In the quiet machinery of business, amidst roaring innovation and fast-tracked decision-making, there is a silent, paper-thin architect of trust: the tax invoice. It does not speak, but it verifies. It does not persuade, but it confirms. Beneath its modest layout lies a calculated choreography of compliance, clarity, and credibility. Yet far too often, businesses underestimate the power of a well-designed tax invoice template, until a delay, a miscalculation, or an audit reminds them otherwise.

In this article, we journey beyond the surface of billing and into the structure of accountability. This is not just about lines and totals; it’s about how a document can embody discipline, trust, and foresight. Let’s go behind the tax invoice and learn how to optimize its function using modern accounting software like mazeed.

💡 Get Your Business Ready for E-Invoicing in the UAE!

Tax Invoice Definition: Beyond the Basics

At its core, a tax invoice is a legal document issued by a registered seller to a buyer, detailing the products or services provided, their prices, the VAT applied, and the total amount payable. But that definition, while accurate, barely scratches the surface.

A well-structured tax invoice template does much more than list amounts:

- It confirms that the seller is VAT-registered.

- It ensures the buyer can claim back input tax (where eligible).

- It protects both parties during audits or disputes.

What Does a Smart Tax Invoice Template Do?

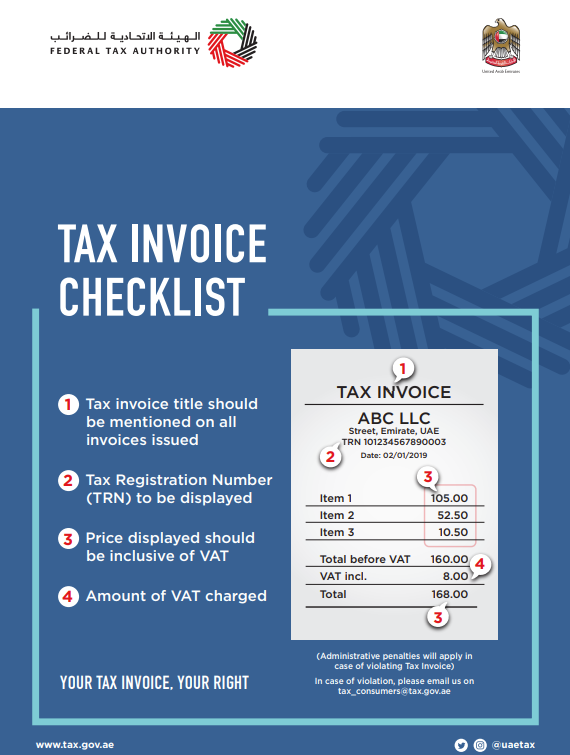

A powerful tax invoice template does more than tick boxes; it tells a story. A story of what was delivered, when, how much it cost, and under what terms. The Intelligent Invoice Template Should Include:

1. Header of Identity and Authority

- Business name, logo, and contact details.

- Tax Registration Number (TRN).

- Invoice Title (e.g., Tax Invoice).

2. Unique Invoice Reference

- This isn’t just a serial number, but a unique identifier for audits, payment tracking, and filing.

- Helps both sender and recipient avoid duplication or confusion, reinforcing the concept behind invoice reference meaning.

3. Invoice and Due Dates

- The invoice date defines the tax point, the moment VAT becomes applicable.

- The due date aligns with the invoice payment terms. For instance, an invoice payment terms example NZ might be “Payment due within 14 days of issue.”

4. Customer Details

- Client name, address, and (if applicable) VAT number.

- Ensures mutual traceability and legal compliance.

5. Itemized Description of Goods/Services

A core component that adds transparency and legal validity:

- Quantity and unit price.

- Line-by-line subtotals.

- Any discounts or adjustments.

6. VAT Calculation Details

- The VAT calculator should auto-calculate both line-item and total tax values.

Must clearly display:

- VAT rate applied (e.g., 5%, 15%, etc.)

- VAT amount per line

- Total

💡 From Quote to Invoice, Seamlessly

Create compliant tax invoices, track payments, and look professional to your clients in seconds with mazeed accounting software.

How to Calculate UAE VAT Right Every Time?

Every day, business owners and accountants wrestle with the same question: How to calculate VAT? Understanding VAT begins with knowing whether your price is inclusive or exclusive of tax.

A. Calculating VAT on a Price Excluding VAT

If the listed price excludes VAT, you’ll need to calculate and add the VAT separately.

Formula:

VAT = Price excluding VAT × (VAT rate ÷ 100)

Total Price = Base Price + VAT

Example:

Base Price = 1,000 AED

VAT Rate = 5%

VAT = 1,000 × 0.05 = 50 AED

Total = 1,050 AED

This approach is standard in the UAE tax invoice format, and using a digital VAT calculator ensures accuracy in real time.

B. Calculating VAT from a Price Inclusive of VAT

When the total already includes VAT, you’ll need to extract it to find the price excluding VAT.

Formula:

VAT = Total Price × VAT rate ÷ (100 + VAT rate)

Net Price = Total Price – VAT`

Example:

Total Price = 1,050 AED

VAT Rate = 5%

VAT = 1,050 × 5 ÷ 105 = 50 AED

Net Price = 1,000 AED

Read more: Credit Invoice Format in UAE

Invoice vs Quote: Two Pages, Two Purposes

A quote is a promise in progress. An invoice is a claim already due. The difference between an invoice vs a quote may seem semantic, but in legal and financial terms, it’s vast.

Key Differences:

| Aspect | Invoice | Quote | Relevant Keywords |

| Purpose | Request payment for goods/services delivered | Provide estimated cost before sale | invoice vs quote, tax invoice template |

| Legal Standing | Legally binding financial document | Non-binding, subject to negotiation | invoice reference meaning |

| Content | Includes VAT, total payable, payment terms, invoice reference | Pricing estimates, validity period, no VAT charged | VAT calculator, invoice payment terms example NZ |

| Timing | Issued after service/goods delivered | Issued before agreement or sale | invoice payment terms example NZ |

| VAT Application | VAT must be calculated and shown | No VAT applied as no transaction occurred | how to calculate VAT, VAT calculator |

Blurring the line between the two can lead to disputes, delayed payments, and taxation errors. Your tax invoice template should never resemble a quote, it should exude authority.

Invoice Reference Meaning: The Secret Code of Financial Integrity

The invoice reference is not a trivial ID. It is a digital breadcrumb, a control number that links documents, payments, and obligations. Think of it as the serial number on a bond, it tracks legitimacy.

Why It Matters:

- Enables precise tracking of payments and reconciliations

- Prevents duplication of transactions

- Aids in dispute resolution and auditing

- Essential for enterprise-level accounting systems

Designing your tax invoice template to generate reference numbers through tool like mazeed accounting software automatically ensures financial transparency from day one.

