Have you ever stopped to think about the story an invoice tells? In the world of finance and accounting, invoices aren’t just boring sheets of numbers, they’re the language businesses use to communicate trust, responsibility, and accuracy. But what happens when a mistake is made, or a return is necessary? That’s where the credit invoice format in UAE comes into play.

It’s more than a sheet; it’s a statement, a rectification, and a formal footprint of accountability. In this article, we traverse the winding alleys of invoice formatting, zooming in on credit invoices, while exploring a bouquet of related forms and standards that empower businesses to stay compliant, professional, and ahead.

💡 Pro tip: Get Your Business Ready for E-Invoicing in the UAE!

What Is a Credit Invoice Format in UAE?

A credit invoice format in UAE, also known as a credit memo, is issued when a seller needs to formally adjust the amount owed by the buyer—usually due to returns, overcharges, or discounts. Its role is not merely corrective; it’s communicative, ensuring that records on both ends align seamlessly.

Key Tip:

Always mirror the invoice header table in the original invoice for traceability.

Read more: How to Send Invoice in Email?

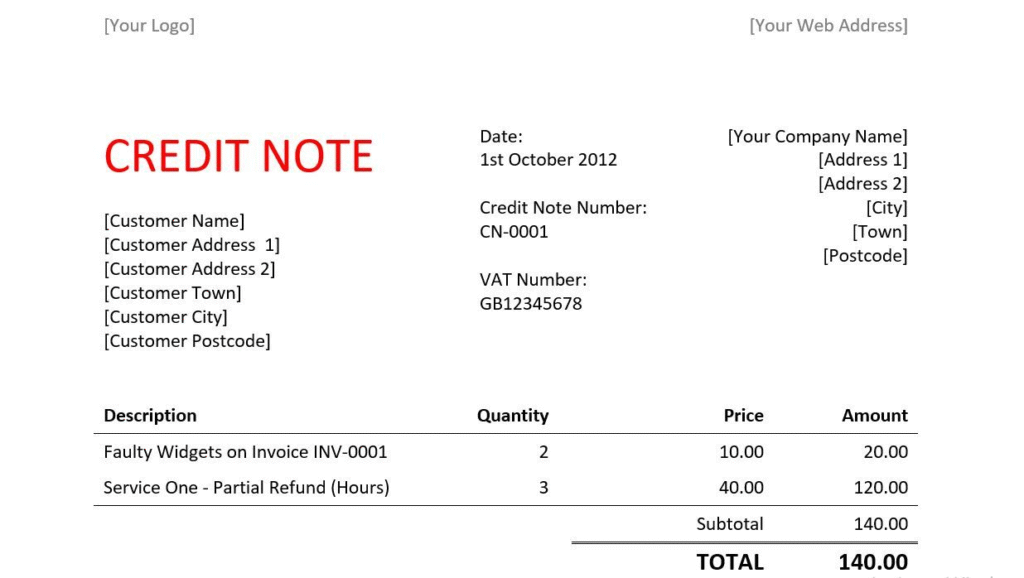

The Blueprint of a Perfect Credit Invoice

The credit invoice formatin UAE transforms from a mere document into a clear, compelling story of business rectification. Imagine a canvas where every line and figure paints a transparent picture of the transaction — a tale of trust, accuracy, and professionalism.

To bring this vision to life, a structured table acts as the blueprint, guiding the reader effortlessly through the critical components. Below is a detailed layout showcasing the essential elements that breathe clarity and formality into a credit invoice:

| Element | Description |

| Invoice Number | A unique identifier (e.g., CRD-2025-108) that anchors the document within your accounting system. |

| Reference to Original Invoice | Linking back to the initial transaction for seamless reconciliation. |

| Date of Issue | When the credit was officially granted, ensuring timely records. |

| Buyer Details | The recipient’s name and contact info, safeguarding transparency. |

| Seller Details | Your company’s identification for legal and branding purposes. |

| Reason for Credit | A concise, clear explanation—damaged goods, overbilling, or promotional adjustment. |

| VAT Adjustment | Accurate calculation reflecting tax regulations, such as those required in the UAE invoice format with VAT. |

| Total Credited Amount | The net figure reflecting the amount reduced from the buyer’s payable balance. |

💡Create Credit Invoices Easily

Issue compliant credit notes with VAT adjustments using mazeed accounting software!

