Understanding the UAE’s Value-Added Tax (VAT) system can be tricky. But knowing about zero-rated supplies is key for UAE businesses. This guide will cover everything about zero-rated supplies, including the legal side, who’s involved, and what’s included.

If you run a business or work in finance in the UAE, you need to get VAT. Knowing about zero-rated supplies is especially important. It helps with tax planning, staying compliant, and enjoying tax-free benefits.

Understanding Zero Rated Supplies in UAE’s VAT System

If you own a business in the United Arab Emirates, knowing about zero rated supplies is key. The UAE tax authorities have set up a clear system for these tax-free transactions. This system helps businesses run more efficiently.

Basic Principles of Zero Rating

Zero rating lets certain goods and services be sold at a 0% VAT rate. This makes them tax-free. Businesses can still get tax back on what they buy but don’t have to charge VAT on what they sell. Zero rating supports important sectors and activities that benefit everyone.

Legal Framework and Regulations

The rules for zero rated supplies in uae are in the Federal Decree-Law No. (8) of 2017. This law and its rules tell us who can get zero rating, what documents are needed, and how to get tax back.

Key Stakeholders and Their Roles

- The Federal Tax Authority (FTA) oversees the VAT system, including zero rating rules.

- Businesses must follow the FTA’s rules and keep detailed records to stay compliant.

- Customers pay less for zero-rated goods and services, making them more affordable.

Knowing the basics, laws, and who’s involved in zero rated supplies in the UAE helps businesses. They can better use the VAT system to their advantage.

What do you know about zero rated supplies in UAE?

In the United Arab Emirates, zero rated supplies in uae are key in the value-added tax (VAT) system. These are goods and services with a 0% VAT rate. This makes them VAT-free for everyone. Knowing about zero rated supplies is vital for understanding UAE’s tax rules.

Zero rated supplies are items not taxed at the usual 5% VAT rate. They are taxed at 0%, which helps businesses get back the tax they paid on these items. This is good for both the seller and the buyer, as it keeps the final cost the same.

Some important features of zero rated supplies in the UAE include:

- Essential goods and services, like healthcare and education

- Exports of goods and services outside the UAE

- Supplies of precious metals like gold and silver

- International transport services

Businesses dealing with zero rated supplies must follow certain rules. They need to keep accurate records and know the laws well. This is important to avoid fines and ensure they follow the tax rules correctly.

By grasping the idea of zero rated supplies in the UAE, businesses and consumers can benefit from tax savings. They also make sure they follow the rules. This knowledge helps in running operations smoothly, reducing taxes, and making the VAT system more efficient.

