Dubai has become one of the most attractive destinations in the world for foreign entrepreneurs. Its strategic location, modern infrastructure, and business-friendly regulations make it easier than ever for non-residents to establish and grow a company. If you are considering starting a business in Dubai as a foreigner, this guide walks you through the process, costs, legal structures, and key things you should know before getting started.

Why Foreigners Start Businesses in Dubai

Dubai actively encourages foreign investment. Over the past few years, major legal reforms have made company formation more accessible to international founders.

Key reasons foreigners choose Dubai include:

- 100% foreign ownership for most business activities

- No personal income tax

- Strong global banking and logistics infrastructure

- Fast company registration processes

- Ability to apply for UAE residency through business ownership

These advantages make starting a business in Dubai as a foreigner a realistic option for both small entrepreneurs and established companies.

Can Foreigners Legally Own a Business in Dubai?

Yes. Foreigners can legally own and operate businesses in Dubai. In most cases, you can own 100% of the company without the need for a local partner, especially in Free Zones and for many mainland activities.

There are three main legal options available:

- Free Zone company

- Mainland company

- Branch of a foreign company

Choosing the right structure depends on your target market, budget, and business activity.

Read more: How Much Does It Cost to Start a Small Business in Dubai

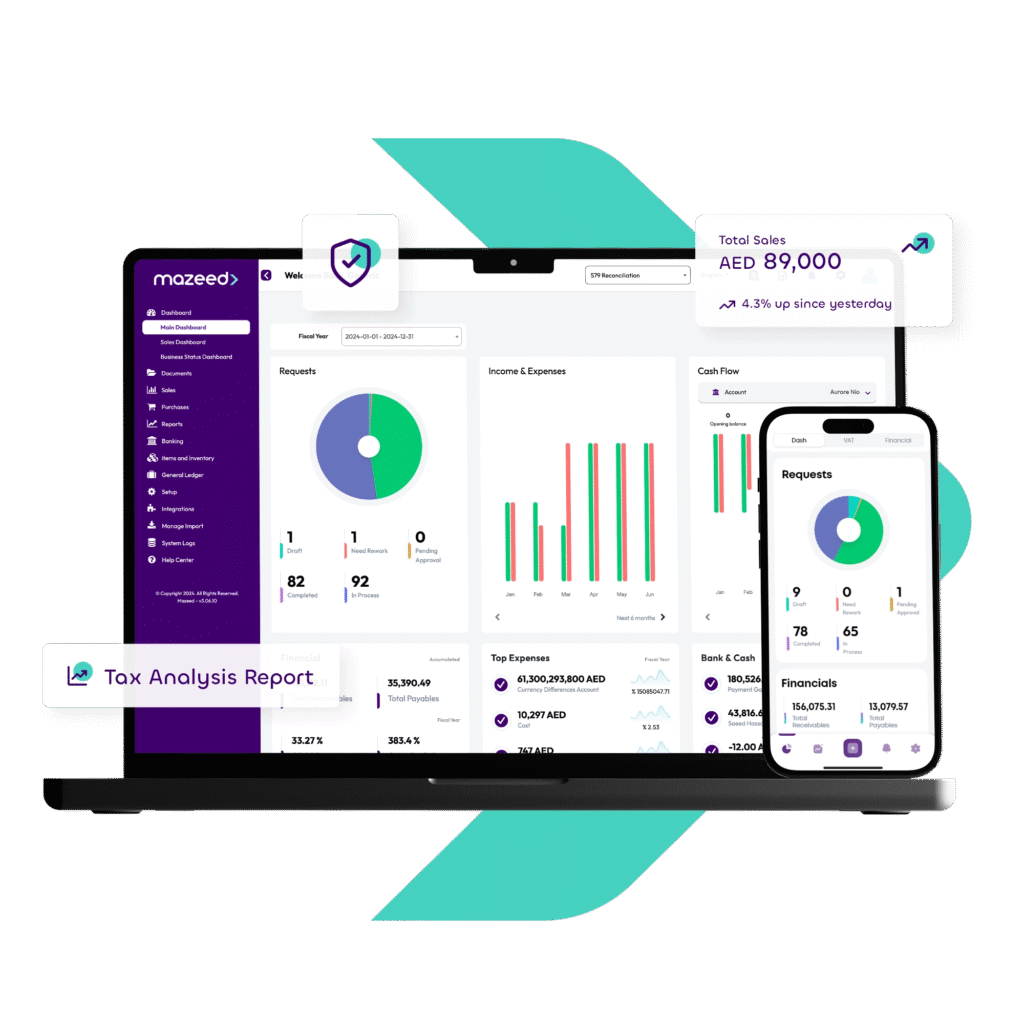

💡 Simplify Accounting with Smart Software

Handle invoices, track expenses, and stay 100% tax compliant with mazeed accounting software!

Free Zone vs Mainland for Foreign Business Owners

Free Zone Companies

Free Zones are popular among foreign entrepreneurs because they offer simplified procedures and lower startup costs.

Advantages include:

- Full foreign ownership

- Faster setup

- No requirement for a physical office in many cases

- Ideal for international trade, consulting, online businesses, and services

Limitations:

- Direct trading within the UAE mainland may require a distributor or local agent

Mainland Companies

Mainland companies allow you to operate directly in the UAE market without restrictions.

Advantages include:

- Access to local clients and government contracts

- No limitation on where you operate in Dubai

- 100% foreign ownership for most activities

Requirements:

- Physical office space is usually mandatory

- Slightly higher setup and operating costs

For many founders, mainland companies offer more long-term flexibility when starting a business in Dubai as a foreigner.

Step-by-Step: How to Start a Business in Dubai as a Foreigner

1. Choose Your Business Activity

Your business activity defines the type of license you need. Activities may include consulting, trading, e-commerce, services, or manufacturing. Not all activities have the same regulatory requirements, so this step is critical.

2. Decide on the Legal Structure

Select whether your company will be Free Zone or mainland based on where you want to operate and how you plan to serve customers.

3. Register a Trade Name

Your trade name must be unique, relevant to your activity, and comply with UAE naming rules. Approval is required before moving forward with licensing.

4. Apply for a Trade License

Depending on your activity, you will apply for one of the following:

- Commercial license

- Professional license

- Industrial license

This license is the legal foundation of your business.

5. Secure Office Space

Free Zones may offer flexi-desks or virtual offices, while mainland companies usually require a physical office lease registered under Ejari.

6. Open a Business Bank Account

Opening a corporate bank account is often the most sensitive step for foreign founders. Banks conduct due diligence on the company activity, shareholders, and expected transactions.

7. Apply for Residence Visas

Once the company is registered, you can apply for investor visas and employee visas. This allows you to live and work legally in the UAE.

Read more: Guide to Know General Trading License Cost in Dubai

Cost of Starting a Business in Dubai as a Foreigner

The cost varies based on your setup choices, number of visas, and office requirements.

Typical Free Zone Costs

- License only: AED 5,500 to AED 15,000

- License with visa package: AED 12,000 to AED 18,000

- Flexi-desk or virtual office: optional additional cost

Typical Mainland Costs

- Trade license and registration: AED 12,000 to AED 30,000 or more

- Office rent: AED 20,000 to AED 50,000+ per year

- Visa costs: AED 3,000 to AED 7,000 per person

In most cases, starting a business in Dubai as a foreigner costs between AED 12,000 and AED 50,000, depending on the business model.

Read more: What is TRN in UAE and Importance of Having It?

Do You Need to Be a UAE Resident to Start?

No. You do not need to be a UAE resident to register a company. Many foreigners complete company formation remotely and apply for residency visas after the business is registered.

This flexibility is one of the key reasons Dubai attracts global entrepreneurs.

Taxes and Compliance for Foreign Business Owners

Dubai remains highly tax-friendly, but compliance is still required.

Key points include:

- No personal income tax

- Corporate tax applies above a defined profit threshold

- VAT registration is required if taxable turnover exceeds the legal limit

- Annual license renewals are mandatory

Understanding these obligations early helps avoid penalties and delays.

Common Challenges Foreigners Face

Foreign entrepreneurs may face challenges such as:

- Bank account approval delays

- Choosing the wrong Free Zone for their activity

- Underestimating total operating costs

- Lack of clarity on compliance requirements

Working with experienced advisors can help reduce these risks when starting a business in Dubai as a foreigner.

Final Thoughts

Starting a business in Dubai as a foreigner is more accessible today than ever before. With full ownership options, low taxes, and a transparent regulatory system, Dubai offers strong opportunities for international founders. Success depends on proper planning, choosing the right structure, and understanding both costs and compliance requirements from the start.

With the right setup, Dubai can be a powerful base for regional and global business growth.

References

- SwiftHub – Starting a Business in Dubai as a Foreigner

- Dubai 4 Investors – Company Formation for Foreigners

- Company Formation in Dubai – Foreign Business Setup Guide

- Tasyer – Conditions for Establishing a Company in Dubai for Foreigners

- Freezone UAE – Business Setup Procedures for Foreigners

FAQs about Starting a Business in Dubai as a Foreigner

What is the most profitable business in Dubai for foreigners?

Some of the most profitable businesses in Dubai for foreigners include consulting services, e-commerce, general trading, real estate brokerage, digital marketing, and food and beverage businesses. Profitability depends on demand, pricing, location, and how well the business is managed.

What is the minimum investment to start a business in Dubai for foreigners?

The minimum investment to start a business in Dubai for foreigners can be as low as AED 5,500 to AED 12,000 for certain Free Zone licenses. Mainland businesses usually require a higher investment due to office and operational costs.

What is the cheapest business to start in the UAE?

Service-based businesses such as consultancy, freelancing, online services, and digital marketing are among the cheapest businesses to start in the UAE because they require minimal setup, low overhead, and no inventory.

Can you own 100% of a company in Dubai?

Yes, foreigners can own 100% of a company in Dubai in most Free Zones and for many mainland business activities, without the need for a local partner.

Is it worth starting a business in Dubai?

Yes, starting a business in Dubai is worth it for many entrepreneurs due to its tax-friendly environment, strong infrastructure, global connectivity, and growing market. Success depends on proper planning and choosing the right business activity.

Which business is best to start for beginners?

For beginners, service-based businesses such as consulting, online services, e-commerce, and small trading businesses are often the best to start because they require lower investment and are easier to manage.

What is the highest paid small business?

High-paying small businesses in Dubai often include management consultancy, IT services, real estate brokerage, specialized contracting, and professional services where expertise and experience drive higher income.

Which business is most profitable in Dubai?

Businesses that serve essential or high-demand markets such as real estate, trading, logistics, food and beverage, tourism, and professional services tend to be among the most profitable in Dubai.

What is the easiest business to start?

The easiest businesses to start in Dubai are usually consultancy, freelancing, online services, and e-commerce businesses, as they require fewer approvals, lower capital, and minimal physical infrastructure.

What is booming in Dubai?

Sectors currently booming in Dubai include real estate, tourism, e-commerce, logistics, digital services, and food delivery. These industries benefit from population growth, technology adoption, and strong government support.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the official UAE Portal.