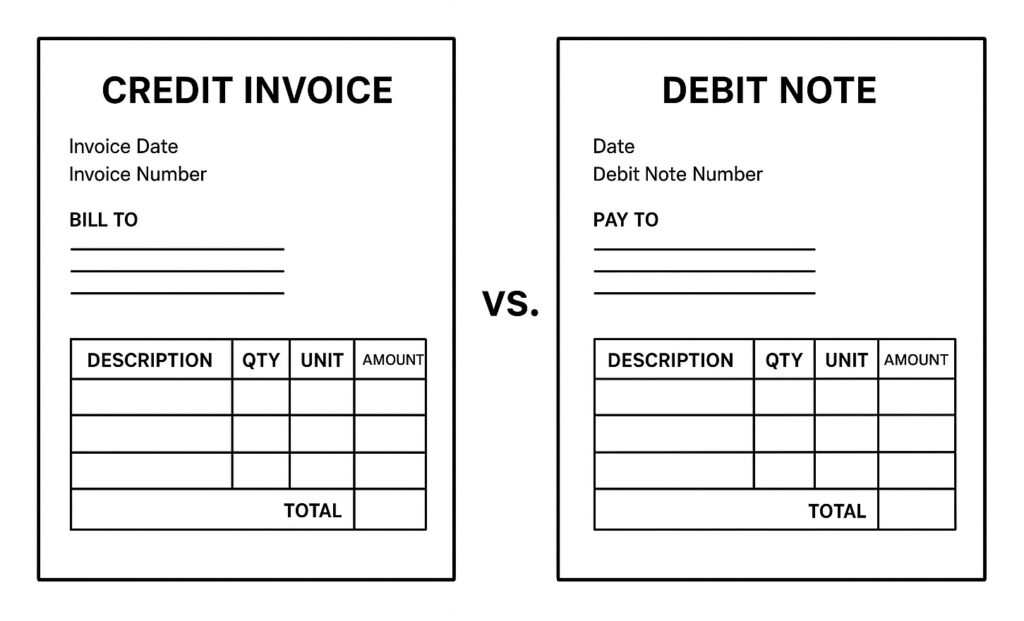

Credit Invoice Format vs. Debit Note: When to Use What?

Confusion often looms over the roles of credit invoices and debit note for reimbursement of expenses.

Credit Invoice Format:

Think of the credit invoice format in UAE as the seller’s formal acknowledgment that the amount owed by the buyer is to be reduced. This usually occurs due to returned goods, billing errors, or agreed-upon discounts. By issuing a credit invoice format, the seller effectively says: “We recognize that your payable balance should decrease.” It’s a document that balances the books, rectifies discrepancies, and maintains trust.

Debit Note for Reimbursement of Expenses:

In contrast, the debit note is the buyer’s assertive request for an adjustment—often to recover overpaid amounts, return faulty items, or claim reimbursements. When expenses incurred by employees or third parties need reimbursement, a debit note formalizes that claim, outlining the details and ensuring the seller understands the expected payment adjustment.

When a company reimburses employee expenses or vendor charges, the debit note for reimbursement of expenses becomes an essential instrument, and its format needs to mirror professionalism similar to the credit invoice format in UAE.

Read more: Guide to UAE VAT Invoice Format

Diverse Invoice Formats Across Industries

The nature of business significantly influences the type of invoice required. Below are a few industry-specific examples and how their formats adapt.

1. Automobile Industry

The automobile invoice format is unique due to:

- Engine/Chassis number details

- Road tax & insurance breakdown

- Delivery and service charges

This format must integrate payment details on invoice and tax compliance, especially when selling to VAT zones.

2. Export and Shipping

International business demands compliance with trade norms. The export invoice format in Excel should include:

- HS codes

- Currency exchange rates

- Country of origin

- Port of loading/destination

Pair it with a shipping invoice format for logistics partners and customs clearance.

Pro Tip:

Using a bill HTML template allows automation, visual clarity, and digital sharing without formatting loss.

Digital Templates and Their Power

When time is tight and stakes are high, digital templates offer a lifeline. From quotation invoice software to printable options, companies now automate more than just numbers.

Payment Voucher Format in Word:

Ideal for small to mid-sized business reimbursements.

Delivery Note Format:

Records shipped items to avoid disputes

Bill HTML Template:

Allows real-time updates and mobile-friendly invoicing. Automation does not merely streamline, it elevates your brand’s credibility.

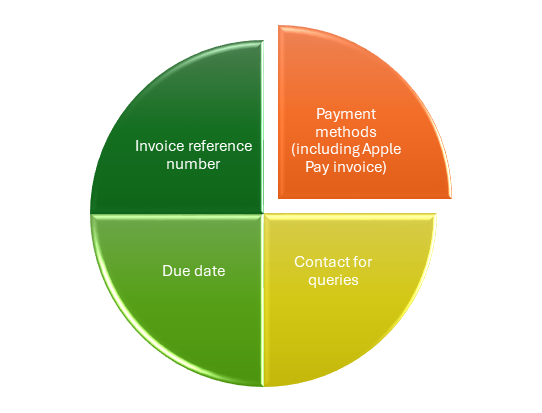

Integrating Modern Payments into Invoices

The rise of digital wallets, especially Apple Pay, has ushered in the era of seamless payments. Invoices that include Apple Pay invoice options boost collection speed and convenience.

Example: Including a QR code or embedded payment link in your invoice footer with payment details on invoice makes it easier for clients to settle dues immediately.

Read more: How to Prepare Tax Invoice Format UAE?

The Importance of Payment Reminders and Follow-ups

A professionally written payment follow-up reminder is as vital as the invoice itself. While the tone must be polite, the message should be firm, specifying:

Avoiding payment delays starts with clarity and consistency in your reminders.

UAE Compliance: VAT and Invoice Structuring

In the Emirates, a UAE invoice format with VAT is non-negotiable for registered businesses. The essential components include:

- TRN (Tax Registration Number)

- VAT breakdown per line item

- Total VAT amount

- Grand total including VAT

Falling short of compliance could invite penalties, hence the need for tools like quotation invoice software and standardized formats.

Read more: UAE Mandates E-Invoicing from July 2026

💡A New Way to Manage Invoices & Returns

mazeed combines smart software with expert guidance to handle credit invoices, VAT corrections, and client disputes.

Comparing Invoice Types: Navigating the Spectrum of Business Documentation

Invoices come in myriad forms, each tailored to meet specific transactional needs and regulatory demands. To the untrained eye, they may seem interchangeable, but a discerning business understands that mastering the right invoice format can unlock efficiency, compliance, and clarity.

| Invoice Type | Use Case | Key Feature |

| Credit Invoice Format | Refunds, returns, overcharges | References original invoice, states reason, adjusts VAT accurately. Crucial in UAE invoice format with VAT compliance. |

| Export Invoice Format in Excel | International trade | HS codes, currency rates |

| Automobile Invoice Format | Vehicle sales | Engine/Chassis info |

| UAE Invoice Format with VAT | Local trade in UAE | TRN, VAT line details |

| Payment Voucher Format in Word | Internal payments or reimbursements | Simple to customize, easy for record-keeping, and supports expense claims such as debit note for reimbursement of expenses. |

| Bill HTML Template | Digital invoices shared online | Responsive design, easy to update, integrates with payment follow up reminders and Apple Pay invoice options. |

| Delivery Note Format | Shipment verification | Item-wise list, receiver signoff |

Key Takeaways: Credit Invoice Format in UAE

- Credit Invoice Defined: Also called a credit memo; issued by sellers to reduce what a buyer owes (returns, overcharges, discounts).

