Running a retail business in the UAE means managing tight margins, daily transactions, inventory across locations, and evolving tax requirements. With digital transformation accelerating across the region, using accounting software for retail is no longer optional. It is a core tool to keep finances accurate, operations efficient, and tax reporting FTA compliant.

If you are exploring how accounting software can improve your overall business operations, check out our main guide, why you need accounting software in UAE, for a complete overview of the benefits, features, and industry-wide impact.

The UAE Retail Landscape at a Glance

The UAE retail market is large and still growing. Industry research shows the UAE retail market was valued at around USD 145.3 billion in 2024, with expectations of continued expansion in the coming years.

Retailers must handle both high transaction volumes and increasing digital sales channels, which means manual bookkeeping and spreadsheets quickly become a liability.

Why Retail Businesses Need Accounting Software

Retailers face several accounting challenges that software directly solves:

- High transaction volumes across stores and online marketplaces.

- Multiple payment methods and payment gateway reconciliations.

- Inventory shrinkage, returns, and supplier invoice complexity.

- VAT reporting and, soon, structured e-invoicing requirements from UAE authorities.

Accounting software for retail automates transaction capture, reconciles bank and POS records, tracks inventory costs, and prepares VAT reports in formats that reduce manual rework. The automation also frees time for owners and finance teams to focus on sales, margins, and growth.

💡 Your Accounting Made Simple

Save time and reduce errors with smart tools that keep your books accurate and compliant.

Key Features Retail Teams Should Look for

Not every accounting tool fits retail needs. When choosing accounting software for retail, prioritize the following features:

- POS and channel integrations that sync every sale automatically.

- Real-time inventory and stock alerts to avoid stockouts and overstock.

- Automated reconciliation to match bank, card, and marketplace payments.

- VAT-ready reporting and exportable files for FTA submissions.

- Multi-store consolidation for group reporting and profit analysis.

- Real-time dashboards that show margins by product, location, and period.

These capabilities make financial operations predictable and audit-ready while helping manage margins more proactively.

E-Invoicing and Retail Compliance in UAE

The UAE is actively building a national e-invoicing system operated through the Ministry of Finance. The official guidance explains the purpose and structure of the e-invoicing initiative and its benefits for transparency and policy planning.

Practical e-invoicing timelines and rollout phases are being tracked by tax and compliance firms. The planning and phased implementation indicate retail businesses will need to be ready to generate structured electronic invoices and integrate with official platforms when required. Using an FTA-ready accounting system today will reduce the implementation risk and simplify compliance when e-invoicing phases are enforced.

Measurable Impacts of Accounting Automation

There is credible evidence that automation in finance delivers measurable improvements in speed, accuracy, and control:

- Finance and accounting automation practices such as RPA and system integration are shown to improve productivity and internal control, helping teams close faster and reduce manual errors.

- Industry surveys and accounting platform reports consistently find that firms adopting modern accounting tools gain faster reporting cycles and more time for advisory work and growth activities. For example, major accounting platforms and surveys highlight substantial gains in accountant productivity and faster reporting when modern tools are used.

While exact percentages vary by sector and implementation, the direction is clear: automation reduces repetitive tasks, tightens controls, and accelerates month-end and VAT workflows.

Practical ROI Examples for Retail

Here are practical ways retail stores typically see ROI from accounting software for retail:

- Faster month-end close and reporting, which gives managers timely insight to act on pricing and promotions.

- Reduced reconciliation time for card and marketplace platforms, cutting the hours finance teams spend on matching payments.

- Better inventory costing and shrinkage monitoring, which improves gross margins.

- Quicker VAT preparation and fewer errors in tax reports, lowering audit risk and potential penalties.

For larger retailers and chains, these savings compound across locations, improving cash flow and enabling more accurate merchandising decisions.

