Running a manufacturing business in UAE is full of promise but also comes with challenges. From tracking raw materials to managing VAT, corporate tax, and production costs, financial management can quickly get complicated. That is why accounting software for manufacturing companies is needed to automate financial operations, improve accuracy, and stay compliant with UAE regulations.

Read more: Why You Need Accounting Software in UAE?

The Growth of Manufacturing in UAE

The UAE’s manufacturing sector is one of the main drivers of economic diversification. According to the Ministry of Industry and Advanced Technology, manufacturing contributes around 10% of the UAE’s GDP, with a target to increase this to 14% by 2031 under the Operation 300bn strategy. UAE Ministry of Industry and Advanced Technology

The country was also ranked 29th globally in the United Nations Industrial Development Organization’s Competitive Industrial Performance Index, highlighting its strong industrial competitiveness.

MOIAT News

As manufacturing expands, financial processes have become more complex, requiring greater control over costs, taxes, and compliance. That is why adopting an accounting software for manufacturing companies in UAE is no longer optional but essential.

Why Manufacturing Businesses Need Accounting Software in UAE?

Manufacturing companies face more complex financial processes than most industries. They need to handle multiple cost centers, production stages, inventory categories, and VAT reporting requirements.

Using accounting software for manufacturing companies helps streamline these processes by automating data collection and reporting. It connects production, procurement, inventory, and finance into a single system.

Key advantages include:

- Real-time tracking of raw materials, work in progress, and finished goods

- Automated cost allocation for labor, materials, and overhead

- Easy management of multi-plant or multi-location operations

- Simplified VAT and corporate tax filing in compliance with FTA standards

- Integration with ERP or production systems to ensure financial accuracy

With these features, businesses can save time, reduce errors, and gain full visibility over their financial health.

Read more: Is Your Accounting Software UAE Ready?

💡Make Accounting Smarter for Manufacturers

Save time and reduce errors with smart tools that keep your books accurate and compliant.

Key Features to Look for in Accounting Software for Manufacturing Companies

When choosing accounting software for manufacturing companies, make sure it includes features built for industrial operations in UAE.

Essential features include:

- Production Cost Tracking to record costs across multiple manufacturing stages.

- Inventory and Work-in-Progress (WIP) Management to monitor materials, semi-finished, and finished goods.

- VAT and Corporate Tax Modules that comply with UAE’s FTA requirements.

- Multi-Plant Support to manage operations across different factories or warehouses.

- Integration with ERP or Production Systems for smooth data synchronization.

- Automated Reconciliation to match transactions quickly and reduce human error.

- Custom Financial Reports to analyze profitability, cost of goods sold, and cash flow.

These functions ensure your accounting processes align perfectly with both production and compliance needs.

E-Invoicing for Manufacturing Companies in UAE

E-invoicing is becoming mandatory for all VAT-registered businesses in UAE, including manufacturers. The Federal Tax Authority is introducing the national e-invoicing system to ensure accuracy, transparency, and efficiency in business transactions.

Manufacturing companies generate large volumes of invoices for suppliers, distributors, and clients. Managing these manually increases the risk of human error and non-compliance. By using accounting software for manufacturing companies that supports e-invoicing, businesses can automatically generate, validate, and share invoices that meet FTA’s technical specifications.

To learn more about how the system will be implemented and when it becomes mandatory, visit our detailed guide:

👉 E-Invoicing Timeline in UAE

Benefits of Accounting Software for Manufacturing Companies in UAE

Implementing accounting software for manufacturing companies brings measurable improvements in efficiency and compliance.

According to research by Rockford Computer LLC, manufacturing businesses using automation and ERP systems report up to 30% fewer production inefficiencies and significantly faster reconciliation cycles.

Rockford Computer

Manufacturers in UAE that use integrated accounting tools also experience:

- Better control over material and production costs

- Improved VAT and tax accuracy

- Faster monthly closing and financial reporting

- Reduced accounting costs and administrative workload

With automation, financial teams can focus on strategy instead of manual data entry, resulting in better decision-making and sustainable growth.