- Core Elements: Invoice number, link to original invoice, issue date, buyer/seller details, reason for credit, VAT adjustment, total credited amount.

- Credit vs Debit Note:

- Credit Invoice → Seller acknowledges reduction.

- Debit Note → Buyer requests adjustment (e.g., reimbursements).

- Industry-Specific Formats:

- Automobile → engine/chassis info, taxes, delivery/service charges.

- Export/Shipping → HS codes, currency rates, country of origin, ports.

- Digital Templates: Automate invoicing (Word, Excel, HTML, software). Enhance clarity, speed, and compliance.

- Modern Payments: Adding QR codes/Apple Pay invoice options speeds up collections.

- Follow-Ups: Professional payment reminders prevent delays and protect relationships.

- UAE VAT Compliance: Must include TRN, VAT breakdown per line item, total VAT, and grand total.

- Credit vs Refund:

- Credit = reduces customer balance.

- Refund = actual cash/bank outflow. They can be linked but aren’t the same.

- Accounting Entries: Credit invoices reduce revenue & VAT liability; refunds further record cash/bank outflows.

FAQs: Credit Invoice Format in UAE

How to write a credit on an invoice?

Don’t edit the original invoice. Issue a credit invoice (credit note) that references the original invoice number/date, states the reason, and shows negative line items, tax/VAT adjustments, and the new totals. Send it to the customer and apply it to their balance.

What is a credit invoice?

A credit invoice (credit note) is a seller-issued document that reduces the amount a customer owes—typically for returns, overbilling, or discounts. It corrects revenue and, where applicable, adjusts VAT/sales tax tied to the original invoice.

How to generate a credit invoice?

1- Select the customer and the original invoice.

2- Add the items/amounts to be reversed as negative lines.

3- Enter the reason for credit.

4- Recalculate VAT/tax.

5- Issue, approve, and send; then apply it to open invoices or refund.

Is a credit invoice a refund?

Not by itself. A credit invoice reduces receivables; a refund is money returned. You can either keep the credit on account (to offset future invoices) or pay it out as a refund.

How to invoice for a refund?

Issue a credit invoice for the amount to return, then record a refund payment (card reversal/transfer/cash) and apply it against that credit so the customer’s balance and your bank reconcile.

What is a credit vs refund?

– Credit (credit note): Ledger adjustment that lowers the customer’s balance.

– Refund: Cash/bank outflow back to the customer (often to the original payment method).

They can be linked, but they’re not the same action.

How does credit get refunded?

Two ways:

1- Apply to future/open invoices (no cash moves).

2- Payout refund via bank/card reversal/cash and apply it to the credit to close it.

What is a refund receipt?

A document confirming money returned: customer details, amount, method (e.g., card reversal), date, reference to the credit invoice and original invoice, and tax/VAT impact if applicable.

What are the types of refunds?

– By scope: Full or partial (line-item).

– By settlement: Original method reversal (card/wallet like Apple Pay), bank transfer, cash, or store credit.

– By policy: With receipt / no-receipt / exchange.

What is a refund in billing?

A negative charge (or reversal) that decreases the customer’s billed amount and may trigger an outbound payment back to them.

How do you record a refund in accounting?

Unpaid invoice (credit only):

Dr Sales Returns & Allowances (or Revenue –)

Dr Output VAT/Sales Tax (reduce liability)

Cr Accounts Receivable

Paid invoice (credit + cash refund):

(1) Issue credit:

Dr Sales Returns & Allowances

Dr Output VAT/Sales Tax

Cr Accounts Receivable

(2) Refund cash/bank:

Dr Accounts Receivable

Cr Cash/Bank

What type of payment is a refund?

It’s not a method; it’s a transaction type. The refund is settled via a payment method (card reversal, bank transfer, cash, wallet like Apple Pay). On the GL it reduces revenue (via a contra account) and cash/bank when paid out.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.