Tax Services in UAE

Let FTA-certified tax experts handle your entire compliance process from registration to filing.

Trusted by Thousands of Businesses

4,000+

Businesses Onboarded

7M+

Transactions Processed

4.7

Excellent Customer Reviews

Full Tax Coverage

What Our Tax Agents Can Do for You

Whether you're just getting started or facing an audit, our certified tax experts are ready to help.

Tax Registration

We register your business for VAT and Corporate Tax with the FTA—fast, accurate, and fully compliant.

Tax Readiness

SessionGet a 1:1 session to assess your financials, spot risks, and prepare for smooth, penalty-free filings.

Tax Accounting

We record and organize every transaction to ensure your books are tax-ready, all year round.

Tax Annual Filing

Our experts prepare and file your VAT and Corporate Tax returns on time, every time.

Compliance Checks

We audit your records and systems to make sure everything meets FTA requirements before submission.

Reconsideration & Disputes

We’ll help you request reconsideration or file a formal dispute to waive your penalties.

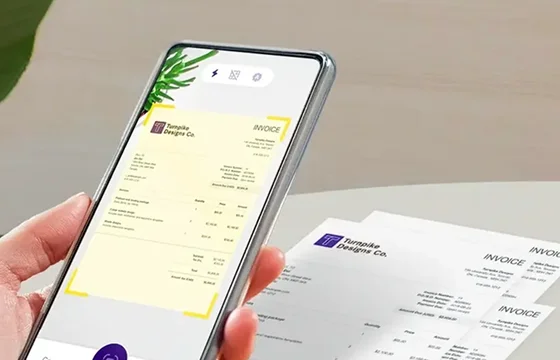

You Upload Invoices, We Handle the Rest

Just scan your invoices, and our experts will handle everything from recording daily transactions to filing your tax return.

Dedicated Tax Advisor

You're assigned a certified accountant who speaks your language and knows your business. Reach out anytime for help or advice.

Real-Time Dashboards

Track your tax liabilities, due dates, and submission status right from your mazeed account. Always know where you stand.

More Services for Your Needs

Stay on top of your finances with accurate, organized books and real-time insights.

Manage your budget, cut unnecessary costs, and plan for your business’s future.

Success Partners

Real Stories, Real Results

Frequently Asked Questions

Quick answers to your most common queries

How do mazeed advisors handle my accounting and tax requests?

Once you upload your documents through the mazeed app, our certified advisors review, process, and manage everything from accounting entries to tax filings. You can track the progress of your requests in real time with no back-and-forth emails or waiting.

What do I need to do after uploading my documents?

Nothing else. Once your documents are uploaded, our advisors take over. You’ll receive updates through the app as each step is completed, from data entry to review and submission.

What do I need to do after uploading my documents?

You can view the live status of every request in your dashboard. Whether it’s bookkeeping, VAT filing, or financial reporting, you’ll always know what stage it’s at and who’s working on it.

Can I see my financial reports anytime?

Yes. The system updates your financial data automatically as our advisors process your records, allowing you to check real-time financial reports and insights anytime directly from your app.

Let’s Handle Your Taxes the Smart Way

Join thousands of UAE businesses using mazeed to achieve tax compliance and reduce risks.