The budget vs actual report is a cornerstone of business financial management, offering a detailed comparison between what was planned financially and what was actually achieved. This report provides valuable insights for managers, helping them control costs, forecast future performance, and make informed decisions to steer the company toward its goals.

What Is a Budget vs Actual Report?

A budget vs actual report compares budgeted revenues and expenses against actual figures for a given time period—monthly, quarterly, or yearly. The core purpose is to identify variances, whether positive or negative, and analyze their causes.

The Budget vs Actual Report Typically Includes:

- Projected vs actual revenues

- Budgeted vs actual operating expenses

- Cost of goods sold (COGS) budget vs actual

- Net profit or loss compared to budgeted targets

When properly used, the budget vs actual report highlights inefficiencies, uncovers unexpected expenditures, and identifies areas where the company is outperforming expectations.

What Information Does a Budget vs Actual Income Statement Show?

A budget vs actual income statement shows how a business performed compared to what was originally planned.

It provides:

- Budgeted revenue and expenses for a specific period

- Actual revenue and expenses recorded during the same period

- The difference between budgeted and actual figures (variance)

So, what information is provided by a budget versus actual income statement?

It tells you whether your business met its financial expectations, where costs went over budget, and which areas performed better or worse than planned.

This makes the budget vs actual income statement a key tool for tracking performance and improving future planning.

Why Is the Budget vs Actual Report Important?

Managing a business without comparing actual results to budgets is like navigating without a map. The budget vs actual report serves as this map, allowing business leaders to:

- Control spending and reduce waste

- Improve the accuracy of future budgets

- Identify trends and seasonality

- Enhance cash flow management

For example, if marketing expenses consistently exceed the budget, the report helps flag this early for corrective action.

💡 Simplify Your Budget vs Actual Reporting

Track variances, manage cash flow, and analyze reports easily with mazeed accounting software.

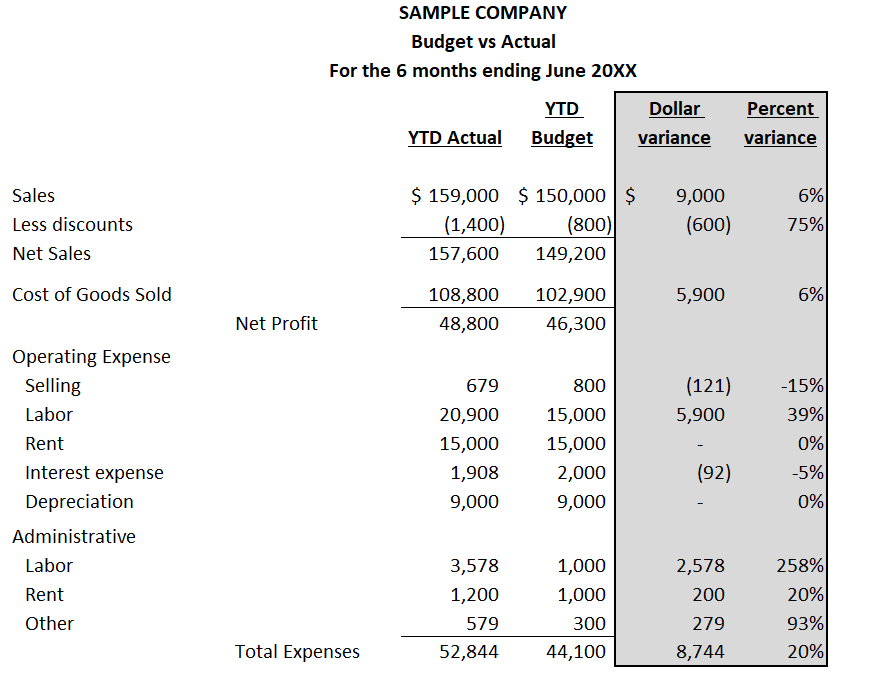

Statement of Comparison of Budget and Actual Amounts

A statement of comparison of budget and actual amounts clearly shows how planned figures compare to real financial results.

This statement typically includes:

- Budgeted amounts

- Actual amounts

- Variance (difference between the two)

- Sometimes variance percentages

By reviewing this comparison, businesses can easily identify:

- Overspending or cost savings

- Revenue gaps or unexpected growth

- Areas where forecasting needs improvement

This comparison helps management take corrective action early instead of waiting until the end of the year.

Cash Flow and Its Relation to Budget vs Actual Reports

Cash flow management is a critical part of budgeting. The daily cash flow statement template is a practical tool businesses use to monitor daily inflows and outflows of cash. This granular tracking ensures that companies maintain sufficient liquidity to meet obligations.