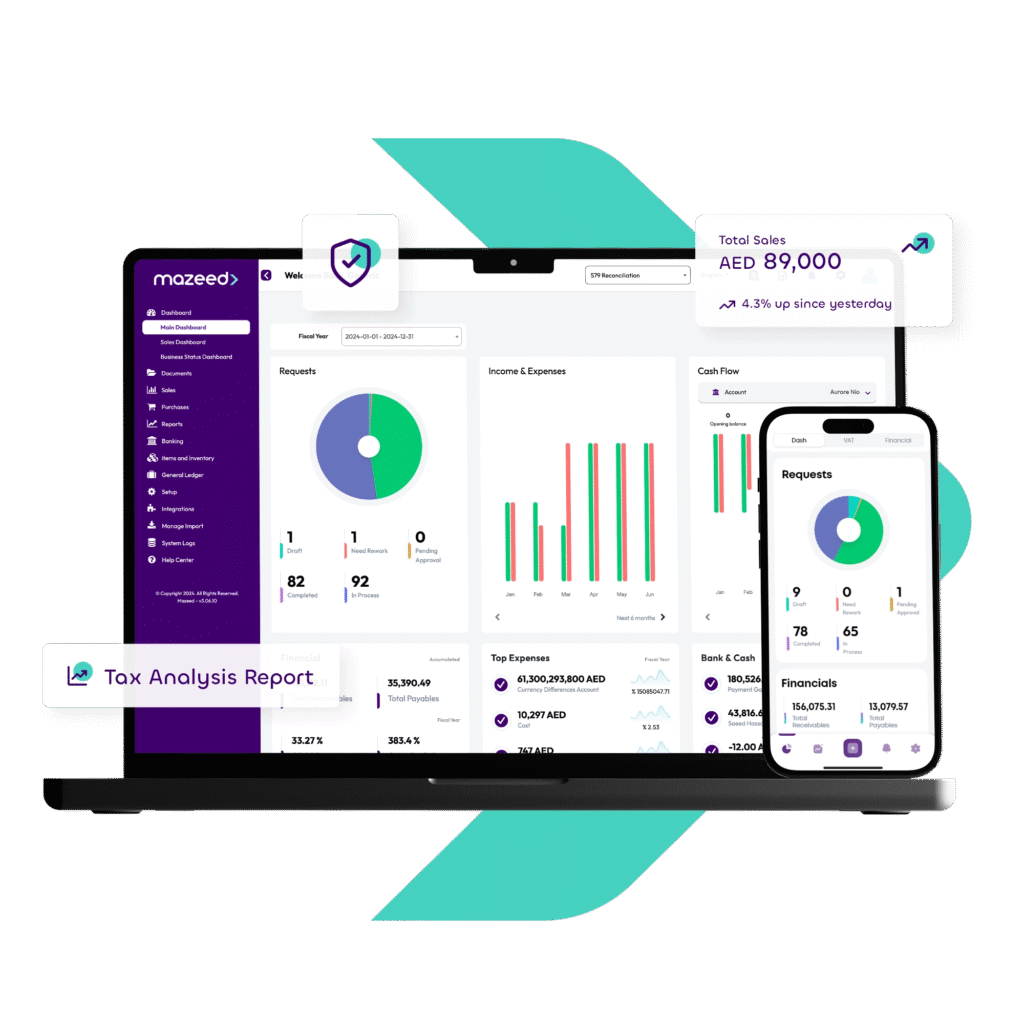

How mazeed Supports Retail Operations

mazeed’s accounting platform is built to meet these retail needs with features such as POS integrations, inventory costing, VAT-ready reporting, and multi-store consolidation. Pairing software with certified tax and accounting experts helps retailers stay compliant and implement e-invoicing when it becomes mandatory in required phases. For a deeper look at e-invoicing readiness, see our dedicated guide.

Next Steps for Retail Business Owners

- Audit current workflows and list recurring manual tasks (reconciliation, VAT preparation, inventory updates).

- Choose accounting software for retail that integrates with your POS and marketplaces.

- Validate VAT and e-invoicing readiness with your vendor and tax advisor.

- Start with automated reconciliation and reporting modules to see fast operational gains.

- Train staff and schedule a phased rollout to avoid disruption.

FAQs: Accounting Software for Retail Businesses in UAE

Which accounting software is mostly used in the UAE?

The best accounting software in the UAE includes mazeed accounting software, Tally, QuickBooks, and Zoho Books. mazeed stands out for its FTA compliance, ease of use, and automation tailored for UAE businesses.

What is the best accounting software for a retail business?

mazeed accounting software is one of the best accounting software for retail businesses in the UAE. It streamlines daily transactions, integrates with POS systems, manages inventory, and ensures 100% VAT compliance.

Which ERP is mostly used in UAE?

Popular ERPs in the UAE include SAP, Oracle, Odoo, and Microsoft Dynamics 365. For small and medium retail businesses, mazeed provides a simpler, cost-effective alternative with integrated accounting and tax features.

Which accounting software is easiest to use?

mazeed accounting software is known for its user-friendly interfaces. mazeed is particularly easy for non-accountants, offering automated features and simplified dashboards.

Which software is best for retail?

The best software for retail combines inventory, sales, and accounting management. mazeed is ideal for UAE retailers as it integrates POS, automates bookkeeping, and aligns with FTA VAT rules.

What is retail software called?

Retail software is often referred to as POS (Point of Sale) software or retail management software, which may include accounting, sales, inventory, and reporting tools in one platform.

How retail accounting is used in the retailing business?

Retail accounting helps track revenue, expenses, inventory costs, and profitability. It provides insights into stock levels, sales performance, and cash flow, enabling better business decisions.

How to maintain retail shop account?

Retail shop accounts are maintained by recording daily sales, purchases, and expenses. Using accounting software like mazeed manages this process, ensuring accurate reports and compliance with VAT regulations.

How to manage inventory in a retail store?

Inventory can be managed using software that tracks stock levels, purchase orders, and product movement. mazeed simplifies inventory tracking, syncs with POS systems, and updates accounts in real time.

What is the balance sheet of a retail store?

A retail store’s balance sheet shows assets (cash, inventory, equipment), liabilities (loans, payables), and equity (owner’s capital). It provides a snapshot of the store’s financial health at a specific date.

Key Takeaways: Accounting Software for Retail Businesses in UAE

With the UAE market scale and the move toward structured e-invoicing, adopting robust accounting software for retail is a strategic step. It improves accuracy, speeds reporting, and places retailers in a stronger position to grow and comply with upcoming regulations. For more on how e-invoicing will affect UAE businesses, visit the Ministry of Finance e-invoicing page.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.