methods. Payment is processed securely, and you will receive an official invoice for your subscription.

Yes, you can choose to pay monthly or annually. Annual billing often comes with a discount. You’ll see the option for monthly vs yearly when selecting your plan.

Absolutely. You can upgrade or downgrade your plan at any time from your account dashboard. The change will take effect in the next billing cycle, and your data remains intact.

Join thousands of businesses using mazeed to simplify their accounting and stay fully compliant.