Imagine finding out about a surprise AED 5,000 withdrawal from your company account just before a VAT filing deadline. The purpose of bank reconciliation in UAE is like a financial stethoscope. It helps you find any differences between your records and bank statements early. This way, you can avoid costly mistakes.

Why Differences Happen?

These differences might come from simple mistakes like delayed check processing or bank fees. But in the UAE’s fast market, ignoring these can lead to bigger problems. Regular transaction matching lets you fix errors early. This helps avoid penalties during audits or tax season.

Reconciliation as a Safety Net

Think of reconciliation as your business’s immune system. It catches small problems before they harm your cash flow. When your records match bank statements perfectly, you feel confident in your financial decisions. This confidence helps you grow your business, whether by expanding to new Emirates or negotiating with Dubai suppliers.

The Benefits of Regular Checks

By doing this check monthly (or weekly for busy accounts), you get a clear picture of your finances. If you notice a missing AED deposit, you can find it right away. If you see unknown charges, you can stop them before they cause more trouble. This proactive approach helps you plan for growth instead of just reacting to problems.

Read more: How to Track Expenses for Small Business in UAE

Understanding the Core Purpose of Bank Reconciliation in UAE

In the UAE’s fast-paced business world, bank reconciliation is key. It helps manage transactions in dirhams and dollars. It also handles big payroll spikes, like Ramadan bonuses. This process makes sure your records match your bank statements.

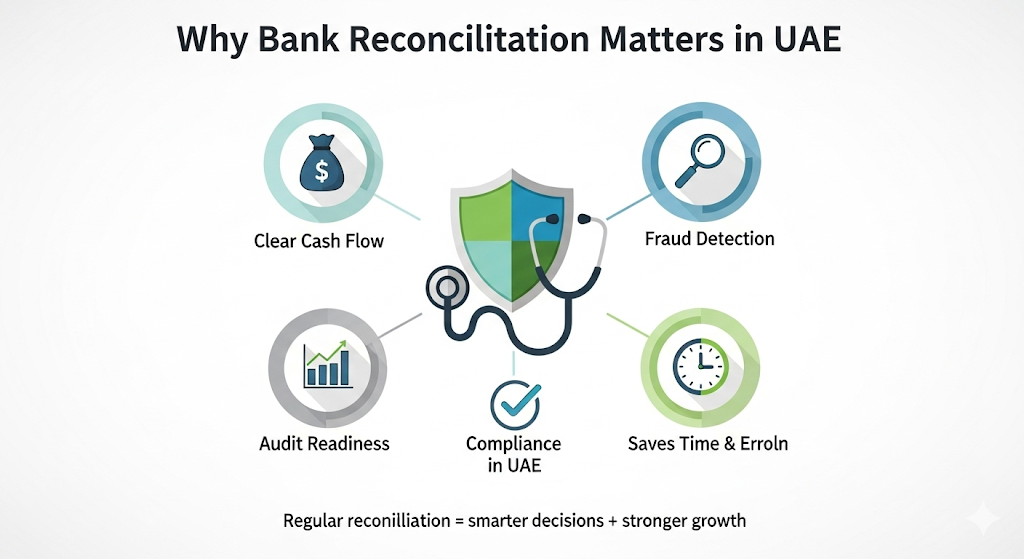

Why Bank Reconciliation Is Essential in UAE?

The purpose of bank reconciliation in UAE is to match the cash balance on a company’s books with the corresponding amount on its bank statement. This process identifies discrepancies such as outstanding checks, deposits in transit, bank errors, or unrecorded transactions, ensuring accurate financial records and preventing fraud.

