Running a real estate business in the UAE requires balancing property sales, rentals, construction costs, and compliance with evolving VAT and tax laws. Manual accounting often leads to errors, slow decision-making, and compliance risks. Using accounting software for real estate helps streamline financial operations, ensure legal compliance, and give clearer insights into profitability.

If you want to see how accounting software supports all industries, check out our main guide, why you need accounting software in UAE.

UAE Real Estate Market Trends

Understanding market size and growth helps illustrate the scale of opportunity and responsibility in the real estate sector.

- According to MarkNtel Advisors, the UAE residential real estate market was valued around USD 36.32 billion in 2024 and is projected to grow to USD 52.32 billion by 2030, with a compound annual growth rate (CAGR) of about 5.1%. MarkNtel Advisors

- Mordor Intelligence reports that the UAE residential real estate market was USD 143.22 billion in 2025 and is expected to reach USD 217.09 billion by 2030, growing at an approximate 8.66% CAGR. Mordor Intelligence

- For the commercial real estate segment, Mordor Intelligence estimates a market size of USD 51.05 billion in 2025, rising to about USD 68.81 billion by 2030, with a CAGR around 6.2%. Mordor Intelligence

These figures show real estate is a high-value sector with steady growth. That implies more transactions, more documents, more compliance obligations, and therefore a greater need for reliable accounting systems.

Why Real Estate Businesses Need Accounting Software

Real estate companies in the UAE face several challenges where accounting software for real estate delivers value:

- Complex transaction types: sales, leasing, developer contracts, maintenance, property management, brokerage, and more.

- VAT obligations: many real estate services and transactions are subject to 5% VAT. Commercial leases, property sales off-plan, etc., are relevant. The National News

- Long-term contracts and payment schedules: Some contracts include milestone payments, deferred payments, or spreads over years.

- Asset depreciation, maintenance costs, capital improvements: These need accurate tracking for financial health.

- Record retention and audit compliance: FTA requires certain documents to be kept for a minimum duration. This is especially important in real estate where contracts may last many years. Trowers

With the right accounting software for real estate, these challenges can be addressed reliably and efficiently.

💡 Simplify Accounting with Smart Software

Handle invoices, track expenses, and stay 100% tax compliant with mazeed accounting software!

Key Features in Real Estate Accounting Software

When selecting a solution for real estate, make sure it includes:

- Lease and Rental Management: Handling leases, rent roll, inflows/outflows, deposit and maintenance schedules.

- Project & Construction Cost Tracking: For developers, contractors, or property developers—tracking costs, timelines, payments.

- VAT-Ready Invoicing and Reporting: Generating invoices that comply with UAE VAT law, exporting reports in FTA-friendly formats.

- Asset Management & Depreciation: Maintaining and depreciating property assets where applicable.

- Multi-unit & Multi-property Support: Portfolios with many properties or rental units, possibly across emirates.

- Integration with Property Management Tools: Syncing with systems for bookings, maintenance, facilities, etc.

- Audit Trail & Secure Data Storage: Strong record-keeping capability for legal compliance and due audits.

VAT & E-Invoicing Compliance in UAE for Real Estate

Real estate VAT rules in the UAE have specific implications:

- Commercial property sales, commercial leases, brokerage and property management services are subject to 5% VAT. The National

- Residential properties are exempt in many leasing cases, and the first sale of new residential property (within 3 years of completion) is often zero-rated. trowers

- Businesses involved in real estate must maintain detailed records including invoices, contracts, lease agreements for multiple years to satisfy FTA rules. Protax Advisors LLC

Accounting software that is VAT-aware and compliant reduces risk of errors in tax filings, steadies cash flow, and simplifies audit readiness.

Additionally, as part of the UAE’s digital transformation, the Federal Tax Authority (FTA) is introducing mandatory e-invoicing to enhance tax transparency and reduce errors in VAT reporting. The rollout, which follows Saudi Arabia’s successful ZATCA model, covering all registered businesses.

