When customers buy on credit, your company must track it well to keep cash flowing. This is where accounts receivable journal entry becomes essential, especially for UAE businesses in fast-changing markets.

Keeping accurate records helps you see who owes you money and follows VAT rules.

Properly logged transactions make audits easier, help with taxes, and show payment patterns. For Dubai or Abu Dhabi businesses, this helps them grow in tough markets.

These records also help track what you owe to vendors. Together, they show who you owe and who owes you. Keeping them up to date helps avoid cash problems and improves partner relationships in the Emirates.

Getting good at this helps your balance sheets show your company’s real value، With UAE’s push for digital growth, using efficient methods makes audits and financial choices easier.

Understanding Accounts Receivable Journal Entry Basics

Managing accounts receivable journal entry (AR) is key to keeping your UAE business healthy.

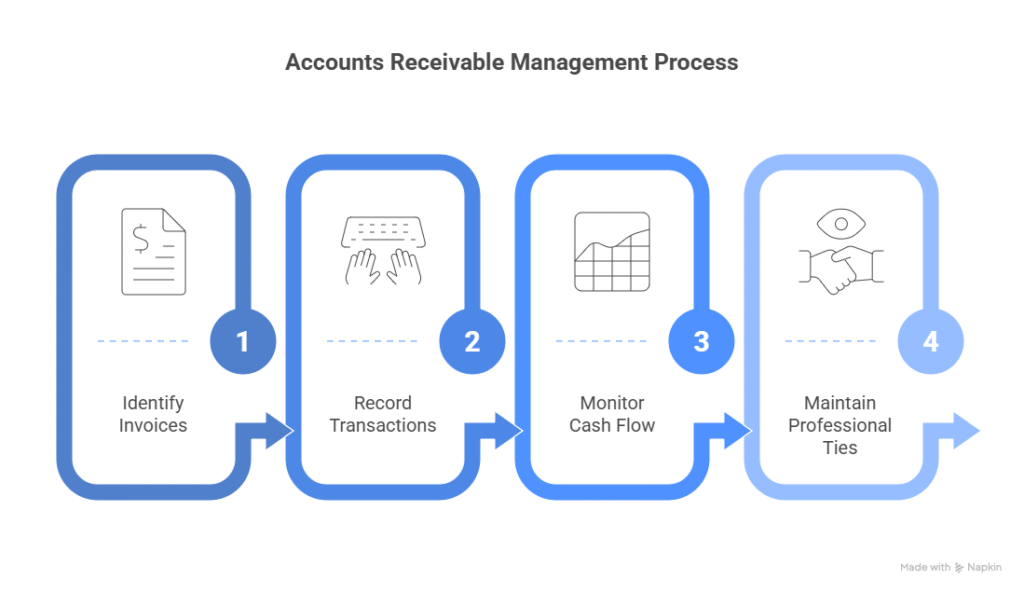

It aligns with local financial expectations. Tracking invoices for Dubai clients or monitoring transactions across emirates is essential. Each journal entry reveals your cash flow and professional ties.

Read more: Accrual Accounting Journal Entries

How Accounts Receivable Journal Entries are Made (Double-Entry System)

In the double entry accounting system, every transaction impacts at least two accounts, with debits always equaling credits.

💡 Manage Accounts Receivable with Ease

Track invoices, automate AR entries, and stay VAT compliant with mazeed accounting software.

When a Sale is made on Credit:

This is the most common and initial entry for accounts receivable.

Debit: Accounts Receivable (This increases the asset account, representing the money owed to your company).

Credit: Sales Revenue (This increases the revenue account, recognizing the income earned from the sale).