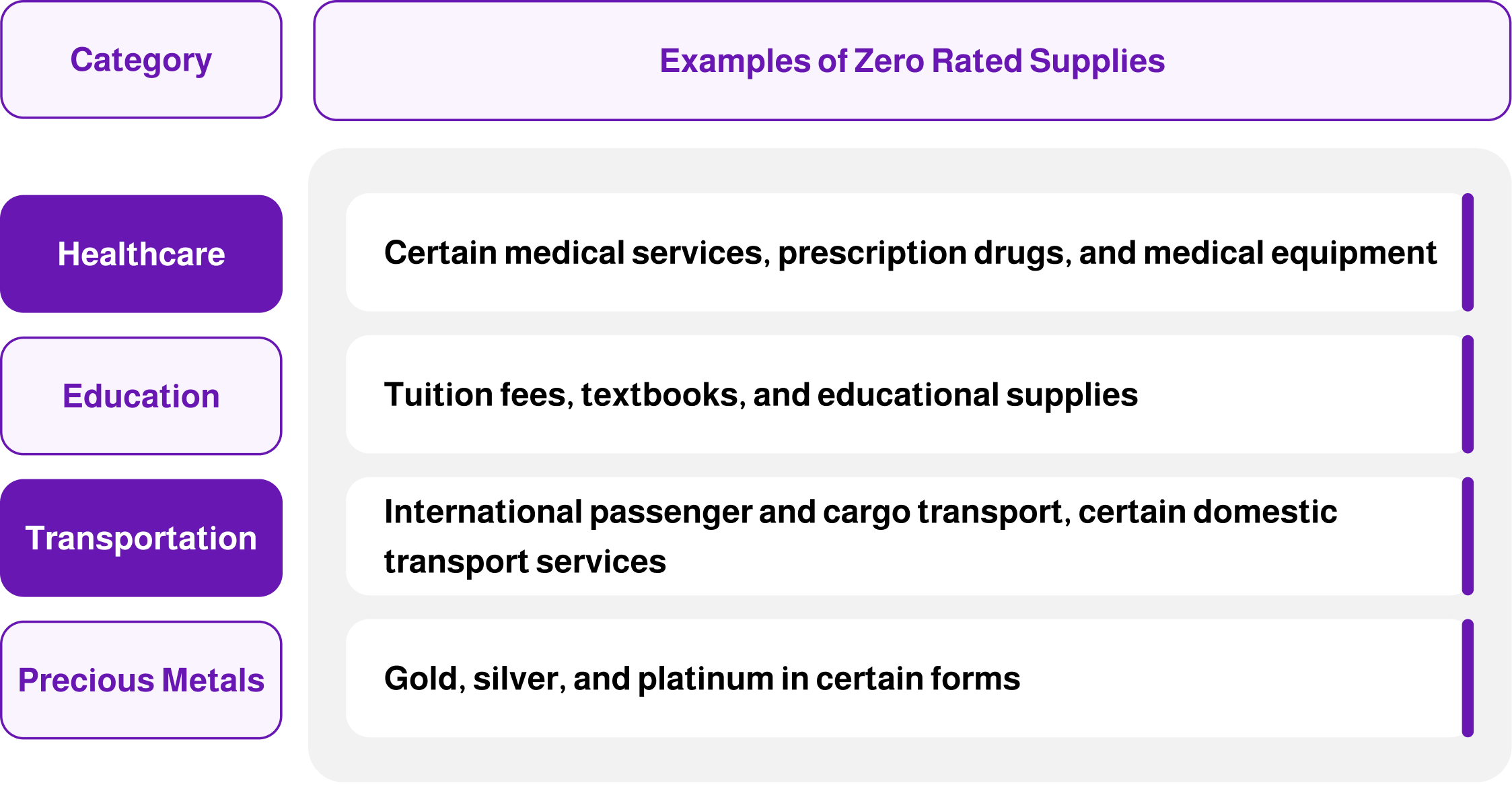

Categories of Zero Rated Supplies in UAE

In the UAE, some goods and services have a 0% VAT rate. This is known as “zero-rated supplies.” It offers big tax savings for both businesses and people. Let’s look at the main types of zero-rated supplies in the UAE.

A- Healthcare Services and Related Products

The UAE puts a lot of focus on healthcare. Many medical services and important health products are zero-rated. This includes doctor visits, prescription drugs, and medical tools. It makes healthcare affordable for everyone in the UAE.

B- Educational Services

Education is also zero-rated in the UAE. This includes fees for schools and universities. Zero-rating education helps everyone learn and grow. It’s key for the UAE’s future.

C- Transportation Services

The UAE has a great transportation system. Many public transport options are zero-rated. This includes buses, metro, taxis, and plane tickets. It makes travel cheaper and encourages using public transport.

D- Precious Metals and Investments

The UAE is famous for its precious metals and investments. Certain deals in gold, silver, and other metals are zero-rated. It helps the UAE stay a top place for these markets.

These are the main zero-rated supplies in the UAE. They are important for the country’s growth. Knowing about zero-rating helps businesses and people save on taxes.

- Education Services

- Health care

- International transport

- Oil and gas

- Precious metals

- Supply of certain healthcare services

- Charitable building supplies

- Residential buildings

- Aircraft and vessels for rescue

- Air passenger transport

- Exempt supplies of vat

- Medicines and pharmaceuticals

- The first supply for residential buildings

Difference Between zero rated supplies vs exempt supplies

In the UAE’s VAT system, there’s a key difference between zero rated supplies vs exempt supplies. It’s important for businesses to understand this to follow UAE VAT rules and stay compliant.

Zero-rated supplies have a 0% VAT rate. This means no VAT is charged to the customer. But, businesses can still get back the tax they paid on these supplies. Exempt supplies, however, don’t have VAT, and businesses can’t get back the tax they paid for these items.

Difference between zero rated and exempt supplies:

The main difference zero rated supplies vs exempt supplies is how they affect a business’s VAT reporting and cash flow. Zero-rated supplies let businesses get back the tax they paid. But, exempt supplies don’t, which can really impact a company’s finances and how it follows the rules.

Businesses in the UAE need to check their transactions carefully. They must make sure they’re classifying their supplies right. This helps them manage their VAT better and keep their finances healthy.

Input Tax Recovery for zero rated supplies in UAE

Understanding input tax recovery for zero rated supplies in uae can be tricky. But knowing the key steps helps businesses get the most from their VAT refunds. It’s important to know about documentation, the timeline, and common issues when claiming input tax credits.

Documentation Requirements

Businesses need to keep detailed records and documents for input tax recovery. This includes invoices and customs declarations. These must show the zero rated nature of the transactions. Having these documents ready and in line with VAT rules is key for a smooth process.

Recovery Process and Timeline

The time it takes to get input tax back can vary. But usually, businesses get their VAT refunds in 20-30 business days after a complete claim. The process involves filing forms with the Federal Tax Authority (FTA) and providing the right documents. Keeping up with FTA updates can make the process easier.

Common Recovery Challenges

Even though the process is clear, businesses might face some hurdles. These can be due to missing documents, data errors, or FTA delays. Good communication with the FTA and careful record-keeping can help overcome these issues.

By grasping the documentation needs, the recovery steps, and common hurdles, UAE businesses can confidently handle input tax recovery for zero rated supplies. This way, they can make the most of their input tax recovery and UAE VAT refunds.

Export-Related zero rated supplies in uae

In the United Arab Emirates, the VAT system has a special rule for international deals called “zero rating.” This rule means that some exports from the UAE don’t have to pay VAT. This is a big help for businesses that trade across borders.

To get zero rating, exports must follow certain rules set by the UAE’s VAT laws. These rules make sure the goods or services are really going to places outside the Emirates. This keeps the UAE’s VAT system strong.

Key Conditions for zero rated supplies in uae Exports

- The goods or services must be physically exported from the UAE to a location outside the UAE.

- The exporter must keep the right documents, like customs forms and commercial invoices, to show the export.

- The customer getting the exported goods or services must be outside the UAE.

- The exported items can’t be used or eaten in the UAE before they’re shipped out.

By following these rules, UAE businesses can get ahead in the global market. This boosts UAE exports and makes the country a key player in international trade.

It’s important for UAE companies to know about zero rated international deals. By being up to date and following the rules, businesses can make the most of this tax break. This helps them grow in the global market.

Documentation Requirements for Zero Rated Transactions

Understanding the UAE’s VAT system can be tricky, especially for zero rated supplies. Businesses must follow certain rules to keep accurate records. This includes knowing about the key forms, certificates, and record-keeping guidelines.

Required Forms and Certificates

To make a zero rated supply, you need to have the right forms and certificates. These are:

- VAT Zero-Rated Supply Certificate: This is filled out by the supplier to show the sale is zero rated.

- Export Declaration Form: This is needed for goods shipped out of the UAE, proving the export.