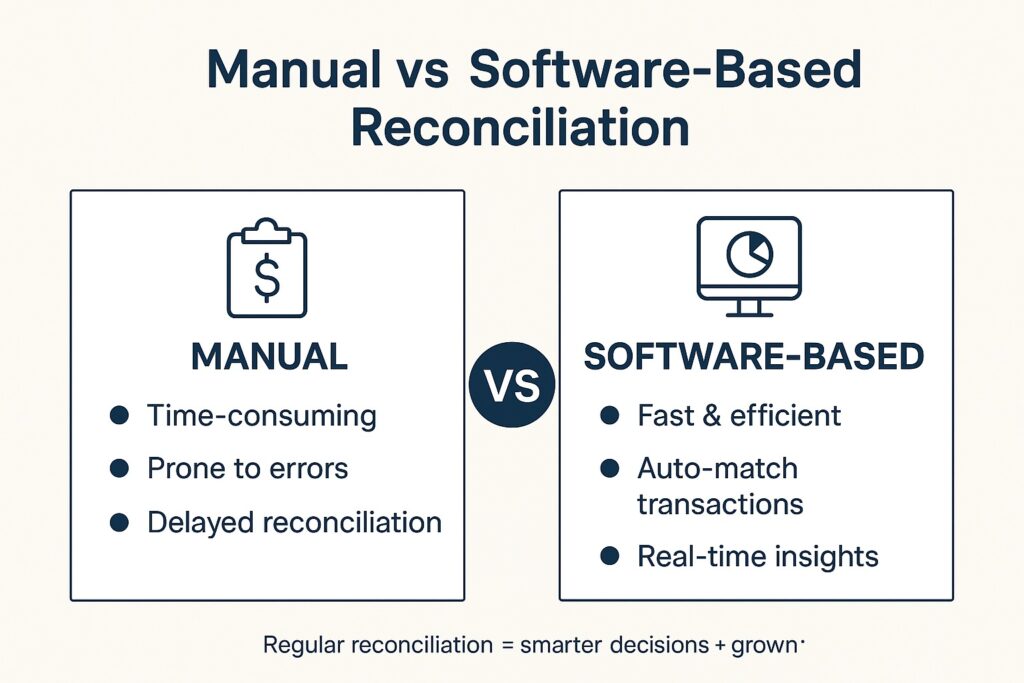

Role of Accounting Software in UAE

For any business, big or small, meticulous financial management is paramount, and at the heart of this lies effective reconciliation. Utilizing robust accounting software, like mazeed, is the first step in streamlining financial operations. This software serves as the central repository for all transactions, making the subsequent process of bank reconciliation far more efficient.

Without proper accounting software, the task of matching internal records with external bank statements becomes a daunting, error-prone endeavor. Regular bank reconciliation is not merely a bookkeeping task; it’s a critical control mechanism.

Every transaction, from incoming payments to outgoing expenses, must be meticulously checked against the bank’s records. This is precisely why do we need to do reconciliation to detect discrepancies, prevent fraud, and ensure the accuracy of financial statements.

What Bank Reconciliation Means for Your Business

Think of reconciliation as your financial detective. It finds problems before they cost you a lot. For UAE businesses, this means:

- Tracking multi-currency transactions without spreadsheet headaches

- Spotting duplicate payments to Dubai suppliers

- Catching unexpected charges from UAE banks like Emirates NBD

Read more: Impact of Accounting Software for Business Performance in UAE

Modern Tools Make It Easier

Modern accounting software bank reconciliation tools like mazeed accounting software help. They track AED and foreign currencies in real-time. They turn complex calculations into easy reports.

The purpose of bank reconciliation in UAE is to align the cash balance recorded in a company’s accounting records with the balance reported by the bank. This crucial task uncovers differences like unpresented checks, recent deposits not yet processed by the bank, or bank charges, leading to a precise cash position.

💡 Streamline Reconciliation with mazeed!

Match transactions, detect errors & stay audit-ready in UAE with mazeed accounting software.

Going Beyond a Business Bank Account

Opening a business bank account in Dubai is a crucial first step, but mazeed takes it further by offering extensive support for financial management and compliance in the UAE.

With mazeed, you get more than just a bank account. Their platform provides automated accounting software alongside expert financial and tax advisory services. This combination streamlines your operations, handling everything from recording transactions to filing taxes, ensuring your business stays on track and compliant.

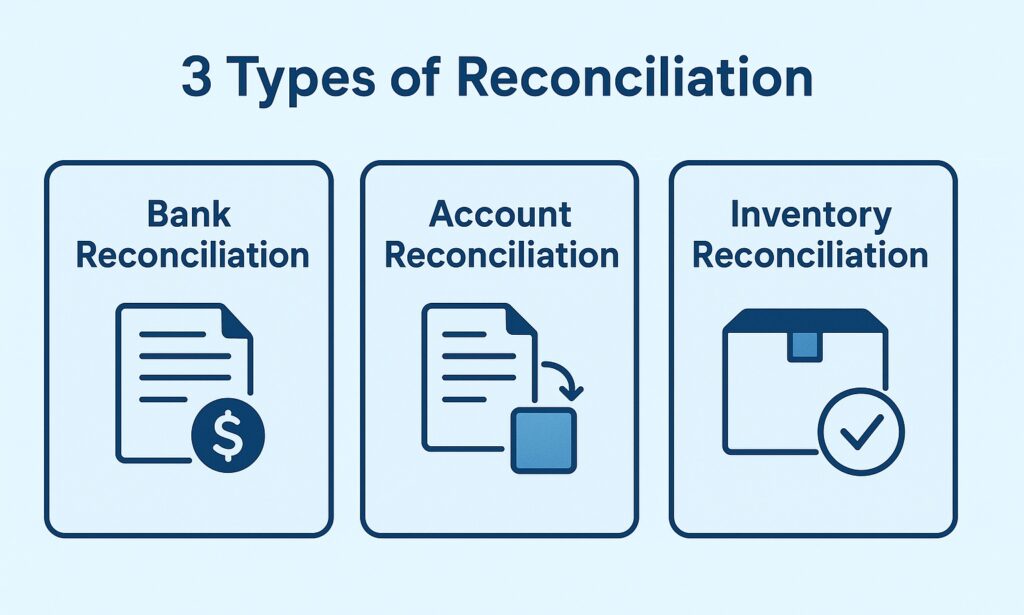

Essential Tools for Reconciliation

A- Bank Account Reconciliation Form

To facilitate this crucial process, many organizations rely on a structured bank account reconciliation form. This form provides a systematic way to track all outstanding deposits and checks, making the bank account reconciliation form an invaluable tool for auditors and financial managers alike. Beyond the general ledger, specific areas require their own reconciliation efforts.

B- Payment Reconciliation Journal

For instance, the payment reconciliation journal plays a vital role in ensuring that all customer payments are accurately recorded and applied against outstanding invoices.

Maintaining a clean and accurate payment reconciliation journal is essential for cash flow forecasting and customer relationship management.

C- Payroll Reconciliation

Similarly, the payroll reconciliation process is indispensable.

Given the sensitive nature of employee compensation, the payroll reconciliation process ensures that all wages, taxes, and deductions are correctly processed and paid, mitigating potential legal and financial risks. This rigorous payroll reconciliation process safeguards both the company and its employees.

Why Do We Need Reconciliation?

Ultimately, the question of why do we need to do reconciliation boils down to financial integrity and operational efficiency. It provides assurance that financial data is reliable, allowing for informed decision-making and preventing costly errors.

Regular, thorough reconciliation, empowered by efficient accounting software and diligent use of a bank account reconciliation form, is the bedrock of sound financial health.

Why You Can’t Afford to Skip This Process?

Ignoring purpose of bank reconciliation in the UAE can cause problems. It can lead to:

- Penalties for VAT filing errors

- Damaged relationships with local suppliers

- Missed opportunities from inaccurate cash flow data

One Dubai based retailer found 18,000 AED in duplicate payments. They did this during their quarterly reconciliation. This money would have been lost if they hadn’t checked.

Common Purpose of Bank Reconciliation & Red Flags in UAE Banking

Watch out for these UAE-specific warning signs:

- AED amount mismatches in import/export transactions

- Ramadan bonus payments not reflected in bank feeds

- Missing entries for bank charges from UAE financial institutions

Advanced purpose of bank reconciliation systems now flag these issues. They use AI to learn your transaction patterns.

Your Step-by-Step Purpose of Bank Reconciliation in UAE

Mastering bank reconciliation in the UAE means following global standards but also local rules and VAT needs. We’ve broken it down into five easy steps for businesses in the Emirates.

1. Gather Essential Documents

First, collect these UAE-specific records:

- Bank e-statements (ADCB / ENBD / FAB formats)

- Digital invoices with TRN numbers

- Payment receipts showing AED amounts

- VAT-301 reports from your tax agent

The purpose of bank reconciliation is to compare and contrast the cash figures from an organization’s internal ledgers against those provided by its bank. By doing so, businesses can pinpoint variances, including bank fees, errors, or outstanding transactions, thereby maintaining up-to-date and reliable financial information.

Read more: What is Contra Entry?

Required Records for UAE Businesses

Download bank statements from your UAE banking portal to avoid format issues. The Central Bank asks businesses to keep records for 5 years. Start with organized digital folders.

2. Match Transactions Like a Pro

Compare your ledger entries with bank statements line by line. Look for:

- Exact AED amounts

- Correct transaction dates

- Proper VAT coding (5% or 0%)

Using mazeed for AED Transactions

Set your mazeed account to:

- Currency: AED

- Date format: DD/MM/YYYY

- VAT codes: Configure UAE-specific tax rates

Enable auto-match to pair 87% of transactions instantly. Flag mismatches with red alerts for manual review.

3. Identify and Resolve Discrepancies

Common issues in UAE reconciliations:

| Issue | Quick Fix |

|---|---|

| Delayed cheque clearance | Add 3 business days to post-dated cheques |

| AED-USD conversion differences | Use Central Bank’s daily rate |

| VAT amount mismatches | Cross-check with FTA portal figures |

Handling Common UAE-Specific Issues

When resolving discrepancies:

- Document adjustment reasons in Arabic/English

- Get manager approval via email

- Update both bank and ledger entries

4. Update Your Payment Reconciliation Journal

Record all adjustments in your payment reconciliation journal with:

- Adjustment dates

- Responsible staff names

- Linked VAT report numbers

5. Finalize and Document the Process

Complete your bank account reconciliation form with:

- Final balance confirmation

- List of unresolved items

- Next steps timeline

6. Creating Audit-Ready Records

Store these digitally for MOF inspections:

- Signed reconciliation reports

- Supporting documents

- Revision history

- Retention period: Minimum 5 years from financial year end

💡 A Smarter Way to Manage Finances in UAE

mazeed combines accounting software with certified experts to simplify bank reconciliation, ensure VAT and CT compliance & protect cash flow.

Takeaways: Transform Reconciliation from Chore to Strategic Advantage

Regular bank reconciliation sharpens your financial clarity in the UAE’s fast-paced market. It helps spot payment delays before they disrupt operations.

Businesses using monthly reconciliation often report stronger cash flow management. This is critical for funding expansion projects in Dubai or Abu Dhabi.

Clean records simplify investor presentations and audits required by UAE authorities. Integrating reconciliation with payroll cycles ensures employee payments match bank outflows precisely.

Consider how Emirates NBD users automate transaction matching through their business portals. This reduces manual work while flagging discrepancies during payroll reconciliation, keeping compliance with CBUAE regulations and VAT reporting requirements.

Turn reconciliation into a growth engine by scheduling it before major financial decisions. Pair your bank statements with tools like QuickBooks or mazeed for real-time insights.

In a market where 43% of UAE businesses face cash flow challenges, consistent reconciliation becomes your shield against financial surprises.

Start viewing each matched transaction as data for smarter budgeting. When reconciliation becomes habitual, you’ll identify spending patterns faster and negotiate better terms with suppliers. That’s how routine checks evolve into strategic advantages across the UAE’s competitive landscape.

FAQs: Purpose of Bank Reconciliation in UAE

1. What is the purpose of the bank reconciliation?

The purpose of bank reconciliation is to match a company’s internal cash records with its bank statement, ensuring accuracy, detecting errors or fraud, and providing a true picture of available funds.

What are the 5 importances of bank reconciliation?

The five main importances are:

1- Detecting errors in records.

2- Preventing fraud and unauthorized transactions.

3- Ensuring accurate cash flow management.

4- Recording missing items like fees or deposits.

5- Supporting compliance and audit readiness.

What is the main purpose of reconciliation?

The main purpose of reconciliation is to ensure that financial records agree with external statements, maintaining accuracy and trust in financial reporting.

What is the primary purpose of the BRS?

The primary purpose of the Bank Reconciliation Statement (BRS) is to explain differences between the bank balance in company books and the bank statement, making adjustments to show the correct balance.

Why is reconciliation important?

Reconciliation is important because it prevents financial errors, highlights fraud, improves decision-making, and ensures reliable financial statements.

Who is responsible for bank reconciliation?

Typically, the company’s accountant or bookkeeper is responsible for preparing the bank reconciliation, with final oversight from finance managers or auditors.

What are the three methods of bank reconciliation?

The three methods are:

1- Document review method: Matching each transaction.

2- Analytics review method: Using ratios and comparisons.

3- Bank statement method: Directly adjusting balances with bank records.

What is the difference between audit and reconciliation?

– Reconciliation: Matches records for accuracy between two sets of accounts.

– Audit: A broader, independent examination of all financial records to ensure compliance and fairness.

What is the journal entry for bank reconciliation?

Bank reconciliation itself does not have a direct journal entry. However, adjustments like Bank Charges (Dr.) / Bank A/c (Cr.) or Accounts Receivable (Dr.) / Bank A/c (Cr.) are recorded to align books with the bank statement.

What are the 4 parts of bank reconciliation?

The four parts are:

1- Deposits in transit.

2- Outstanding checks.

3- Bank errors.

4- Company errors or adjustments.

How do you prevent errors in reconciliation?

You can prevent errors by:

– Reconciling regularly (monthly or weekly).

– Using accounting software.

– Reviewing supporting documents.

– Assigning responsibility to trained staff.

What are the golden rules of accounting?

The three golden rules are:

– Debit what comes in, credit what goes out.

– Debit the receiver, credit the giver.

– Debit expenses and losses, credit incomes and gains.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.