UAE Small Business Relief is defined in Article 21 of the UAE Corporate Tax Law.

It is not an exemption from the tax system, instead, it’s a simplified treatment: eligible businesses are treated as if they have no taxable income. This means they do not need to calculate or pay Corporate Tax for that period.

The goal is to give micro and small businesses breathing space as they transition into the tax regime. Think of it as a “training wheels” phase: you are still in the system, but with minimal reporting.

Why it Matters for SMEs?

The UAE economy is dominated by small businesses. In fact, according to the Ministry of Finance, 82% of businesses in the UAE are micro-businesses with annual revenue below AED 3 million.

Without relief, these companies would face the same compliance obligations as much larger corporations. By introducing UAE Small Business Relief, the government:

- Reduces the compliance burden (simpler reporting, fewer calculations).

- Helps SMEs save costs by avoiding unnecessary tax advisory and accounting expenses.

- Creates certainty: if your revenue is under AED 3M, you know your Corporate Tax bill will be 0%.

This is a pro-growth measure designed to support entrepreneurs and encourage reinvestment in their businesses.

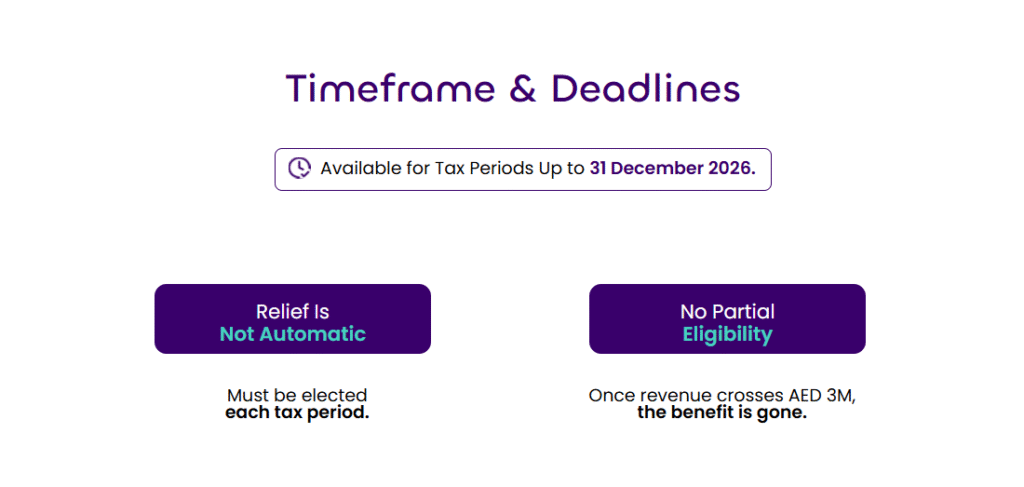

Timeframe & Deadlines

UAE Small Business Relief is temporary. It applies to tax periods starting on or after 1 June 2023 and is valid until 31 December 2026.

An important point: the relief is not automatic. Businesses must elect to apply it each tax period when filing their Corporate Tax return.

If you don’t elect it for a given period, you will be assessed normally under Corporate Tax rules. And once your business grows beyond AED 3M, you cannot go back to the relief in future periods.

💡 Simplify Tax Compliance with Smart Software

Stay on top of filings, track revenue & ensure eligibility for UAE Small Business Relief with mazeed accounting software.

The AED 3M Revenue Rule

The heart of UAE Small Business Relief is the AED 3 million revenue threshold.

To qualify, your revenue must not exceed AED 3,000,000 in:

- The current tax period, AND

- All previous tax periods (starting from 1 June 2023).

This is strict: if your revenue exceeds AED 3M even once, you permanently lose eligibility. Even if revenue falls below AED 3M later, you can’t return to UAE Small Business Relief.

Revenue includes all income, whether taxable or exempt: for example, dividend income is counted. However, VAT collected is excluded.

Who Can Benefit / Can’t Benefit?

