Running a small or medium business feels like a constant juggling act, especially in today’s competitive market.

Entrepreneurs wear many hats, constantly seeking ways to do more with less. This means boosting efficiency, cutting costs, and achieving financial stability, all while keeping their unique vision alive.

But what if there’s a tool that can unlock all of that?

Enter: accounting software.

Let’s explore the impact of accounting software for business performance, especially for small and medium-sized businesses (SMBs) in the UAE.

Why Businesses Can’t Ignore the Impact of Accounting Software Anymore

Let’s face it—spreadsheets were great in the 90s, but in today’s fast-moving world, they often create more problems than they solve. Mistakes, delays, and a lack of real-time insights can hold a business back.

That’s where the impact of accounting software for business performance becomes crystal clear. Accounting software like mazeed streamlines bookkeeping, enhances accuracy, reduces errors, and helps business owners make confident decisions in real time.

In this blog post, we explore the many ways accounting software is revolutionizing business performance in the UAE.

Read more: 6 Benefits of VAT Compliant Accounting Software in UAE

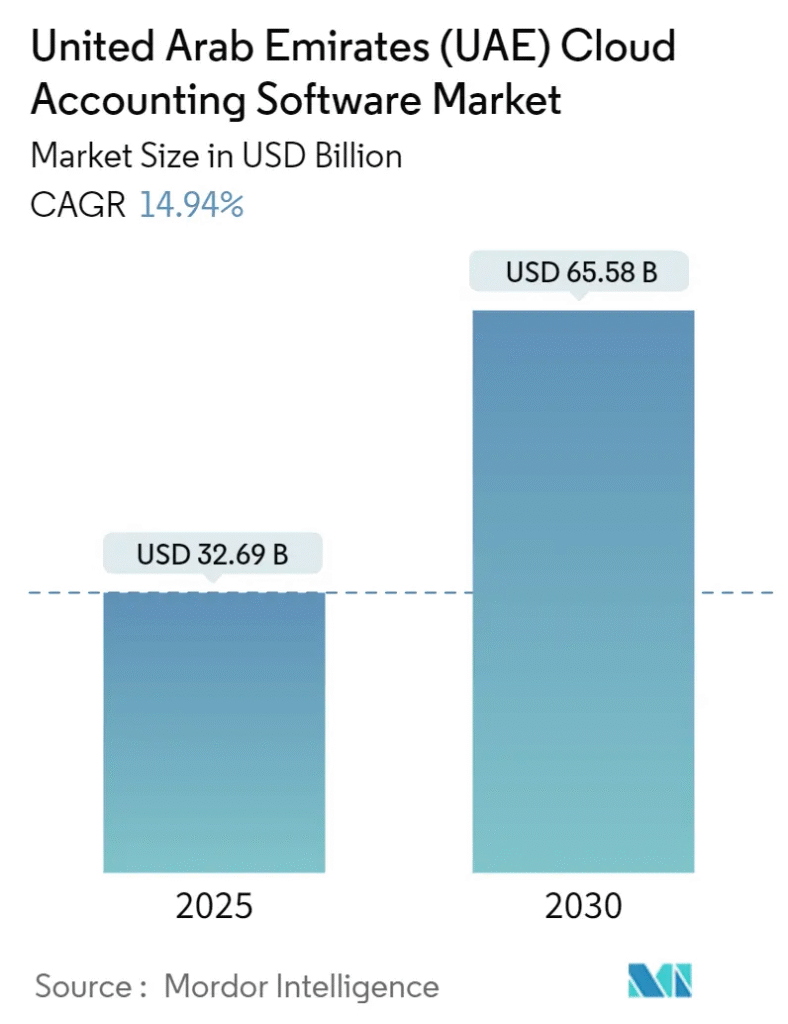

Cloud Accounting Software Market Size in UAE

💡 Simplify Your Accounting with mazeed!