E-invoicing will require all taxable businesses to issue and store invoices electronically in a structured format (such as XML or PDF/A-3) that can be validated by the FTA system.

Read more about E-Invoicing Timeline in UAE!

Benefits of Accounting Software for Real Estate

Where reliable studies exist, these are the benefits often reported by real estate businesses using solid accounting software for real estate:

- Improved reporting speed: Businesses with modern accounting tools report faster financial closings and better visibility into cash flows and expenses.

- Lower error rates and better compliance outcomes due to automated invoice generation and structured data formats.

- Reduced workload for maintenance of contracts, lease adjustments, and tracking of long-term payments.

- Better decision-making based on real-time dashboards showing property ROI, occupancy, rental yield, and maintenance costs.

While many of these are sector-common results rather than UAE-specific published stats, they align with growth trends in market size and regulation that require higher financial accuracy.

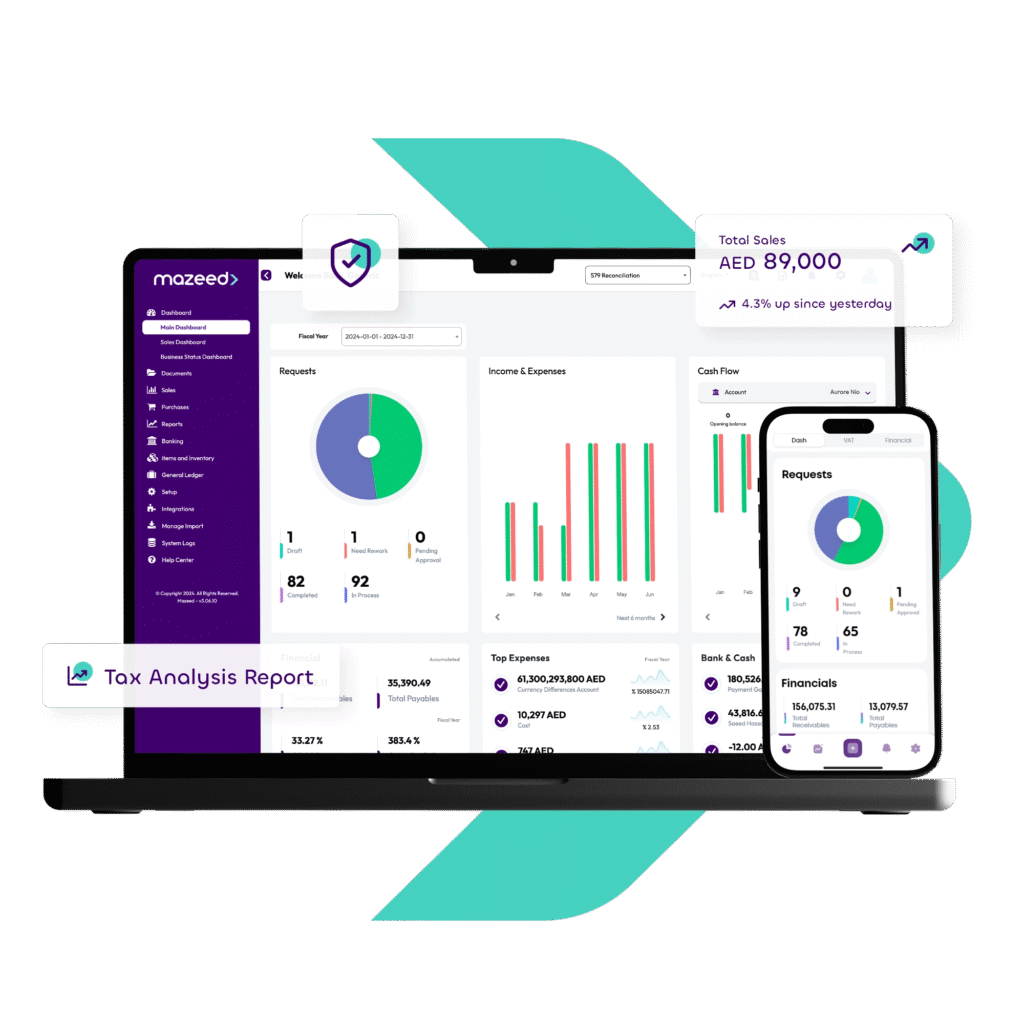

How mazeed Supports Real Estate Businesses

mazeed’s platform is built to meet the specific needs of real estate companies in the UAE:

- Handles lease and rental flows, including contracts, payments and renewals.

- Supports multi-unit portfolios and properties across emirates.

- Provides VAT-compliant invoicing and report exports.

- Includes asset depreciation tracking and project cost monitoring.

- Ensures data retention for audit and legal compliance.

Using a platform like mazeed helps reduce manual effort, avoid compliance risk, and enable faster, more strategic financial decision making.

Next Steps to Adopt Accounting Software for Real Estate

- List all property types, leases, and contracts you manage to understand your accounting complexity.

- Define VAT-related transactions in your business (commercial leases, brokerage, sales, etc.).

- Evaluate software with features above and check for e-invoicing readiness.

- Migrate existing contracts and financial records carefully.

- Train staff on contract flow, invoicing, rent/lease adjustments, and usage of dashboards.

FAQs: Accounting Software for Real Estate in UAE

What is the best accounting software for a real estate company?

mazeed accounting software is one of the best accounting software for a real estate company, designed to handle property transactions, rental income, maintenance costs, and VAT compliance. It offers automated reports and real-time insights to help manage multiple properties efficiently.