Who Can Benefit:

- Resident natural persons (e.g., sole proprietors, freelancers).

- Resident juridical persons (companies incorporated in the UAE).

- Businesses consistently under AED 3M revenue.

Who Cannot Benefit:

- Qualifying Free Zone Persons (QFZPs): since they already enjoy a special 0% tax regime under other provisions.

- Multinational Enterprise Groups (MNEs) with global consolidated revenue above AED 3.15B.

- Non-resident taxable persons: the relief is for UAE-resident businesses.

- Any business found to be artificially splitting activities to keep each entity’s revenue below AED 3M.

The Federal Tax Authority (FTA) has explicitly warned against splitting businesses. If detected, the business will face penalties and back taxes.

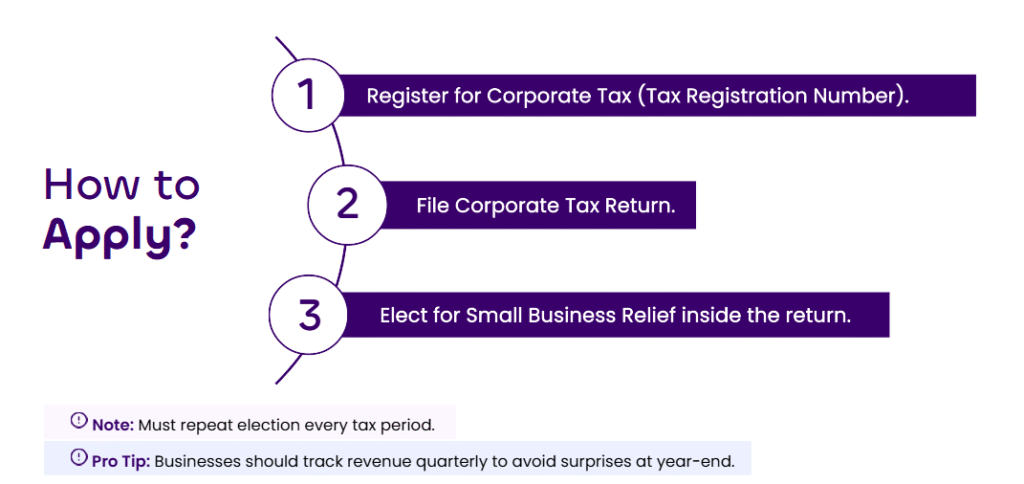

How to Apply?

The application is simple but has two steps:

- Corporate Tax Registration: Every business must register with the FTA and obtain a Tax Registration Number (TRN). Even if you expect to elect UAE Small Business Relief, you must still register.

- Election via Tax Return: Relief is chosen when filing the Corporate Tax return for each tax period.

Important: you must elect every tax period; it does not carry over.

Record-Keeping Requirements

Even under UAE Small Business Relief, businesses must keep proper records. The Corporate Tax Law requires businesses to maintain accounting and tax documentation for at least 7 years.

This includes invoices, receipts, contracts, and financial statements. Why? Because the FTA may review revenue figures to confirm you were eligible for relief.

So UAE Small Business Relief is not a free pass, you must still show evidence of compliance if asked.

Other Rules You Must Know

A few additional rules to keep in mind:

- Artificial Splitting: Not allowed. Businesses cannot set up multiple small entities to stay under the AED 3M threshold.

- Tax Groups: The AED 3M limit applies to the entire group’s consolidated revenue. If a group elects UAE Small Business Relief, total group revenue must not exceed AED 3M.

- Transfer Pricing: While documentation is not required under UAE Small Business Relief, businesses must still respect the Arm’s Length Principle when dealing with related parties. The FTA can review these transactions at any time.

💡 A New Way to Handle Small Business Relief

mazeed combines a smart software with expert tax advisors to stay compliant, manage records & maximize SME cost savings.

