Running a construction or contracting business in the UAE comes with complex financial challenges, from tracking project costs and subcontractor payments to ensuring timely VAT reporting and cash flow control. With digital transformation and e-invoicing on the horizon, adopting accounting software for construction and contracting is essential to manage projects profitably and stay compliant.

If you want the full context on automation across industries, see our pillar guide, why you need accounting software in UAE.

The UAE Construction Market: Scale & Momentum

The construction sector in the UAE is large and active. Market research shows significant project pipelines and steady growth forecasts. For example, Mordor Intelligence estimates the UAE construction market at about USD 42.75 billion in 2025, with a forecast to USD 52.66 billion by 2030.

Industry analysis from Deloitte also highlights the region’s strong construction activity and the increasing role of digital tools in project delivery.

Recent coverage by Reuters and Knight Frank describes how developers and contractors are responding to booming project pipelines and rising in-house construction trends, underscoring the need for tighter financial controls. (References: Reuters, Knight Frank)

Why Construction & Contracting Firms Need Accounting Software?

Construction accounting is project-centric. Each job has its own budget, timeline, suppliers, and margin profile. Common pain points include:

- Managing multiple vendor and subcontractor invoices and retentions.

- Tracking work in progress and recognizing revenue across milestones.

- Calculating landed and equipment costs for accurate job costing.

- Handling VAT on local purchases and cross-border services.

- Producing audit-ready records for tax authorities.

A construction-aware accounting system automates purchase orders, links bills to projects, manages retainage and progress billing, and generates project P&L reports. This reduces manual errors and keeps managers informed in real time.

Key Features to Prioritize

When evaluating accounting software for construction and contracting, look for:

- Project costing and work-in-progress tracking.

- Progress billing and retainage management.

- Supplier invoice matching and automated reconciliation.

- Multi-currency and landed cost support where import of materials applies.

- VAT reporting and the ability to export structured data for tax submissions.

- Integration with procurement, payroll, and field/project management systems.

Software built for construction helps turn scattered invoices and spreadsheets into a single source of truth for project finance.

💡 Your Accounting Made Simple

Save time and reduce errors with smart tools that keep your books accurate and compliant.

E-invoicing in UAE and What It Means for the Industry

The UAE Ministry of Finance has published official guidance on the national e-invoicing initiative. The program requires structured electronic invoices and encourages businesses to adopt systems that can generate and transmit compliant invoices. Read the Ministry of Finance e-invoicing overview for exact requirements and timelines.

The Federal Tax Authority also hosts VAT guides and clarifications that outline record-keeping and reporting obligations relevant to construction businesses. These pages explain documentation and retention expectations useful for audit readiness.

For contractors, e-invoicing means invoices and credit notes should be generated in machine-readable formats and linked to project records. Using accounting software for construction that supports e-invoicing reduces the risk of non-compliance and simplifies both supplier and client invoicing flows.

Remember, it’s important to know the e-invoicing implementation timeline in UAE to avoid any problems for your business.

What Researches Say about Automation Benefits?

Rather than relying on a single percentage that may not apply universally, use these authoritative sources which describe the operational benefits of digital finance and e-invoicing:

- The OECD explains how electronic invoicing improves tax compliance and reduces administrative burdens.

- Construction and finance transformation content outlines how digital finance tools reduce manual work, accelerate reporting, and improve decision-making across projects

- Market analysis from e-invoicing research groups documents global growth in e-invoice adoption and efficiency gains where structured electronic invoicing is applied.

These sources support the practical view that automation leads to faster closes, fewer reconciliation issues, and clearer audit trails, outcomes that are especially important for multi-project construction firms.

Benefits of Accounting Software for Construction Firms

Adopting construction-aware accounting software for construction typically delivers:

- Faster and more accurate month-end closes.

- Reduced invoice processing time through automated supplier matching.

- Clearer project profitability reports, helping managers act earlier on overruns.

- Easier VAT preparation and reduced audit risk thanks to structured records.

- Better cash flow forecasting to fund procurement and payroll.

These outcomes help contractors improve margins, reduce disputes, and scale operations more confidently.

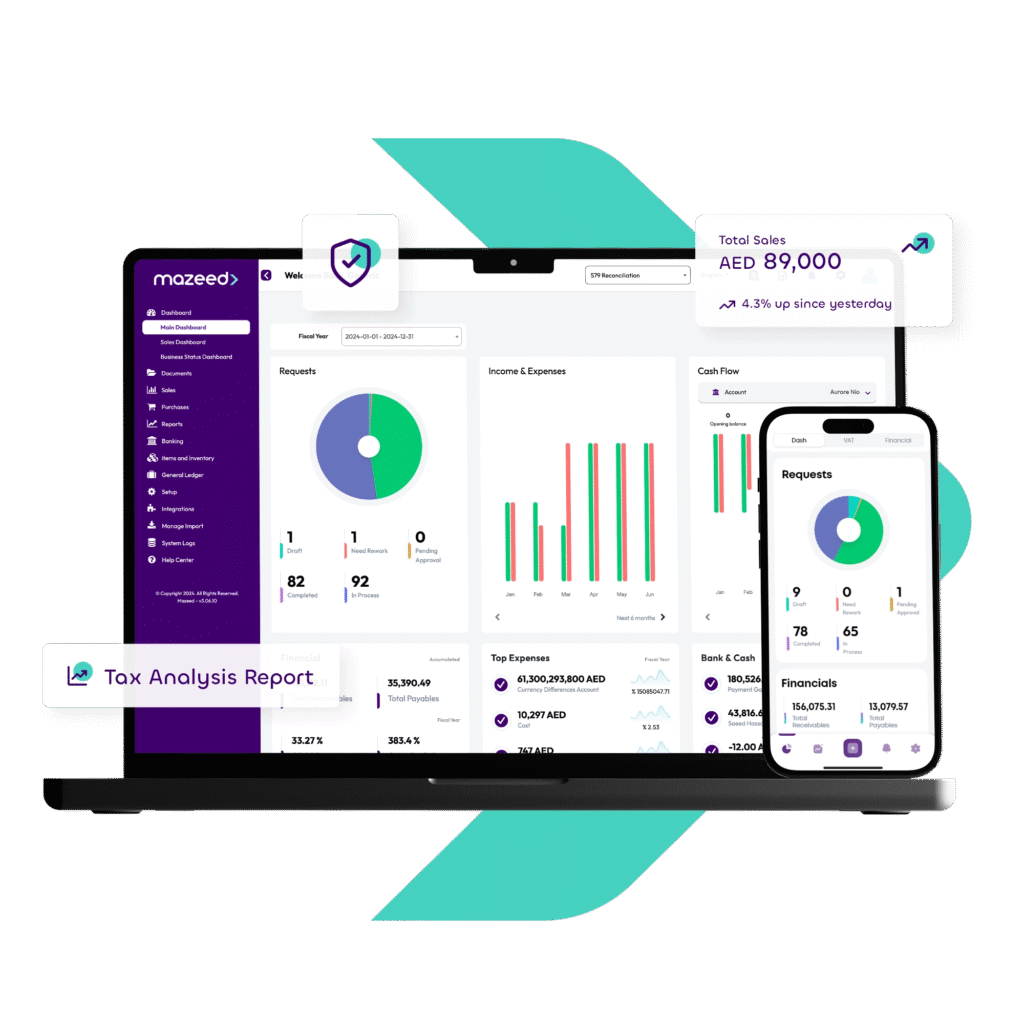

How mazeed Supports Construction and Contracting

mazeed offers accounting features tailored for construction, including project cost tracking, progress billing, subcontractor payment workflows, VAT-ready reporting, and integration options for procurement and field systems. mazeed also helps clients prepare for e-invoicing adoption and FTA requirements by supporting structured invoice exports and record retention.

Learn more about mazeed’s construction capabilities and how the platform can be integrated with your project systems.

Next Steps for Construction Businesses

- Map your current billing, retention, and change order processes.

- Choose software that supports job costing, progress billing, and supplier reconciliation.

- Confirm e-invoicing and VAT export capabilities with your vendor.

- Run a pilot on a single project to validate workflows and reporting.

- Train finance and project teams on new processes and controls.

FAQs: Accounting Software for Construction

What is the best software for construction accounting?

mazeed accounting software is one of the best accounting software for construction companies in the UAE, built to handle project-based accounting, job costing, subcontractor management, and VAT compliance. It helps contractors monitor budgets, expenses, and profitability in real time.

Which software is best for a construction company?

For UAE construction companies, mazeed, QuickBooks, and Tally are among the top choices. mazeed stands out for its local compliance, Arabic interface, and ability to automate financial tracking for multiple projects and contracts.

What accounting is used in construction?

Construction accounting focuses on project-based accounting, where each project is treated as a separate cost and revenue center. It tracks direct and indirect costs like materials, labor, and overheads, which can be efficiently managed using mazeed accounting software.

What is the top accounting software?

The top accounting software for UAE businesses includes mazeed, Tally, Zoho Books, and QuickBooks. mazeed is preferred by many construction firms for its locality, simplicity, FTA compliance, and industry-specific features.

How do you record construction accounting?

Construction accounting records transactions by linking expenses, invoices, and revenues to specific projects. Using mazeed, contractors can automate this process, assign costs to projects, and generate real-time profitability reports.

What type of accounting is used in construction?

The construction industry uses job cost accounting, a method that tracks the costs and revenues for each individual project. This system ensures accurate budgeting and financial reporting, which mazeed accounting software simplifies through smart tracking tools.

Final Thought

With the UAE construction market projected to grow strongly, construction and contracting businesses face increasing financial complexity. Adopting specialized accounting software for construction & contracting is not only about saving time — it’s about controlling costs, enabling growth, and staying compliant in a regulated environment.

When you adopt systems built for construction and combine them with expert support and future e-invoicing readiness, you put your firm in a much stronger position to win projects, manage risk, and deliver profits.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.