Automate your daily recordkeeping, stay 100% tax compliant, and get real-time financial insights—all in one easy-to-use platform. Start free and manage your finances smarter.

The Impact of Accounting Software for Business Performance in Small Businesses

1. Avoid Legal Penalties

Every UAE business must comply with tax regulations. Fines are common when businesses fail to follow proper procedures. One major impact of accounting software for business performance is compliance—automated updates to tax rules, proper storage, and error-free reporting help businesses stay in the clear.

2. More Accurate Sheets

Manual entry errors can derail your finances. The impact of accounting software here is huge: automation, built-in checks, and real-time accuracy mean your financial data is always reliable—making your business performance stronger.

3. A More Efficient Workspace

Time saved is money earned. Automating invoicing, reports, and reconciliations is a major impact of accounting software for business performance, giving you back hours each week to focus on what truly matters—growth.

4. Real-Time Insights

With accounting software, you get live data on your financial health—no more waiting for month-end reports. This real-time impact on business performance allows better cash flow management and quicker decisions.

5. Stress-Free Tax Season

UAE taxes are here to stay. The impact of accounting software includes easier tax filing, categorized expenses, and instant report generation—minimizing mistakes and penalties.

6. Business Growth

Data-driven decision-making is a critical business performance benefit. With historical trends and predictive insights, you can refine your marketing, hiring, and spending—all thanks to the impact of accounting software.

7. Smarter Inventory Management

Track what’s selling and what’s not in real time. The impact of accounting software for business performance here extends to avoiding stockouts or overstock—helping you meet demand and reduce waste.

8. Peace of Mind

Knowing your financials are organized, compliant, and up to date gives business owners confidence. The impact of accounting software isn’t just operational—it’s emotional too.

The Impact of Accounting Software for Business Performance in Medium-Sized Businesses

As businesses grow, so do their financial demands. For medium-sized businesses in the UAE, the impact of accounting software becomes even more significant.

A. Scalability

Cloud-based solutions grow with your business. Add users, features, or custom reports anytime. This flexibility has a direct impact on business performance by reducing bottlenecks and enhancing workflow.

B. Better Collaboration

The impact of accounting software for business performance also includes team efficiency. Real-time access means your finance team, management, and external consultants can collaborate without delay.

C. Enhanced Data Security

With more financial data comes greater risk. Cloud software ensures encrypted storage, access control, and regular backups—protecting your business from data loss or breaches.

D. Business Intelligence Dashboards

The impact of accounting software is clearly visible in business intelligence dashboards, allowing companies to monitor KPIs, profit margins, and sales performance in real time—essential for UAE’s fast-evolving market.

Read more: Is Your Accounting Software UAE Ready?

Are There Drawbacks?

Yes—but they’re manageable.

- Cost: Software may require an upfront investment.

- User Expertise: Some basic accounting knowledge is still necessary.

- Limited Automation: Certain tasks still need a professional touch.

Still, the impact of accounting software for business performance far outweighs these limitations, especially when paired with expert financial guidance.

How the UAE Market Makes Accounting Software Even More Essential

The UAE isn’t just any business environment—it’s fast-growing, digitally transforming, and increasingly regulated. That means financial accuracy and compliance aren’t just nice to have; they’re mandatory.

Whether it’s filing VAT, staying ready for FTA audits, or managing cross-border transactions, the impact of accounting software for business performance in the UAE is amplified by the local tax and legal framework. Software helps businesses navigate these complexities with fewer headaches and more confidence.

Real-Life Example: How Accounting Software Helped a UAE Business Thrive

Let’s say you run a small retail business in Dubai. You started with Excel, manually tracking sales, inventory, and expenses. It worked for a while—until VAT was introduced and you started expanding. Suddenly, tax filing became confusing, your inventory numbers didn’t match, and reconciling your bank account took hours.

After switching to accounting software, everything changed. Sales and inventory synced automatically, tax reports were generated on demand, and your accountant could access everything online. You saved time, avoided fines, and started using your financial data to grow—not just survive.

