What is the true value of a payslip? To some, it’s a routine document, generated, issued, archived. But to the discerning professional in payroll accounting, the payslip is far more than a summary of earnings and deductions. It is a formal affirmation of transparency, compliance, and organizational integrity.

In every well-structured payslip format lies a precise narrative: hours worked, taxes withheld, benefits accrued, and contributions made. Each line tells a story, not just of labor compensated, but of responsibilities fulfilled, by both employer and employee. For HR payroll teams, payroll agencies, and finance departments, understanding and optimizing this document is not optional; it is essential.

But this raises an important question: Are we giving the payslip the attention it truly deserves? Does the format you use enhance clarity and trust, or merely meet minimum legal standards? Does your current payroll software offer flexibility and compliance, or is it creating hidden inefficiencies?

In this article, we will explore the strategic importance of the payslip format, its structure, function, and impact. We’ll examine best practices for how to create payslip for employee accuracy, the role of automation in HR payroll, and why modern businesses are rethinking their approach to this fundamental document.

Read more: Credit Invoice Format in UAE

What Is a Payslip and Why Does Its Format Matter?

A payslip is the official record provided to employees outlining their earnings and deductions for a specific pay period. It serves not only as proof of income but also as a vital tool in payroll accounting, highlighting every detail from gross salary to net take-home pay after deductions.

Understanding what is a payslip goes hand in hand with appreciating the importance of a well-structured payslip format. The clarity of this document ensures employees can easily verify their salaries, tax deductions, and other benefits while employers meet compliance standards with tax authorities and labor laws.

A good payslip format ensures:

- Transparent entries for payroll and payroll taxes

- Clear breakdown of allowances, bonuses, and deductions

- Easy reconciliation with internal accounting or payroll software

- Professionalism that reinforces the company’s credibility

Whether generated through an HR payroll department or by a payroll agency, the payslip must be intuitive and legally compliant. Think of it as a contract printed in numbers, one where the layout tells the truth, and the structure prevents misinterpretation.

In the digital age, with companies leveraging payslip templates, Excel downloads, and cloud-based payroll software, consistency in format is not just a convenience, it’s a necessity.

Read more: UAE Tax Invoice Template

💡 Smart Accounting Made Simple

Manage invoices, track expenses, and stay tax-ready, all with mazeed Accounting Software.

Step-by-Step: How to Create Payslip for Employee

To begin, every payslip must include the fundamental building blocks. These are not optional, they’re critical for both employee transparency and audit-readiness.

Key Components of a Payslip:

1. Employee & Company Information

- Employee Name

- Employee ID or Staff Code

- Job Title / Department

- Employer Name & Logo

- Pay Period Covered

2. Salary Breakdown (Gross Earnings)

- Basic Salary

- Housing, Transport, or Utility Allowances

- Overtime or Bonus Pay

- Commission (if applicable)

3. Deductions

- Payroll taxes (income tax, social security, etc.)

- Pension contributions

- Insurance premiums

- Loan repayments or salary advances

4. Employer Contributions

- Social security contributions

- Retirement or gratuity payments

- Health insurance (employer-paid portion)

5. Net Pay

- The final amount credited to the employee’s account after deductions

6. Notes or Remarks (Optional)

- Leave balances

- Payment method

- Holiday pay or year-to-date summaries

An effective payslip also needs to be compatible with HR payroll systems or payroll agencies that manage bulk payrolls efficiently. Utilizing payroll software can simplify this process, allowing for automatic updates to payroll taxes and employee benefits, reducing manual errors.

Read more: UAE VAT Invoice Format

Payslip Format: The Blueprint of Payroll Excellence

A well-designed payslip format is more than a mere layout, it is the architecture of payroll excellence. Just as blueprints determine the structural integrity of a building, a properly structured payslip ensures clarity, legal compliance, and financial transparency. In a business world where accuracy and professionalism are non-negotiable, the payslip format is the silent guardian of both.