Meanwhile, the indirect cash flow statement template Excel helps summarize cash movements over longer periods, adjusting net income for non-cash items like depreciation and changes in working capital. Together, these templates support detailed cash flow forecasting aligned with budget projections, enhancing the accuracy and utility of the budget vs actual report.

Budget vs Actual — What Is the Difference?

To understand what is the difference between budget and actual, it helps to look at how each one is used.

- Budget: Estimated revenue and expenses planned in advance

- Actual: The real income and expenses that occurred

The difference between them shows whether the business performed as expected. These differences highlight areas that need better control, adjustment, or planning.

Comparing budget and actual figures allows businesses to stay proactive rather than reactive.

Opening Cash Balance Definition and Its Impact

The opening cash balance definition refers to the cash available at the start of an accounting period, a figure critical for cash flow forecasting and budgeting accuracy. If the opening balance is incorrect, subsequent budget assumptions and budget vs actual reports can be skewed, potentially leading to poor financial decisions.

Understanding the Difference Between P&L and Income Statement

Though the terms “Profit and Loss statement (P&L)” and “Income Statement” are often used interchangeably, they refer to the same financial report outlining revenues, costs, and expenses over a period, culminating in net profit or loss.

However, understanding the Difference Between P&L and Income Statement in terminology can help avoid confusion in communication, especially across teams or systems that might use one term more frequently.

This report is foundational to preparing a budget vs actual report because it provides historical data and performance benchmarks essential for setting realistic budgets. Recognizing the Difference Between P&L and Income Statement, even if subtle, ensures consistency in financial reporting and clarity when analyzing business performance.

💡 New Way for Financial Management

mazeed is the first accounting software with on-demand accountants and tax experts. All you need to do is scan your invoices with software, and experts will do the rest.

Common Accounting Entries Related to Budgeting

1- Profit Transfer to General Reserve Entry

A typical accounting practice is the profit transfer to general reserve entry, where part of the net profit is allocated to reserves instead of distribution. This affects available earnings and influences budget allocations for dividends, reinvestment, or contingencies.

2- Revenue Recognition Point in Time

The revenue recognition point in time determines when revenue is recorded in the books—often when goods are delivered or services rendered—not necessarily when cash is received. Proper revenue recognition ensures the budget vs actual report reflects accurate and compliant financial results.

3- Service Revenue is What Type of Account?

Understanding that service revenue is what type of account (an income account) helps in categorizing revenues correctly in both budget and actual reporting, thereby supporting accurate financial analysis.

4- Practice Income Statement and Balance Sheet Problems

For finance professionals, solving practice income statement and balance sheet problems is a valuable way to hone budgeting skills and understand the interplay between financial statements. These exercises prepare them to create accurate budget vs actual reports by highlighting potential errors in forecasting and reporting.

Detailed Example: Budget vs Actual Report for a Retail Business

| Category | Budgeted Amount ($) | Actual Amount ($) | Variance ($) | Variance (%) |

| Revenue | 500,000 | 480,000 | -20,000 | -4% |

| Cost of Goods Sold | 300,000 | 310,000 | +10,000 | +3.3% |

| Operating Expenses | 100,000 | 95,000 | -5,000 | -5% |

| Net Profit | 100,000 | 75,000 | -25,000 | -25% |

This example shows how variances can indicate areas needing attention. For instance, higher than expected COGS reduced profits despite lower operating expenses.

How to Use the Budget vs Actual Report Effectively?

- Regular Review: Consistent monthly or quarterly reviews help catch issues early.

- Variance Analysis: Investigate causes behind significant variances to inform corrective measures.

- Adjust Forecasts: Use insights gained to refine future budgets and cash flow forecasts.

- Align with Cash Flow: Integrate cash flow statements like the daily cash flow statement template and indirect cash flow statement template Excel to ensure liquidity aligns with operational needs.

- Communicate Results: Share findings with relevant departments for accountability and collaboration.

Challenges in Budget vs Actual Reporting

Some common challenges businesses face include:

- Inaccurate budget assumptions

- Poor data collection and entry errors

- Failure to update budgets based on changing business conditions

- Lack of integration with cash flow and accounting systems

Addressing these issues with proper training, software solutions like mazeed, and clear processes ensures the budget vs actual report remains a reliable tool.

Why Planned Amounts and Actual Amounts Differ

The differences between planned amounts and actual amounts happen for many reasons, such as:

- Changes in market conditions

- Unexpected expenses

- Lower or higher sales than expected

- Timing differences in revenue or costs

- Inaccurate assumptions during budgeting

Not all differences are negative. Some show growth opportunities, while others highlight risks. Reviewing these differences regularly improves budgeting accuracy and financial control.