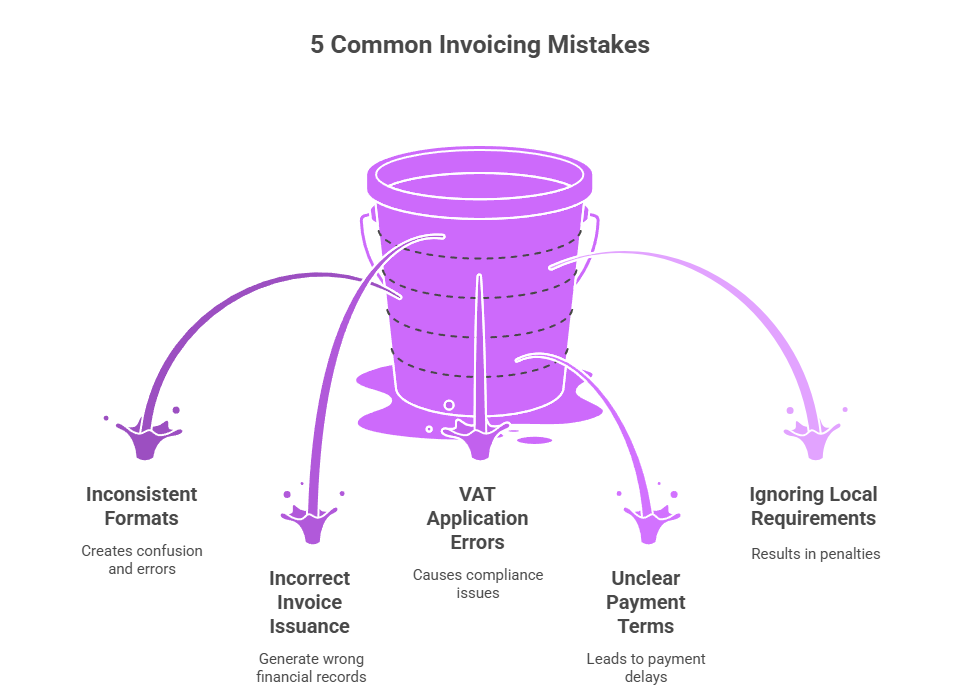

Common Mistakes on the UAE Tax Invoice Template

Without a reliable system, businesses often fall into traps:

💡 Compliance in A New Way

mazeed combines smart accounting software and certified expert in one place to manage your financials at up to 85% less cost.

The Soul of Structure: Why Templates Trump Improvisation

When it comes to issuing tax invoices, many businesses fall into the trap of improvisation, assembling documents ad hoc with the hope that they pass regulatory scrutiny. But improvisation, though occasionally inspired, is unreliable. It lacks memory, consistency, and most critically, compliance.

Read more: How to Send Invoice in Email?

A smart, adaptable tax invoice template:

- Ensures standardization of every document issued

- Embeds VAT compliance by default

- Reduces human error in calculations

- Reflects brand professionalism

- Seamlessly integrates with accounting software

mazeed automates the process to help you:

- Confidently calculate price excluding VAT with precision

- Clearly define invoice payment terms tailored for your market, be it a detailed invoice payment terms example NZ or customized global terms

- Maintain consistent, unique invoice references to keep your books spotless

- Differentiate seamlessly between invoice vs quote, streamlining your sales process

With mazeed, compliance and professionalism become effortless habits. Your business gains a trustworthy financial backbone, freeing you to focus on innovation, service, and growth.

FAQs: UAE Tax Invoice Template

What is a tax invoice template in UAE?

A UAE tax invoice template is a standardized format businesses use to issue VAT-compliant invoices, ensuring they meet Federal Tax Authority (FTA) requirements.

What should a UAE tax invoice include?

It must include the supplier’s name, address, TRN (Tax Registration Number), a unique invoice number, date of issue, description of goods or services, quantity, VAT rate, VAT amount, and the total amount payable.

Is a tax invoice mandatory in the UAE?

Yes, VAT-registered businesses must issue a tax invoice for all taxable supplies of goods and services as per FTA rules.

What is the difference between a simplified invoice and a tax invoice in UAE?

A simplified invoice is used for supplies under AED 10,000 and requires fewer details, while a full tax invoice is required for higher-value transactions and B2B supplies.

Is an electronic tax invoice allowed in the UAE?

Yes, electronic tax invoices are accepted, provided they contain all mandatory details and follow FTA guidelines.

What is the penalty for not issuing a tax invoice in UAE?

Failure to issue a compliant tax invoice can result in administrative penalties, including fines starting from AED 2,500.

Where can I download a UAE tax invoice template?

Businesses can download FTA-approved invoice templates from accounting software providers or create their own as long as they comply with UAE VAT law.

How do I know if my tax invoice is FTA compliant?

Check that it includes the TRN, VAT amount, supplier and recipient details, and follows the required Arabic and English language format.

Do freelancers in UAE need to issue tax invoices?

Yes, if a freelancer is VAT-registered, they must issue tax invoices to clients for taxable services.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.