How mazeed Supports Manufacturing Companies in UAE

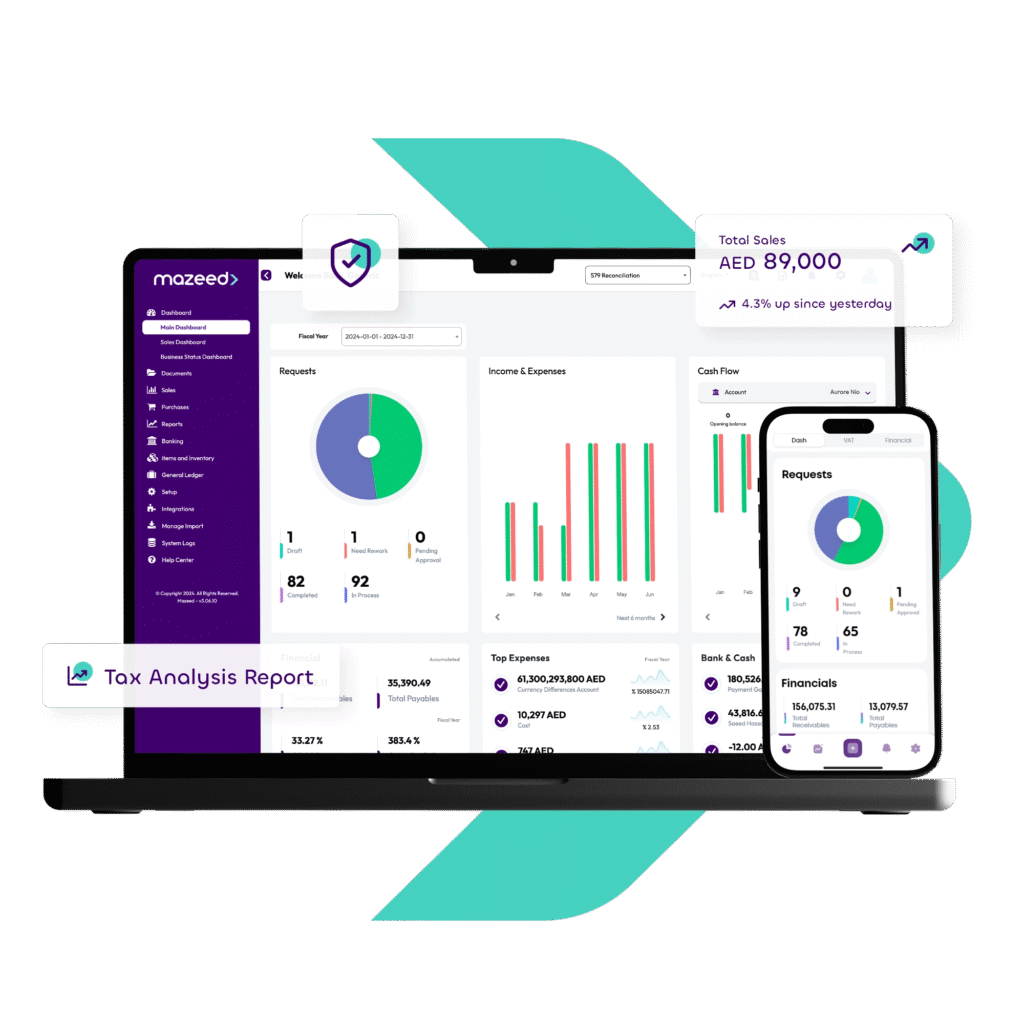

mazeed offers accounting software for manufacturing companies in UAE that integrates accounting, inventory, and tax management into one simple platform. The software simplifies VAT, corporate tax, and e-invoicing workflows while providing real-time financial insights.

Along with the software, mazeed connects you with certified tax and accounting experts who ensure 100% compliance and help reduce accounting costs by up to 85%. This combination of technology and expertise makes mazeed the ideal partner for manufacturing businesses looking to optimize operations and stay compliant.

FAQs: Accounting Software for Manufacturing Companies in UAE

Which accounting software is mostly used in the UAE?

In the UAE, popular accounting software includes mazeed, Tally, Zoho Books, and QuickBooks. mazeed stands out as it’s localized software with FTA-compliant tax features, making it ideal for manufacturing companies managing complex cost structures and tax reporting.

Which accounting software is best for a manufacturing company?

mazeed is one of the best accounting software options for manufacturing companies in the UAE. It simplifies inventory management, production costing, and tax filing, providing real-time financial insights and helping businesses stay compliant with UAE Corporate Tax and VAT regulations.

What type of accounting is used in manufacturing?

Manufacturing businesses typically use cost accounting, which tracks production costs, materials, labor, and overheads. This helps determine product pricing, profitability, and cost control.

What is the best software for manufacturing?

mazeed is among the best for manufacturing due to its features and integration. It allows tracking of raw materials, production costs, and sales, while ensuring seamless compliance with UAE tax laws.

Which ERP is mostly used in UAE?

Manufacturing accounts are maintained by recording all production costs, including raw materials, labor, and factory overheads. Using software like mazeed simplifies this by streamlining entries, generating cost reports, and linking data directly to VAT and Corporate Tax records.

Which costing method is best for manufacturing?

The most common costing methods are job costing, process costing, and activity-based costing (ABC). Activity-based costing is often preferred as it provides accurate cost distribution across multiple production activities.

Is manufacturing accounting difficult?

Manufacturing accounting can be complex due to variable costs, inventory valuation, and overhead allocation. However, using software like mazeed simplifies these tasks, reducing errors and saving time.

What is the format for a manufacturing account?

A manufacturing account typically includes sections for raw materials consumed, direct labor, factory overheads, and the cost of goods produced. Modern accounting systems like mazeed automatically generate this format through integrated production data.

What is ABC costing?

ABC costing, or Activity-Based Costing, is a method that allocates overhead costs based on activities that drive expenses. This gives manufacturers a clearer picture of product-level profitability and efficiency.

What are the basics of manufacturing accounting?

Manufacturing accounting involves tracking raw materials, work-in-progress, finished goods, labor, and overheads. It helps determine the cost per unit, manage budgets, and assess profitability.

What are the 7 flows of manufacturing?

The seven flows of manufacturing include raw materials, work-in-progress, finished goods, information, people, equipment, and engineering. Managing these efficiently ensures smooth production and cost control.

What is GAAP in manufacturing?

GAAP (Generally Accepted Accounting Principles) provides standardized rules for financial reporting. In manufacturing, GAAP ensures that costs, inventory, and revenues are recorded consistently and accurately.

What are the five types of manufacturing?

The five main types are repetitive, discrete, job shop, continuous process, and batch manufacturing. Accounting software like mazeed supports all these types through customizable workflows and real-time reporting.

Key Takeaways: Accounting Software for Manufacturing Companies in UAE

The UAE’s manufacturing industry is expanding rapidly, and so are its accounting and compliance challenges. Using accounting software for manufacturing companies helps streamline operations, improve cost control, and ensure compliance with UAE’s tax and e-invoicing requirements.

Whether your business produces goods locally or manages multiple plants across the Emirates, investing in modern accounting software will simplify financial management, reduce errors, and prepare your business for the future of automated compliance.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.