Read more: VAT Accounting Entries: Input and Output VAT

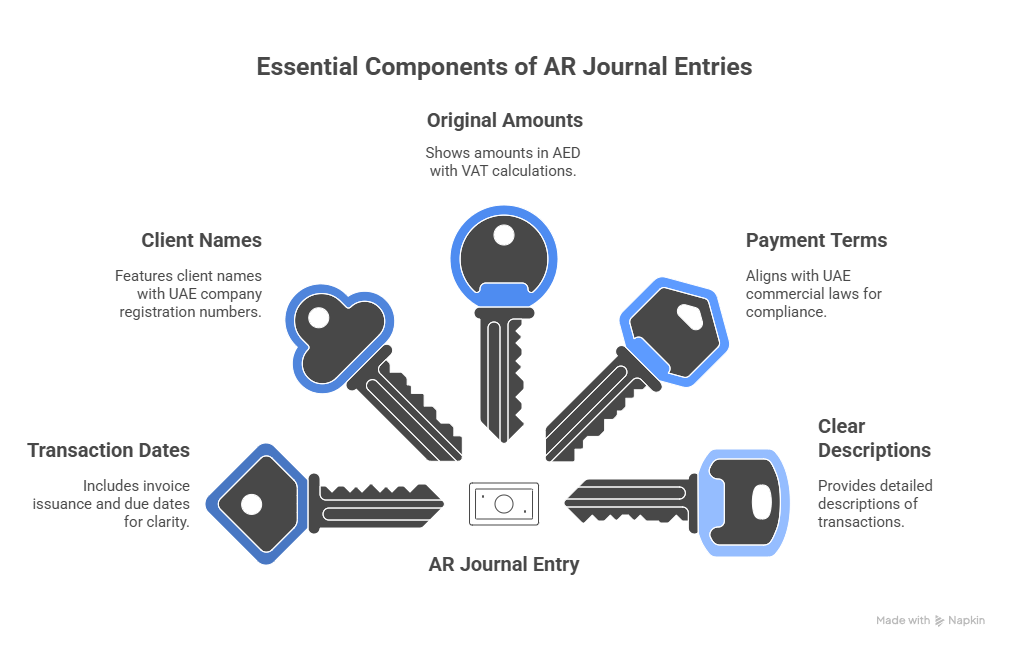

What Makes Up an AR Journal Entry?

AR journal entries are like financial breadcrumbs. They show where your money comes from and when.

Five elements define every entry:

- Transaction dates (invoice issuance and due dates)

- Client names with UAE company registration numbers

- Original amounts in AED plus VAT calculations

- Payment terms matching UAE commercial laws

- Clear descriptions like ”Dubai office interior design project”

For instance, a Sharjah contractor records client payment with specific VAT codes. This follows Federal Tax Authority rules.

It’s crucial for businesses to have a firm grasp on account aging to maintain healthy financial operations. Understanding account aging helps in managing cash flow effectively, and a key component of this is the accounts payable aging report.

By regularly reviewing the accounts payable aging report, companies can identify overdue invoices and prioritize payments. Each accounts payable journal entry directly impacts these reports, so accuracy is paramount.

A meticulous accounts payable journal entry ensures that the data used for generating an aging report is reliable. The aging report provides a snapshot of financial obligations, clearly showing what is due and when.

This ties into the outstanding report meaning, which highlights unpaid invoices and helps assess financial liabilities. In essence, the outstanding report is about understanding the current state of unpaid debts. Utilizing robust payable software can significantly streamline these processes.

Good payable software automates the tracking of invoices and generation of reports, making account aging and accounts payable aging much simpler to manage.

The right payable software not only helps with each accounts payable journal entry but also provides insightful aging report data, offering a clear outstanding report meaning immediately.

Read more:Fixed Asset Register

Why Accurate Tracking Matters in UAE Businesses

Imagine navigating Dubai’s Business Bay without GPS. That’s what AR management without account aging feels like. It sorts unpaid invoices by days overdue.

This helps you:

“Prioritize collections without damaging valued Emirati partnerships – it’s the difference between saying ‘Your payment is late’ and ‘Let’s resolve this respectfully.’”

Outstanding reports are your secret weapon in UAE markets. They show which Abu Dhabi clients pay late, and which Ras Al Khaimah partners are reliable. You’ll notice patterns, like construction firms needing longer payment cycles than retail buyers. Bonus: These reports also help in UAE commercial disputes.

Three UAE-specific benefits come from tight AR tracking:

- Avoid VAT penalties during FTA audits

- Maintain wasta (influence) through professional money management

- Identify clients needing payment plan adjustment

How to Record an Accounts Receivable Journal Entry

Managing accounts receivable journal entry in the UAE is all about precision. This is true, thanks to VAT rules and local payment habits. Let’s go through the steps with examples from Dubai or Abu Dhabi.

1. Identify the Transaction Details

First, write down important info like invoice dates and client names. For instance, if you sell AED 50,000 worth of goods to a Dubai retailer with 30-day terms, remember if VAT applies (usually 5% in UAE).

2. Create Your Initial Entry

Use payable software like QuickBooks or mazeed accounting software to simplify the process.

Debit Accounts Receivable

Boost your AR balance by the total owed. For our example: Debit Accounts Receivable AED 52,500 (AED 50,000 + 5% VAT).

Credit Revenue Account

Then, record the income: Credit Sales Revenue AED 50,000 and Credit VAT Payable AED 2,500 separately for accuracy.

Read more: What is Contra Entry?

3. Handle VAT Compliance (UAE-Specific)

UAE businesses must file VAT returns every quarter. Here’s a quick guide for VAT entries:

| Transaction | Debit | Credit | |

| Taxable Sale (AED 10,000 + 5% VAT) | Accounts Receivable: 10,500 | Revenue: 10,000 | VAT Payable: 500 |

| VAT Payment to FTA | VAT Payable: 500 | Bank Account: 500 |

4. Track Payments Received

When a client pays, update the AR and bank records. For partial payments, split the entry between principal and VAT.

5. Manage Late Payments

Make aging reports weekly to find overdue accounts. Most UAE-friendly accounting software does this automatically:

“A well-structured aging report helps prioritize collections while maintaining positive client relationships – essential in Emirates’ business culture.”

For accounts over 60 days late, add a bad debt provision: Debit Expense Account, Credit Allowance for Doubtful Accounts.

