Running an accounting firm today means more than just bookkeeping. With multiple clients, compliance demands, data security concerns, and increasing pressure to offer advisory services, firms need to elevate their technical backbone. That is why many firms are investing in accounting software for accounting firms to automate workflows, improve accuracy, and deliver better value to clients.

Read more: Why You Need Accounting Software in UAE?

The Changing Landscape for Accounting Firms in UAE

The accounting industry is evolving quickly. Firms are expected to deliver regulatory compliance, real-time insights, advisory services, and secure remote access all at once. And the demands on data integrity, security, and productivity are higher than ever. In this environment, standard spreadsheets and siloed systems are no longer sufficient. The right accounting software for accounting firms positions the firm to compete, scale, and add advisory value.

Why Accounting Software for Accounting Firms is Crucial?

Accounting firms face some unique challenges compared to other business types. They serve multiple clients, each with their own books, deadlines, tax rules, and data requirements. Using dedicated accounting software for accounting firms helps address:

- Multi-client environments: one platform to manage many clients, each with distinct financials.

- Automation of routine tasks: data entry, recurring invoices, reconciliations, reducing time and errors. Nomi

- Real-time access to client data: enabling faster responses, audit readiness, and strategic advisory. Nomi

- Compliance and reporting: meet regulatory requirements, standardise processes, and reduce risk. CA Portal Blog

- Secure collaboration: between the firm, its team and clients—especially in remote/hybrid environments. Nomi+1

In other words, when an accounting firm adopts the right accounting software for accounting firms, it moves from being purely transactional to strategic, efficient and future-proof.

Read more: E-Invoicing Implementation Timeline in UAE

💡 Empower Your Accounting Firm

Manage clients, monitor performance and simplify workflows all in one place with mazeed Pro.

Key Features to Look for in Accounting Software for Accounting Firms in UAE

When selecting accounting software for accounting firms, ensure it includes features designed for the accounting practice model. Here are essential capabilities:

- Multi-client management: Ability to serve many clients from one dashboard, separate books, and consolidate across clients.

- Automated workflows: Recurring entries, bank feed imports, reconciliations, and task automation to free up staff time. Bill

- Secure collaboration and access: Cloud-based access, role-based permissions, audit trails, working with clients remotely. Nomi

- Real-time reporting and insights: Dashboards that show firmwide metrics, client metrics, financial health, productivity.

- Compliance & tax readiness: Built-in regulatory support, standardised templates, audit-ready records. CA Portal Blog

- Scalability and integration: Ability to integrate with CRM, tax software, document management, and grow as the firm grows. NetSuite

Together, these features create a seamless, professional backbone that supports both operations and client service.

Benefits of Accounting Software for Accounting Firms

The adoption of accounting software for accounting firms delivers measurable benefits:

- Increased productivity: By automating routine tasks, staff spend more time on value-added services. NetSuite

- Fewer errors and better accuracy: Automated processes reduce manual mistakes and improve data integrity. CA Portal Blog

- Faster client servicing and closing: Real-time access enables quicker responses and completion of engagements. Nomi

- Better client relationships: Firms can provide more frequent, meaningful insights instead of just annual reports.

- Compliance assurance: With regulated workflows and audit trails, firms reduce risk and maintain standards.

- Growth and scalability: The firm can handle more clients and complex engagements without linear cost increases. NetSuite

By implementing accounting software tailored for accounting firms, the firm becomes more efficient, more responsive, and more strategic in its service offering.

How mazeed Pro Supports Accounting Firms in UAE?

