In the realm of finance, numbers do more than count, they tell tales. Each transaction, each ledger entry, each debit and credit sings in the chorus of your company’s financial narrative. And like any great story, it must be well organized. That’s where the chart of accounts list comes in. Imagine a grand library with shelves labeled and catalogued meticulously, this is what a chart of accounts does for your business books. It’s not just a list; it’s your financial architecture.

In this article, we dive deep into the structure, purpose, and customization of a chart of accounts list, with smart use of modern tools like accounting template Google Sheets, and bookkeeping categories. We’ll also show how tools like journal entries for vehicle purchases with down payment or ledger books fit into this elegant system.

Read more: The Chart of Accounts for SaaS Company

The Anatomy of a Chart of Accounts List

Behind every well-managed business lies a silent architecture that holds it all together, its chart of accounts list. This isn’t just a table or a ledger; it’s the skeletal framework upon which every financial action, decision, and report stands. Understanding its anatomy is like reading the genetic code of your company’s financial health.

At its core, a chart of accounts list is an indexed map that categorizes every financial transaction. It breaks down the business’s economic life into intelligible parts, allowing you to record, retrieve, and review data with surgical precision.

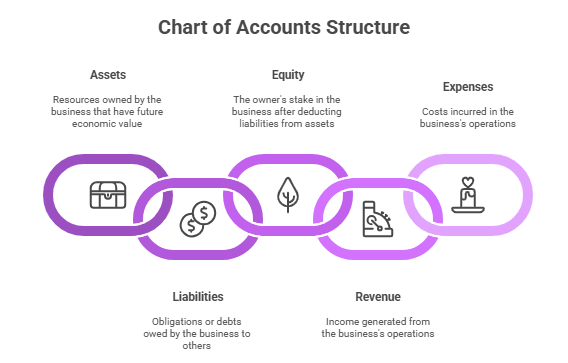

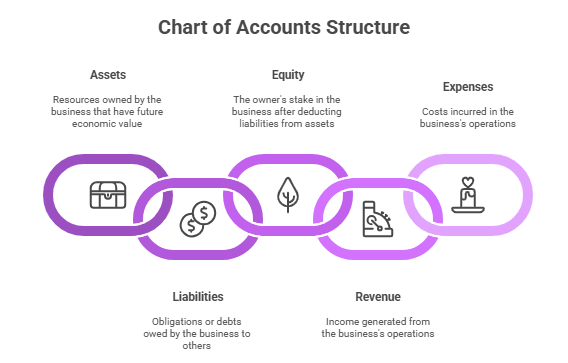

The accounts are typically grouped into five major categories, each with its own role in telling your company’s story:

Standard Chart of Accounts Structure

| Account Type | Account Code Range | Examples | Notes |

| Assets | 1000–1999 | Cash, Accounts Receivable, Inventory | Can include petty cash and fixed assets |

| Liabilities | 2000–2999 | Credit Cards, Loans, Accrued Expenses | Includes short- and long-term obligations |

| Equity | 3000–3999 | Owner’s Capital, Retained Earnings | Reflects shareholder interest |

| Revenue | 4000–4999 | Sales, Interest Income, Commissions | Should align with your bookkeeping |

| Expenses | 5000–5999 | Utilities, Rent, Office Supplies | Break down using detailed bookkeeping categories |

💡 Organize Your Books Easily

Build a clean and accurate chart of accounts that keeps every asset, expense, and ledger entry in perfect order with mazeed accounting software.

Smart Bookkeeping Categories:

A common mistake among business owners, especially when first learning how to keep books for a small business, is either overcomplicating the chart or leaving it too vague. The solution? Strike the perfect balance between detail and simplicity. Your chart of accounts list should reflect your unique operations without becoming an endless scroll.

Here are the essential bookkeeping categories every business should consider:

1- Operating Expenses:

The heartbeat of daily business, rent, utilities, office supplies.

2- Marketing & Advertising:

Online ads, print campaigns, social media promotions.