That’s the real impact of accounting software for business performance—it’s not about software, it’s about peace of mind and better decisions.

Features to Look for When Choosing Accounting Software

Not all software is created equal. If you want to see a real impact on business performance, look for these key features:

- UAE Tax Compliance (VAT + Corporate Tax)

- Multi-currency support

- Inventory tracking

- Cloud access and mobile app

- Automated bank reconciliation

- Real-time dashboards

- Customizable invoices and receipts

- Arabic language support

Choosing the right software isn’t about going fancy—it’s about getting the basics right, and then growing from there.

Read more: 9 Best Accounting Software Dubai

When Software Alone Isn’t Enough

Let’s be real—software can do a lot, but it’s not magic. One of the most important things to remember is that software + expertise is the winning combo.

A qualified accountant can help set things up, interpret the data, and make sure everything’s aligned with UAE regulations. The software handles the heavy lifting, and the expert makes sure it’s lifting in the right direction.

So, while the impact of accounting software for business performance is massive, it’s even bigger when paired with the right support.

💡 mazeed Gives You Both

mazeed is the first accounting software in UAE that gives you both accounting software and FTA-certified experts in one place. Simply, scan your invoices and let the rest be done automatically from bookkeeping to tax return filing.

Final Thoughts: Why the Impact of Accounting Software for Business Performance Can’t Be Ignored

In today’s business landscape—especially in the UAE—accounting software is no longer a luxury; it’s a necessity.

The impact of accounting software for business performance touches every aspect of operations: from compliance and reporting to growth and peace of mind.

To get the most out of it, businesses should combine powerful software with skilled accountants. That’s the real formula for sustainable success.

FAQs about Impact of Accounting Software for Business Performance in UAE

What are the benefits of using accounting software?

Accounting software offers automation, real-time financial reporting, improved accuracy, faster invoicing, and easier tax compliance. For UAE businesses, it also ensures alignment with VAT regulations and reduces manual workload.

What can accounting software do for your business?

It helps manage income and expenses, track cash flow, generate financial statements, file VAT returns in the UAE, and make informed business decisions with data-driven insights.

What is the impact of accounting on business?

Accurate accounting ensures financial transparency, supports compliance, improves cash flow management, and helps businesses evaluate performance and plan for growth.

What is the impact of information systems on business performance?

Information systems streamline operations, improve decision-making, and enhance productivity. In the UAE, integrated systems such as accounting software help companies scale efficiently and stay compliant with local laws.

How does an information system help to improve business performance?

It enables better data management, automation of repetitive tasks, faster reporting, and more strategic resource allocation—all of which contribute to improved performance.

What is the impact of information technology in business?

Information technology boosts communication, increases efficiency, reduces operational costs, and enhances service delivery. In accounting, it enables cloud access, real-time tracking, and digital audits.

What is the impact of information technology on the accounting system?

It transforms manual accounting into automated workflows, reduces errors, allows remote access, supports data security, and simplifies VAT filing for businesses in the UAE.

What is the effect of ICT on the performance of businesses?

Information and Communication Technology (ICT) improves speed, accuracy, and coordination across departments. It enables UAE businesses to adapt to market changes and regulatory updates more effectively.

What is the major impact of technology on business?

Technology accelerates business processes, fosters innovation, and reduces human error. It also enables UAE-based companies to meet financial compliance standards more efficiently.

What is the impact of digital technology on our business?

Digital technology allows for automation, better data analytics, online payment processing, and mobile accessibility, all of which contribute to streamlined operations and improved customer service.

What is the role of the information system?

An information system collects, processes, and delivers data to support business decisions. In accounting, it ensures accurate financial tracking, regulatory compliance, and efficient reporting.

How do technological factors impact a business?

They influence productivity, cost management, customer experience, and compliance. For UAE companies, adopting the right accounting software means easier VAT filing, better financial control, and scalability.