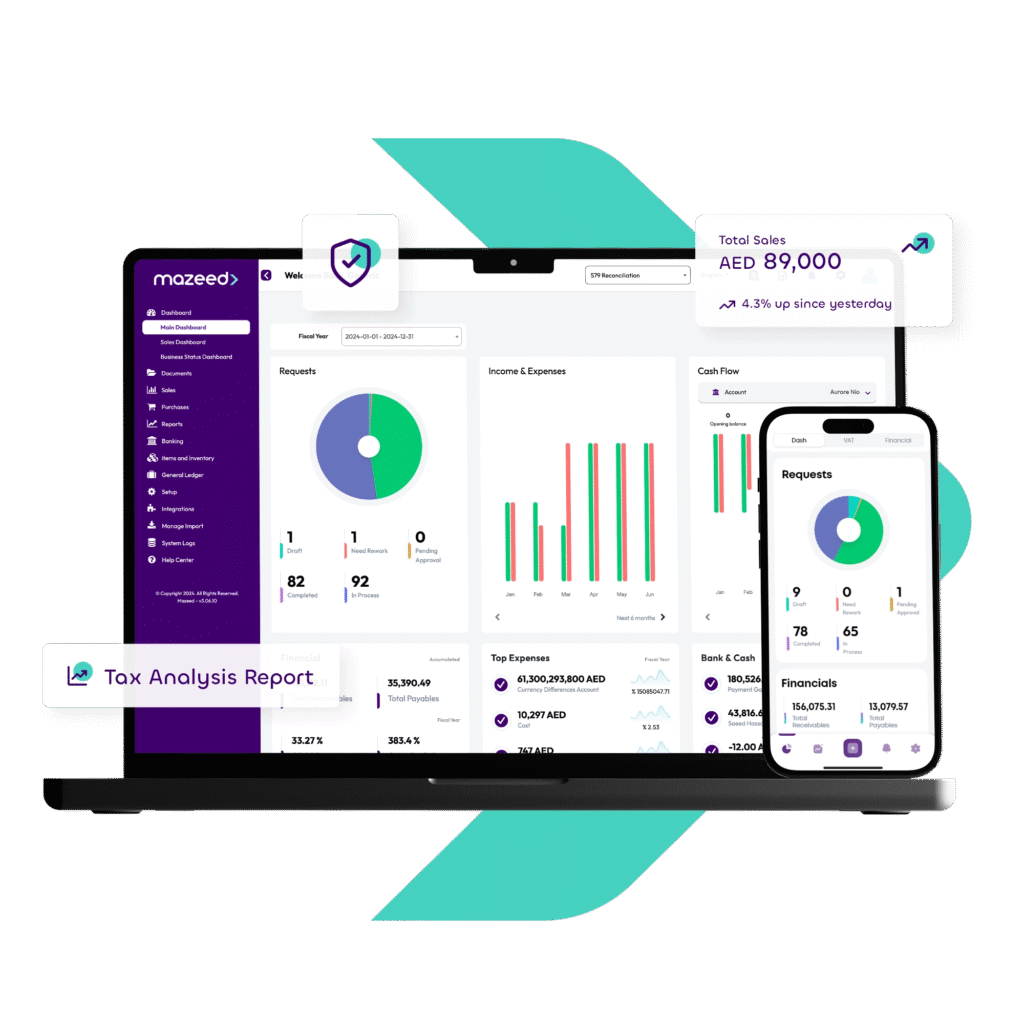

mazeed Pro is an advanced accounting software for accounting firms with two user interfaces — one for the firm and one for its clients.

Firm accountants can manage multiple clients, handle their accounting, and monitor performance in real time.

Clients can upload documents, view reports, and stay updated on their finances — all in one place.

This setup makes collaboration faster, clearer, and more efficient.

FAQs: Accounting Software for Accounting Firms in UAE

What software do most companies use for accounting?

Most companies in the UAE use cloud-based accounting software such as mazeed, Tally, Zoho Books, and QuickBooks. mazeed is preferred for its UAE localized features, real-time financial tracking, and FTA-compliant VAT and Corporate Tax management.

What software do big 4 accounting firms use?

The Big 4 accounting firms — Deloitte, PwC, EY, and KPMG — use a mix of enterprise-level ERP systems like SAP, Oracle, and Microsoft Dynamics. They also rely on custom-built tools and automation software for audit, compliance, and tax management.

What is the most used accounting software in the UAE?

In the UAE, mazeed, Tally, and Zoho Books are among the most widely used accounting solutions. mazeed stands out for offering dual interfaces — one for accounting firms and one for clients — allowing firms to manage multiple clients easily while maintaining compliance.

What are the 7 types of accounting?

The seven main types of accounting are financial accounting, management accounting, cost accounting, auditing, tax accounting, forensic accounting, and government accounting. Accounting firms in the UAE often handle several of these functions for their clients.

What is ERP in UAE?

ERP (Enterprise Resource Planning) systems in the UAE are integrated software platforms that combine accounting, finance, inventory, HR, and operations into one system. mazeed is a localized accounting software designed to meet UAE regulations and support accounting firms in managing multiple business processes efficiently.

What are the 5 types of accounting software?

The five common types of accounting software are spreadsheet-based systems, commercial off-the-shelf software, enterprise resource planning (ERP) systems, customized accounting software, and cloud-based platforms like mazeed.

Which software is best for an accountant?

mazeed is ideal for accountants and accounting firms in the UAE. It simplifies bookkeeping, tax filing, client management, and financial reporting — all in one place — helping firms save time and reduce manual work.

What is the simplest and easiest accounting software?

mazeed is among the easiest accounting software to use in the UAE, thanks to its intuitive dashboard and simple navigation. It’s built for both accounting professionals and business owners with minimal accounting background.

What are the big 4 accounting systems?

The “Big 4” accounting systems typically refer to the leading ERP and financial software used globally: SAP, Oracle, Microsoft Dynamics, and NetSuite. In the UAE, many firms also integrate these systems with localized platforms like mazeed for tax and compliance management.

Key Takeaways: Accounting Software for Accounting Firms in UAE

Accounting firms operate in a dynamic and demanding environment. The rising complexity of client engagements, regulatory pressures, remote collaboration, and the demand for advisory services mean that relying on manual or legacy systems is no longer viable. Choosing the right accounting software for accounting firms enables your firm to streamline operations, improve accuracy, enhance client service, and scale with confidence.

Whether you are a small practice or a growing firm serving multiple clients, investing in the right software today is a strategic move to future-proof your business.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.