3- Cost of Goods Sold (COGS):

Raw materials, manufacturing, packaging, critical for inventory-based businesses.

4- Employee-Related Expenses:

Salaries, training, insurance, and benefits.

5- Professional Services:

Accountants, consultants, legal advisors.

6- Petty Cash Transactions:

Small, everyday purchases, tracked via a dedicated petty cash account in your ledger book.

By establishing smart, well-labeled categories, you pave the way for intuitive tracking, automated reporting, and fewer end-of-year headaches. These categories should sync seamlessly with tools like Google Sheets, ensuring that your entries are cleanly categorized and easily exportable to a bookkeeping PDF free download for audits or tax filing.

Read more: Statement of Account Sample for UAE Businesses

Accounting Template Google Sheets

In a world driven by mobility and immediacy, the traditional spreadsheet has evolved into something far more agile: the accounting template Google Sheets. For small business owners, freelancers, and financial teams alike, these dynamic templates offer a flexible, cloud-based alternative to expensive accounting software, without sacrificing control or clarity.

Gone are the days of chasing version history or emailing Excel files back and forth. With Google Sheets, you work in real-time, access your books from anywhere, and collaborate instantly. It’s bookkeeping on your terms, customizable, shareable, and smart.

Why Use an Accounting Template Google Sheets?

Here’s how Google Sheets revolutionizes small business bookkeeping:

- Pre-built Formulas and Formatting:

Whether you’re tracking cash flow, income, or expense categories, many templates come with built-in calculations linked directly to your chart of accounts list.

- Simple Customization:

Rename categories, adjust columns, or add new sheets based on your bookkeeping categories without needing coding or software training.

- Seamless Sharing:

Grant access to your accountant or business partner with one click. Transparency becomes effortless.

- Cloud Convenience:

Sync across devices, manage petty cash in the café, approve a journal entry for vehicle purchase with down payment from home, or check your ledger book before a client meeting.

- Easy Export Options:

Save a month-end summary or full-year record as a bookkeeping PDF free download, perfect for audits or compliance checks.

Sample Chart of Accounts

Every business is unique. A retail store doesn’t need the same chart as a consultancy firm. A sample chart of accounts can serve as a flexible foundation, giving structure while allowing personalization. Here’s a sample model for a small eCommerce business:

Sample Chart of Accounts for eCommerce

| Code | Account Name | Type |

| 1010 | Cash on Hand | Asset |

| 1020 | Inventory | Asset |

| 2010 | Accounts Payable | Liability |

| 4010 | Online Sales | Revenue |

| 5010 | Website Hosting | Expense |

| 5020 | Shipping and Delivery | Expense |

| 5030 | Marketing and Promotion | Expense |

How Do I Keep Books for a Small Business?

It’s a question asked by thousands of entrepreneurs each day: how do I keep books for a small business? The answer isn’t in complicated software or elusive accounting jargon, it starts with structure. Just like a house is built on a strong foundation, your financial records must rest on an organized, deliberate framework. And that framework begins with your chart of accounts list.

The Golden Rules of Small Business Bookkeeping

Whether you’re a startup, a side-hustler, or managing a growing team, these essential steps will guide you in your way:

- Start with a clean chart of accounts list.

- Use modern tools like accounting template Google Sheets.

- Update your ledger book daily or weekly.

- Use predefined bookkeeping categories.

- Save or print monthly reports.

- Make space for petty expenses.

Routine is your best friend in bookkeeping.

How to Manage Petty Cash Account Without Petty Mistakes?

Petty cash is essential, but it’s also a notorious sinkhole. Mismanagement here can lead to frustrating losses. Here’s how to manage petty cash account smartly:

- Set a cap (e.g., 200 AED)

- Record every transaction in a petty cash voucher

- Replenish with proper journal entries

- Reconcile monthly with your ledger book

Read more: Master PDC Journal Entry for UAE Businesses

💡 New Way to Manage Finances in UAE

mazeed combines smart accounting software and certified experts in one place so you can achieve compliance, reduce costs, and focus on your business.