- International Transport Documents: These include air waybills, bills of lading, or CMR consignment notes. They show the goods were moved internationally.

Record Keeping Guidelines

Keeping accurate records is key for UAE VAT. For zero rated supplies, you should have:

- Copies of all invoices for zero rated supplies in uae.

- Copies of all important forms and certificates, like the VAT Zero-Rated Supply Certificate and Export Declaration Form.

- Detailed records of the zero rated supplies. This includes what was sold, when, and how much it was worth.

- Proof of export, like transportation documents and customs clearance records.

Following these rules for UAE VAT documentation and zero rated supply records helps you stay legal. It also makes it easier to get back input tax and lowers the chance of audits or fines.

Common Mistakes in Handling Zero Rated Supplies

Dealing with the UAE’s VAT system can be tricky. Businesses often struggle with managing zero rated supplies. Knowing the common mistakes helps ensure UAE VAT compliance and avoids zero rated supplies in uae errors.

One big mistake is misclassifying supplies. Companies might think a supply is zero rated when it’s not. This can lead to wrong VAT reporting and penalties. Also, not keeping good records for zero rated deals can hurt your chance to get back input tax.

- Misclassifying supplies as zero rated supplies uae when they should be standard rated or exempt

- Neglecting to keep detailed records and documentation for zero rated transactions

- Incomplete or inaccurate VAT reporting for zero rated supplies

- Lack of understanding the legal framework and regulations governing zero rating

- Overlooking the specific requirements for export-related zero rated supplies

To dodge these mistakes, businesses should keep up with VAT rules. They should also get help when needed and have strong controls for keeping records right. By tackling these issues, you can improve your UAE VAT compliance and cut down on zero rated supply errors.

Impact of Zero Rating on Business Operations

The UAE’s VAT system has changed a lot for businesses. zero rated supplies in uae have brought big changes. Knowing the financial ups and downs helps companies manage better.

Financial Benefits and Considerations

Zero-rated supplies mean businesses can get back the VAT they paid. This is a big help for companies with lots of zero-rated goods or services. It boosts their cash flow a lot.

But, there’s a catch. Keeping records and following rules can be hard. It takes a lot of time and effort. Companies need to plan well to make sure they gain more than they lose.

Operational Adjustments

Businesses in the UAE might need to change how they work. This could include:

- Setting up good systems to track zero-rated deals

- Teaching employees about zero-rated rules

- Working well with suppliers and customers

- Keeping policies up to date with VAT changes

By making these changes, UAE companies can benefit from zero-rated supplies. They can also stay ahead in the market.

How mazeed Can Help You?

|

Future Changes and Developments in UAE VAT Laws

The UAE VAT system is always changing. Businesses in the UAE need to watch for future tax regulations that could affect them. The current zero-rated supplies help businesses save money, but new laws might bring new rules.

Experts think the UAE might add more things to the zero-rated supplies list. They believe the UAE government could make more goods and services tax-free. This could help businesses make more money and improve their cash flow. This could include new areas like healthcare, education, or transportation.

The UAE VAT authorities might also make it harder to prove zero-rated transactions. Companies need to keep up with any new forms, certificates, and record-keeping rules. This is to avoid fines and keep financial records right.

To get ready for these future tax regulations, UAE businesses should check their processes. They should also get expert advice and plan to adapt to the changing VAT landscape. By being prepared, companies can avoid problems and find new chances in the UAE VAT system.

Zero rated supplies are key in the UAE’s VAT system. They help your business stay compliant and benefit from zero rating. Understanding the basics and who’s involved is crucial.

Healthcare, education, transport, and precious metals are all zero rated. Knowing the differences between zero rated and exempt supplies is important. It helps you understand VAT better.

To make the most of zero rated supplies, learn about the needed documents and how to recover input tax. Be aware of common challenges and export rules. This way, you can avoid mistakes and keep your business safe from penalties or audits.

Saudi (SR)

Saudi (SR)