Learning about accounts receivable journal entry is key for your UAE business. It works well with accounts payable aging analysis to show cash flow clearly. This helps track money coming in and going out in dirhams, meeting tax needs.

Regularly checking aging data helps you manage payments and negotiate better deals. It keeps your working capital healthy. This is important for your business’s success.

By tracking AR and reviewing AP aging, you can spot market trends. This helps avoid cash problems and builds trust with partners in Dubai. For more complex issues, get help from UAE accounting experts. They know the FTA rules well.

Read more:VAT Accounting Entries: Input VAT in UAE

💡 A New Way to Handle Receivables in UAE

We give you smart software with expert support to manage credit sales, improve cash flow, and avoid VAT issues.

How to decrease accounts receivable journal entry?

To decrease the amount of accounts receivable on your balance sheet, you can utilize the provision for doubtful accounts. This is a contra-asset account used to write off bad debt. When you determine that a loan or outstanding payment is unlikely to be collected, deducting it from this provision reduces your accounts receivable, reflecting a more accurate picture of what you expect to collect.

Is Accounts Receivable a Debit or Credit?

Accounts receivable journal entry represents money owed to your business by customers or other entities. Therefore, it is recorded as a debit in your accounting system.

Key Takeaways: Accounts Receivable Journal Entry

- Purpose: Track credit sales to manage cash flow, comply with UAE VAT rules, and support audits/taxes.

- System: Uses double-entry accounting → Debit Accounts Receivable, Credit Sales Revenue (+ VAT).

- Elements of an AR entry: Dates, client details, amounts + VAT, payment terms, and descriptions.

- Importance of aging reports: Identify overdue invoices, manage payments, and maintain good client/vendor relations.

- Software use: UAE-focused accounting tools (QuickBooks, etc.) automate VAT, aging reports, and payments.

- VAT compliance: Must separate Sales Revenue and VAT Payable, and file quarterly returns to FTA.

- Bad debts: Use allowance for doubtful accounts to adjust AR balance realistically.

- AR vs AP link: Together they show who owes you and what you owe, helping balance sheets reflect real value.

- Business benefits in UAE: Avoid VAT penalties, strengthen relationships (wasta), and spot clients needing flexible terms.

- AR role: Ensures accurate credit tracking, supports cash inflows, and improves financial decision-making.

FAQs about Accounts Receivable Journal Entry

Is accounts receivable a debit or credit journal entry?

Accounts receivable is recorded as a debit because it represents money owed to your business, which is an asset. When the customer pays, cash (debit) increases and accounts receivable is credited to reduce the balance.

How is accounts receivable recorded?

In the double-entry system:

– Debit: Accounts Receivable (asset increases).

– Credit: Sales Revenue (income earned).

This entry shows that the business has made a sale on credit and expects payment later.

What is the journal entry of bill receivable?

When a bill receivable is created:

– Debit: Bills Receivable Account

– Credit: Accounts Receivable (or Debtor’s Account)

When the bill is paid, cash is debited and bills receivable is credited.

Is accounts receivable data entry?

Not exactly. Accounts receivable involves more than simple data entry. It requires recording credit sales, tracking invoices, monitoring payments, reconciling balances, and ensuring compliance with accounting standards and VAT rules (in places like the UAE).

How to journal entry for accounts receivable?

Basic steps:

1- Identify the sale made on credit.

2- Debit Accounts Receivable for the total owed (including VAT if applicable).

3- Credit Sales Revenue and VAT Payable separately.

When payment is received, Debit Cash/Bank and Credit Accounts Receivable.

What is AR position?

An AR position (Accounts Receivable role) refers to a finance or accounting job responsible for managing customer invoices, collections, and journal entries. The position ensures timely cash inflows and accurate reporting.

What is the main role of AR?

The main role of Accounts Receivable is to manage money owed by customers, ensure timely payments, reduce bad debts, maintain accurate journal entries, and support cash flow health.

What is accounts receivable basic knowledge?

Basic knowledge includes understanding invoices, credit terms, journal entries (debits/credits), aging reports, VAT/tax compliance, and how accounts receivable fits into the balance sheet as a current asset.

What skills do you need for accounts receivable?

Key AR skills:

– Attention to detail in journal entries

– Knowledge of accounting principles (debits/credits, VAT rules)

– Software proficiency (QuickBooks, SAP, Oracle, etc.)

– Communication and negotiation for collections

– Analytical ability to monitor cash flow and payment trends

What is account receivable job salary?

Salaries vary by region.

– UAE: AED 5,000 – 10,000 per month (average range).

– US: $40,000 – $55,000 annually.

Experience, industry, and location significantly affect salary levels.

What are the main types of accounts receivable?

1- Trade Receivables – money from customers for credit sales.

2- Non-trade Receivables – items like employee advances, tax refunds.

3- Notes/Bills Receivable – written promises for payment at a future date.

How do you start accounts receivable?

To start AR:

1- Record the credit sale in a journal entry.

2- Maintain an accounts receivable ledger with client details.

3- Track due dates with an aging report.

4- Follow up on overdue accounts.

5- Reconcile payments received with invoices.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.