Using Built-In Reports for Budget vs Actual Comparison

Most modern accounting systems include built-in reports for budget vs actual comparison, making analysis faster and more reliable.

Knowing how to use built-in reports for budget vs actual comparisons allows businesses to:

- Automatically compare budgeted and actual figures

- View variances without manual calculations

- Filter results by time period, department, or account

- Monitor performance in real time

Using built-in reports reduces errors, saves time, and gives better visibility into financial performance.

mazeed’s Financial Management Solutions

mazeed offers advanced financial software that simplifies the creation and analysis of budget vs actual reports. With built-in tools for:

- Real-time variance tracking

- Automated profit transfer to general reserve entry recording

- Cash flow monitoring using daily cash flow statement templates and indirect cash flow statement template Excel

- Revenue recognition compliance

mazeed ensures that companies maintain accuracy, reduce manual work, and optimize budgeting processes. Its intuitive dashboards allow finance teams to visualize key metrics, spot trends, and make data-driven decisions quickly.

Key Takeaways: Budget vs Actual Report

The budget vs actual report is a vital instrument for businesses to measure financial discipline and operational efficiency. It acts as a feedback loop, helping organizations learn from past performance to improve future budgets and strategies.

When combined with tools like the daily cash flow statement template, indirect cash flow statement template Excel, and supported by sound accounting entries such as the profit transfer to general reserve entry and correct revenue recognition point in time, businesses gain a comprehensive financial view.

mazeed accounting software further enhances the accouting process, providing automation, accuracy, and insightful analytics, empowering businesses to thrive in competitive markets.

FAQs: Budget vs Actual Report

What is the difference between actual and budgeted results?

The difference between actual and budgeted results is the variance. Budgeted results are planned figures, while actual results reflect real performance. Variance shows whether performance is over or under budget.

How to compare actual vs budget?

To compare actual vs budget, list budgeted figures beside actual results for the same period. Calculate the variance in both numbers and percentages to quickly see over- or under-performance.

What types of change does a budget vs actual report show?

A budget vs actual report shows favorable changes (when actual results are better than budgeted) and unfavorable changes (when results fall short of the budget).

What is the budget actual comparison report?

The budget actual comparison report is a financial tool that compares planned revenues and expenses with real results, highlighting variances for better decision-making.

What is the purpose of the budget vs actual report?

The purpose of a budget vs actual report is to track financial performance, control costs, and improve forecasting by identifying areas where results differ from expectations.

What is the best chart for budget vs actual?

The best chart for budget vs actual is a column or bar chart with side-by-side comparisons. Waterfall charts are also effective for showing variances clearly.

What is budget vs actual P&L?

Budget vs actual P&L compares the planned profit and loss statement with actual results, highlighting revenue, expense, and profit variances.

What is the most important rule for budgets?

The most important rule for budgets is accuracy and realism—budgets should be based on achievable assumptions and regularly reviewed against actual performance.

How to calculate budget vs actual in Excel?

In Excel, subtract the budgeted amount from the actual amount to calculate variance. Use formulas like =Actual-Budget or percentage variance with =(Actual-Budget)/Budget.

How do I show balance in actual budget?

To show balance in actual budget, track remaining funds by subtracting actual expenses from budgeted amounts. This reveals how much of the budget is still available.

What is a budget vs actual dashboard?

A budget vs actual dashboard is a visual tool that presents financial performance using charts and KPIs, making it easier to monitor variances in real time.

What is the formula for actual and budget?

The basic formula is:

Variance = Actual – Budget

Percentage Variance = (Actual – Budget) ÷ Budget × 100

What information is provided by a budget vs actual income statement?

A budget vs actual income statement provides a comparison between planned income and expenses and what actually occurred during a specific period. It highlights variances in revenue, costs, and profitability.

What is a statement of comparison of budget and actual amounts?

It is a financial statement that compares budgeted figures with actual results, helping businesses identify differences and evaluate performance.

What is the difference between budget and actual?

A budget shows planned financial figures, while actual figures show real results. The difference between them reveals how closely a business followed its financial plan.

How do built-in reports help with budget vs actual comparisons?

Built-in reports automatically generate budget vs actual comparisons, showing variances clearly and reducing the need for manual analysis.

Why do planned amounts and actual amounts differ?

Planned and actual amounts differ due to unexpected costs, changes in sales, market conditions, or inaccurate forecasting assumptions

The budget portion of the budget vs. actual report reflects the company’s revenue and expenses at a specific time. True or False?

True. The budget portion of a budget vs. actual report reflects the company’s planned revenue and expenses for a specific period. It serves as a benchmark for evaluating actual financial performance.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority