Running an e-commerce business in the UAE is exciting but comes with complex financial and tax challenges. From tracking daily sales to managing VAT, invoices, and refunds, manual accounting can quickly become overwhelming. That is why more online businesses are turning to accounting software for e-commerce in UAE to automate their operations and stay compliant with the Federal Tax Authority (FTA) requirements.

The Rise of E-Commerce in the UAE

The UAE’s e-commerce market has become one of the fastest-growing in the region, driven by tech-savvy consumers, digital transformation, and strong logistics infrastructure. According to EZDubai and Euromonitor, the market reached AED 27.5 billion in 2023 and is expected to grow to AED 48.8 billion by 2028.

Research from Mordor Intelligence estimates the UAE e-commerce market at USD 12.28 billion in 2025, projected to reach USD 21.18 billion by 2030, reflecting an annual growth rate of 11.5 percent.

Online shopping already represents about 14.4 percent of the total retail market, and this share is expected to increase to 16.5 percent by 2028, according to ADAT.

With this expansion, the FTA has placed greater emphasis on ensuring digital and online businesses maintain accurate, automated, and FTA-compliant financial records. Having a modern accounting system is now essential to manage both growth and compliance.

Why E-Commerce Businesses Need Accounting Software in UAE?

E-commerce companies face more complex accounting needs than traditional businesses. They deal with large transaction volumes, multiple payment gateways, returns, refunds, and VAT requirements for local and cross-border sales.

Using accounting software for e-commerce in UAE simplifies all these processes. The software can automatically sync data from online stores, marketplaces, and POS systems, ensuring every sale and expense is accurately recorded.

An accounting software in UAE helps with:

- Integration with platforms like Shopify, Amazon, and WooCommerce.

- Automated VAT calculation and filing that comply with UAE tax rules.

- Real-time tracking of profits, expenses, and cash flow.

- Simplified management of refunds and promotions.

These features eliminate human error, save time, and help business owners make informed decisions with accurate financial data.

💡 Simplify Accounting with Smart Software

Handle invoices, track expenses, and stay 100% tax compliant with mazeed accounting software!

Key Features to Look For in E-Commerce Accounting Software

When selecting accounting software for e-commerce business in the UAE, choose solutions that are powerful, flexible, and FTA-compliant.

The most important features include:

- Real-Time Sales Tracking to automatically update online and offline transactions.

- VAT and Corporate Tax Management to handle filings and reports in line with UAE regulations.

- Inventory and Order Management to keep stock levels updated and prevent overselling.

- Payment Gateway Integration with Stripe, PayPal, and local gateways.

- Automated Reconciliation to match bank transactions with recorded sales easily.

- Customizable Financial Reports for insights into revenue, expenses, and profitability.

These functions work together to create a seamless financial system that supports compliance and growth.

Understanding UAE E-Invoicing and Its Timeline

The UAE is preparing for the full rollout of its national e-invoicing system led by the FTA. The system aims to standardize how invoices are created, verified, and shared digitally between businesses and the authority.

According to the official e-invoicing timeline in UAE, implementation will happen in two phases:

- Generation Phase (July 2025)

All VAT-registered businesses will be required to issue electronic invoices in a structured format that meets FTA technical specifications. - Integration Phase (July 2026)

Businesses must integrate their accounting software directly with the FTA’s platform for real-time invoice exchange and validation.

Once these phases are active, using FTA-compliant accounting software will be mandatory for all registered businesses, including e-commerce companies. This step will make automation essential for tax reporting, compliance, and audit readiness.

Benefits of Accounting Software for E-Commerce in UAE

Implementing accounting software for e-commerce in UAE delivers measurable results. Below are verified examples from UAE businesses and platforms:

- Sol.online clients in UAE and GCC report up to 50% boost in operational efficiency and a substantial reduction in accounting errors after switching to AI-powered accounting tools.

- In Abu Dhabi, a trading enterprise using automation for its financial close process achieved an 89% reduction in closing time and 78% fewer accounting errors. VAT-compliant invoice processing became faster and less error-prone.

- SMEs using automated accounting tools report faster reconciliation, more accurate VAT reporting, and better time allocation for strategic tasks over repetitive manual work.

These numbers show that when e-commerce businesses in the UAE adopt accounting software, the benefits include significantly fewer errors, faster close cycles, and more efficient compliance with tax regulations.

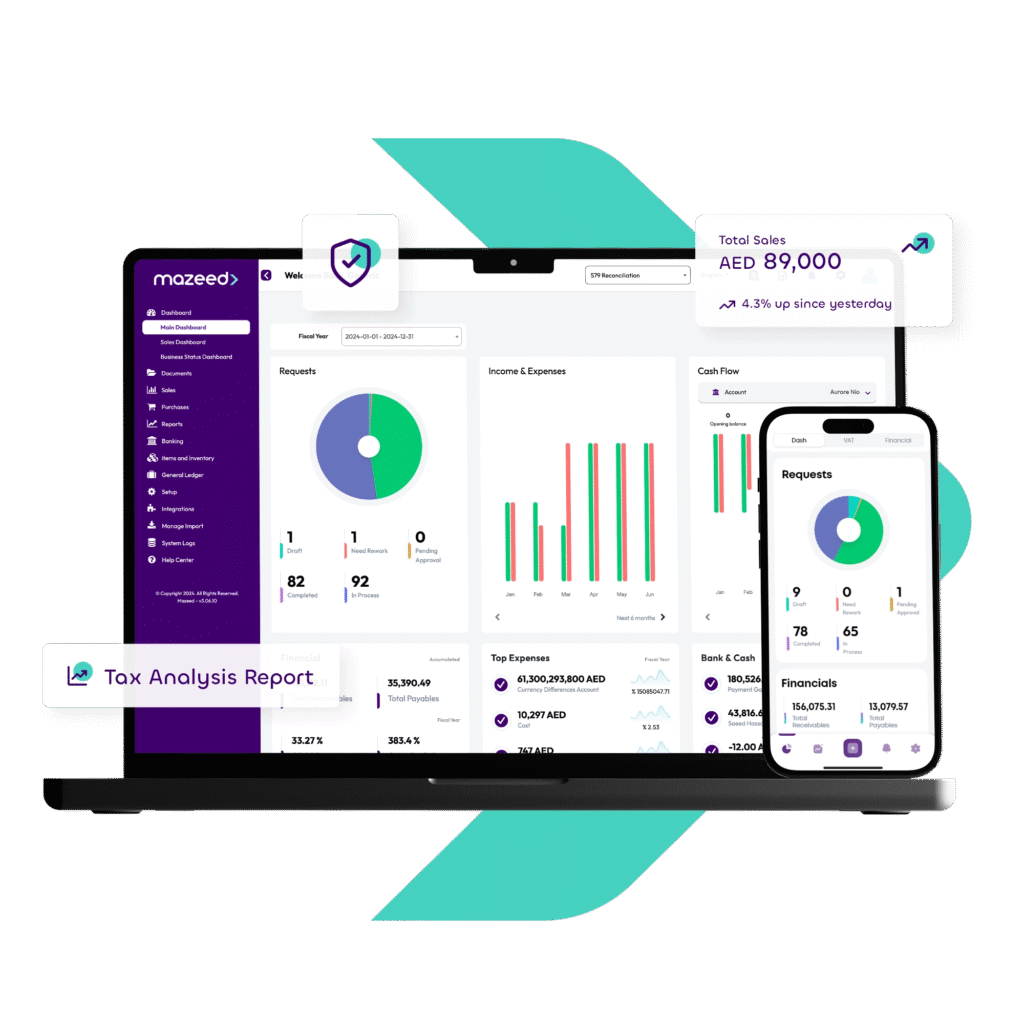

How mazeed Supports E-Commerce Businesses

mazeed provides FTA-compliant accounting software for e-commerce in UAE, designed to simplify every part of your financial workflow. The system integrates seamlessly with popular e-commerce platforms and payment gateways, simplify VAT management, tracks inventory, and generates real-time insights into your financial health.

Along with the software, mazeed offers access to certified tax and accounting experts who ensure 100% compliance and help reduce accounting costs by up to 85%. This combination of technology and expertise makes mazeed the ideal partner for growing e-commerce businesses in the UAE.

FAQs: Accounting Software for E-Commerce in UAE

Which accounting software is mostly used in the UAE?

In the UAE, popular accounting software includes mazeed, Zoho Books, QuickBooks, and Tally. mazeed is fully FTA-compliant, simplifies accounting and VAT filing, and integrates with online sales platforms and POS systems.

Do you need an accountant for ecommerce?

While an accountant is not mandatory, having one helps ensure accurate bookkeeping, tax compliance, and financial reporting. Many e-commerce businesses in the UAE use automated accounting software like mazeed, which reduces the need for manual accounting and simplifies financial management.

Why do businesses use accounting software?

Businesses use accounting software to automate daily financial tasks, track sales and expenses, generate real-time reports, and stay compliant with tax regulations. It also helps save time, reduce human error, and improve financial decision-making.

What is accounting for an e-commerce business?

Accounting for an e-commerce business involves recording online sales, managing expenses, tracking inventory, handling multiple payment gateways, and ensuring VAT compliance. E-commerce accounting software automates these processes to keep financial records accurate and up to date.

Which account is best for an ecommerce business?

For e-commerce businesses, using a business bank account linked with cloud-based accounting software like mazeed is better. This setup allows automatic transaction tracking, accurate reporting, and smoother VAT filing in the UAE.

What are the challenges of e-commerce accounting?

E-commerce accounting challenges include managing multiple sales channels, handling refunds and discounts, calculating VAT accurately, tracking inventory, and reconciling online payments. Accounting software solves these challenges by automating entries and syncing with e-commerce platforms.

What is the biggest challenge in accounting?

The biggest challenge in accounting is maintaining accuracy and compliance while managing large volumes of transactions. For e-commerce businesses, ensuring VAT compliance and real-time financial tracking are key difficulties that automation helps overcome.

What are the two main limitations of e-commerce?

The two main limitations of e-commerce are lack of personal interaction and dependence on technology. Technical issues, security risks, or payment gateway failures can affect business operations and customer experience.

What is the key issue in e-commerce?

The key issue in e-commerce is maintaining trust and data security. Ensuring secure payment systems, protecting customer information, and complying with local regulations such as UAE VAT laws are top priorities.

What are the four basics of e-commerce?

The four basics of e-commerce are product, price, place, and promotion. These fundamentals help businesses attract customers, optimize online sales, and maintain competitiveness in the market.

What are the 3 C’s of e-commerce?

The 3 C’s of e-commerce are content, community, and commerce. These elements work together to attract audiences, build trust, and drive online transactions.

What are the key success factors in e-commerce?

Key success factors in e-commerce include user-friendly website design, efficient logistics, strong digital marketing, reliable payment systems, and accurate financial management using tools like mazeed Accounting Software to automate bookkeeping and VAT compliance.

Key Takeaways: Accounting Software for E-Commerce in UAE

The UAE’s e-commerce industry is growing faster than ever, and with it comes a greater need for accurate, compliant, and automated accounting. By using accounting software for e-commerce in UAE, businesses can streamline their operations, simplify VAT filing, and prepare for mandatory e-invoicing with confidence.

Whether you are selling through your own online store or across multiple platforms, adopting the right accounting software today will save time, reduce costs, and position your business for sustainable growth.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.