Journal Entry for Vehicle Purchase with Down Payment

Purchasing a vehicle for your business is a major transaction, and one that must be recorded correctly in your books. The journal entry for vehicle purchase with down payment ensures your asset and liability records reflect reality.

Scenario:

Your company buys a delivery vehicle worth AED 110,000. You pay AED 30,000 upfront (cash) and finance the remaining AED 80,000 through a business loan.

Journal Entry:

| Account | Debit (AED) | Credit (AED) |

| Vehicle (Fixed Asset) | 110,000 | |

| Cash (Asset) | 30,000 | |

| Loan Payable (Liability) | 80,000 |

Explanation:

- Debit Vehicle (Asset) for the full value:

The business gains a tangible asset worth AED 110,000.

- Credit Cash (Asset) for the amount paid as a down payment:

AED 30,000 goes out of your business’s cash reserve.

- Credit Loan Payable (Liability) for the financed amount:

AED 80,000 represents what you owe.

FAQs: Chart of Accounts List

What are the 5 basic charts of accounts?

The 5 basic chart of accounts categories are: Assets, Liabilities, Equity, Revenue, and Expenses. These form the foundation of any accounting system.

What are the 7 chart of accounts?

Some businesses expand the chart of accounts into 7 main categories: Assets, Liabilities, Equity, Revenue, Cost of Goods Sold (COGS), Operating Expenses, and Non-Operating Income & Expenses.

What are the 5 levels of the chart of accounts?

The 5 levels often include: Category (e.g., Assets), Sub-Category (e.g., Current Assets), Account Group (e.g., Cash & Bank), Account Type (e.g., Checking Account), and Sub-Account (e.g., Petty Cash).

What are the 5 basic types of accounts?

The 5 basic types are Assets, Liabilities, Equity (Capital), Revenue (Income), and Expenses. These are essential for double-entry bookkeeping.

What are the 7 types of accounting?

The 7 types typically include Financial Accounting, Managerial Accounting, Cost Accounting, Tax Accounting, Auditing, Forensic Accounting, and Governmental/Non-Profit Accounting.

What are the 4 main accounts?

The 4 main accounts often refer to Assets, Liabilities, Equity, and Revenue. Expenses are sometimes grouped within revenue reporting for specific analyses.

What is a balance sheet?

A balance sheet is a financial statement that shows a company’s Assets, Liabilities, and Equity at a specific point in time to reflect its financial position.

What is the 4-4-5 accounting system?

The 4-4-5 accounting system is a retail accounting calendar that organizes a 52-week year into quarters with two 4-week months and one 5-week month, simplifying period comparisons.

Which are the three types of accounts?

The three traditional types of accounts are Real Accounts (Assets), Personal Accounts (Individuals or Entities), and Nominal Accounts (Revenue and Expenses).

What are the 3 rules of accounting?

The 3 golden rules are:

1- Debit what comes in, credit what goes out (Real Accounts).

2- Debit the receiver, credit the giver (Personal Accounts).

3- Debit all expenses and losses, credit all incomes and gains (Nominal Accounts).

What is a ledger?

A ledger is a book or digital record that contains all the individual accounts of a business, showing the details of each transaction affecting those accounts.

What are assets and liabilities?

Assets are resources owned by a business that provide future economic benefits, such as cash, equipment, or inventory. Liabilities are obligations the business owes to others, such as loans, accounts payable, or accrued expenses.

How do i create expense categories tied to our chart of accounts in the uae?

To create expense categories tied to your Chart of Accounts (COA) in the UAE, first list all common business expenses (rent, salaries, utilities, marketing, etc.), then match each one to an appropriate expense account in your COA based on UAE accounting standards and VAT rules. Ensure each category is clearly named, consistently used, and VAT-ready (standard-rated, zero-rated, or exempt) to support accurate reporting and compliance.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.