Impact on Other Corporate Tax Rules

Electing UAE Small Business Relief has consequences for other parts of the Corporate Tax framework:

- Tax Losses: You cannot accrue or carry forward losses during a relief period. Losses from prior periods remain available for future use.

- Interest Deductions: Net interest expense incurred during an UAE Small Business Relief period cannot be carried forward.

- Other Reliefs: You cannot use reliefs for group transfers or restructuring in periods where UAE Small Business Relief is elected.

- Exempt Income: Even income that is normally exempt (e.g., dividends) is counted toward the AED 3M revenue threshold.

- Accounting Standards: You may use the cash basis of accounting to calculate revenue. However, the FTA may challenge if results appear unreasonable.

- VAT: VAT collected must be excluded from revenue calculations.

Real-Life Examples

Let’s look at some practical examples:

Example 1: Eligible

- ABC LLC (UAE Resident).

- Sales revenue: AED 2.7M.

- Dividend income: AED 200k.

- Total revenue: AED 2.9M.

Eligible for UAE Small Business Relief.

Example 2: Not Eligible

- XYZ LLC (UAE Resident).

- Sales revenue: AED 2.5M.

- Dividend income: AED 1M (exempt income).

- Total revenue: AED 3.5M.

Not eligible .. exceeds AED 3M.

Example 3: Permanent Loss

- Mr. Y, a sole proprietor.

- Year 1 revenue: AED 1.9M → eligible.

- Year 2 revenue: AED 4.3M → exceeds threshold.

- Year 3 revenue: AED 2M → below threshold again.

Not eligible anymore, because exceeding once means permanent ineligibility.

Key Takeaways

To close, here are the key messages:

- UAE Small Business Relief allows eligible small businesses to pay 0% Corporate Tax.

- Applies until 31 December 2026.

- Strict threshold of AED 3M applies each period.

- Once exceeded, eligibility is permanently lost.

- Businesses must still register, file returns, and keep records for 7 years.

- Relief is valuable for cost savings but comes with trade-offs so no losses, deductions, or restructuring reliefs during relief periods.

- SMEs should carefully evaluate whether electing UAE Small Business Relief is the right choice based on growth plans.

FAQs: UAE Small Business Relief

What is small business relief in UAE tax?

Small Business Relief in the UAE allows eligible businesses with revenues below AED 3 million to be treated as if they have no taxable income, meaning they do not pay corporate tax for that period.

Is small business rate relief?

It is not a lower tax rate but a simplified tax treatment that exempts qualifying businesses from calculating and paying corporate tax.

What is the Corporate Tax exemption for small business in UAE?

Businesses with revenue not exceeding AED 3 million in a tax period can claim relief and be exempt from corporate tax.

What is business restructuring relief in the UAE?

Business restructuring relief allows companies to transfer assets or liabilities during restructuring without triggering immediate corporate tax.

Who is eligible for small business restructuring?

Companies in the UAE undergoing mergers, transfers, or reorganizations may qualify, provided the transactions meet the conditions set by the UAE Corporate Tax Law.

What is a business relief scheme?

A business relief scheme is a tax benefit that reduces or delays tax liabilities for qualifying businesses under certain conditions.

What is the 2 year rule for business relief?

In some jurisdictions, including the UAE, certain business relief benefits (like restructuring) require assets or shares to be held for at least two years to qualify.

Which assets qualify for 100% business relief?

In restructuring, qualifying business assets such as property, equipment, and shares may qualify for full relief if conditions are met.

Is business relief risky?

Business relief itself is not risky, but incorrect application or failure to meet eligibility criteria can result in penalties or denied claims.

Which business has the highest risk?

Startups and businesses in volatile sectors such as trading, crypto, and highly leveraged industries are considered high risk.

How much is business asset relief?

Relief can cover up to 100% of qualifying assets and liabilities transferred during approved restructuring or relief schemes.

Which business is the safest?

Essential services, utilities, and government-regulated industries are generally seen as safer due to stable demand.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.