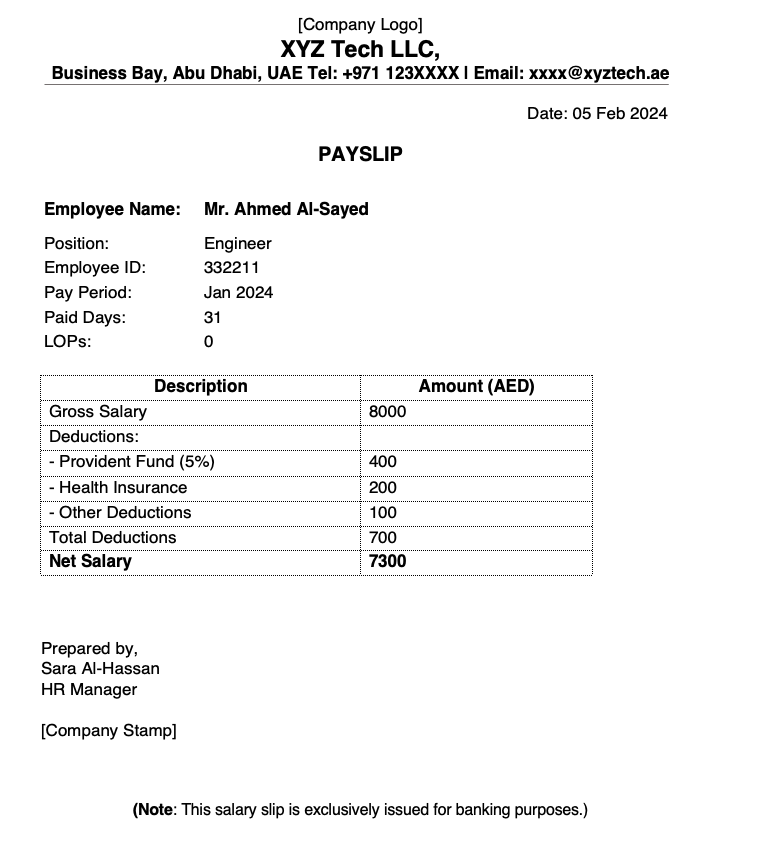

Example Payslip Template Excel (Free Download)

| Payslip Section | Details |

| Employee Name | John Doe |

| Employee ID | 123456 |

| Pay Period | 01-May-2025 to 31-May-2025 |

| Basic Salary | AED 10,000 |

| Allowances | Housing: AED 2,000; Transport: AED 500 |

| Gross Salary | AED 12,500 |

| Deductions | Tax: AED 1,000; Social Security: AED 500 |

| Net Salary | AED 11,000 |

This payslip template Excel is a model example often used in payroll accounting to simplify payroll entries and ease compliance with labor laws, especially in regions like the UAE, where the salary slip in UAE must follow specific regulatory standards.

Payroll Agency or In-House HR Payroll?

Organizations today face the decision of whether to outsource payroll processing to a payroll agency or manage it internally through HR payroll departments equipped with robust payroll software. Each approach has distinct benefits:

A- Payroll Agency:

Outsourcing offers specialized expertise in handling payroll taxes and compliance. It’s ideal for companies lacking dedicated payroll resources.

B- HR Payroll Department:

Managing payroll in-house offers greater control and integration with employee management systems but demands expertise and time investment.

| Feature | In-House HR Payroll | Payroll Agency |

| Control Over Data | ✅ Full | ⚠️ Limited |

| Compliance Management | ⚠️ Requires expertise | ✅ Included |

| Cost Efficiency (Long-Term) | ✅ Higher after setup | ⚠️ May involve ongoing fees |

| Custom Payslip Format | ✅ Fully customizable | ⚠️ Varies by provider |

| Access to Payroll Software | ✅ Internal or licensed | ✅ Often included |

| Handling Payroll Taxes | ⚠️ Manual unless automated | ✅ Automated & accurate |

| Scalability | ⚠️ Slower without systems | ✅ Easily scalable |

Whichever path you choose, understanding the payslip format and the entries for payroll and payroll taxes is essential to ensure accuracy and compliance.

The Power of Payroll Software in Enhancing Payslip Accuracy

In today’s fast-paced digital landscape, where compliance errors can result in financial penalties and employee distrust, payroll software emerges as the quiet hero behind every flawless salary slip in UAE format. Gone are the days when HR teams manually juggled spreadsheets and calendar reminders. The age of automation has arrived, and with it, a revolution in payslip accuracy.

Advantages of payroll software include:

- Automatic updates to payroll tax regulations

- Customizable payslip templates for different job roles

- Integration with accounting systems for streamlined bookkeeping

- Simplified generation of payslip format documents for employee distribution

With the right payroll software, businesses can easily produce accurate payslips, ensuring compliance and transparency.

Read more: Delivery Note Template for UAE Businesses

Why Accuracy in Payslip Matters?

At its core, a payslip is a legal document. It outlines not just what an employee earned, but also how that figure was calculated, taxed, and delivered. Inaccuracies, no matter how minor, can lead to:

- Employee dissatisfaction and legal disputes

- Misreported payroll taxes

- Regulatory non-compliance

- Delayed financial reporting and audit complications

Ensuring error-free payroll begins with the tools you use. And that’s where payroll software reshapes the game.

💡 New Way to Manage Your Finances

mazeed combines smart accounting software with certified accounting and tax experts in one place so you can stay compliant, reduce costs, and focus on growing your business.

Why Design and Accessibility Matter?

When we think of a payslip, we often imagine a sterile, number-heavy sheet of paper. But in reality, the payslip format is more than a ledger, it’s a communication tool. It bridges the gap between employer intent and employee understanding. The way a payslip is formatted and delivered directly affects transparency, trust, and legal compliance. A well-designed payslip format reflects not just accuracy, but clarity. And clarity, especially in payroll matters, is power.

An accessible payslip should use:

- Clear fonts and layout

- Logical grouping of information (earnings vs. deductions)

- Multilingual options if necessary

- Digital formats compatible with mobile devices

Payslip Template Free Download to Simplify Payroll Tasks

For businesses and accountants eager to streamline their payroll process, payslip template free download options provide ready-to-use formats customizable to specific needs. These templates often come in Excel and Word format, allowing for easy editing and integration with payroll systems.

FAQ: Payslip Format in UAE

What is a payslip format in the UAE?

A payslip format in the UAE is a standardized layout that shows an employee’s earnings, deductions, and net salary for a specific pay period in compliance with UAE labor laws.

What details must be included in a UAE payslip?

A UAE payslip should include the employer’s name and logo, employee name and ID, job title, pay period, basic salary, allowances, overtime, deductions, end-of-service contributions if any, and the final net pay.

Is issuing payslips mandatory in the UAE?

Yes. Under the UAE Labor Law and the Wage Protection System (WPS), employers must provide employees with a payslip or salary statement each time they are paid.

What is the standard payslip format for WPS compliance in the UAE?

The WPS payslip format includes employee details, payment date, basic salary, total allowances, deductions (like leave or loans), and net pay transferred to the employee’s bank account.

Can a payslip in the UAE be issued electronically?

Yes. Electronic payslips are widely accepted in the UAE as long as they contain all mandatory information and are easily accessible to employees.

How can I create a payslip template in Excel for UAE employees?

You can design a payslip in Excel by adding columns for earnings, deductions, and totals, ensuring it meets UAE labor law requirements or use payroll software for automated templates.

What deductions are commonly shown on UAE payslips?

Typical deductions include unpaid leave, loan repayments, absence penalties, and any other authorized deductions agreed upon in the employment contract.

How long should employers keep payslip records in the UAE?

Employers should retain payroll and payslip records for at least two years as required by UAE labor regulations and for audit or dispute resolution purposes.

Are payslip formats the same for all UAE companies?

No. While core details are similar due to labor law compliance, each company can customize the payslip format to reflect its branding or internal HR policies.

What should employees do if there’s an error in their payslip?

Employees should report the discrepancy to their HR or payroll department immediately. If unresolved, they may escalate the issue to the UAE Ministry of Human Resources and Emiratisation (MOHRE).

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.