What is the most used accounting software in the UAE?

mazeed is one of the most UAE used accounting software in addition to Tally, Zoho Books, and QuickBooks. mazeed is highly preferred for its FTA compliance, Arabic support, and simplicity features tailored for UAE businesses.

How to do accounting for real estate?

Accounting for real estate involves tracking income from sales or rent, recording property-related expenses, managing depreciation, and ensuring VAT compliance. Using mazeed accounting software simplifies this by simplifying entries, generating financial reports, and maintaining accurate records.

What is the best CRM for real estate?

Popular CRM options for real estate include HubSpot, Zoho CRM, and Salesforce. For UAE-based businesses, integration-ready platforms like mazeed can connect accounting with CRM tools for better client and deal management.

Is there a free CRM for real estate?

Yes, Zoho CRM Free Edition and HubSpot CRM offer free plans that work well for small real estate agencies. These provide basic client tracking, communication tools, and sales management features.

Do I need a CRM for real estate?

Yes. A CRM system helps real estate businesses manage leads, track interactions, schedule follow-ups, and improve sales efficiency.

What platforms do real estate agents use?

Real estate agents in the UAE often use Property Finder, Bayut, and Dubizzle for listings, along with accounting tools like mazeed for business financial management.

Which accounting software is easiest to use?

mazeed accounting software is one of the easiest to use, with a user-friendly dashboard, simplified bookkeeping, and simple VAT filing designed for UAE users.

Is there any free accounting software?

Yes, mazeed offers a free version with essential accounting and invoicing features, perfect for startups and small real estate firms.

What is the most famous accounting software?

Globally, QuickBooks, Xero, and Zoho Books are well-known. In the UAE, mazeed is gaining popularity for being locally built, FTA-compliant, and specifically designed for real estate and trading businesses.

Final Thought

The UAE real estate sector is expanding fast, with rising investor activity, growing transaction volumes, and evolving regulation. For businesses in this space, using robust accounting software for real estate is essential for efficient operations, compliance, and achieving profitable growth.

Sources

- UAE Residential Market Forecast, 2024-2030, MarkNtel Advisors. MarkNtel Advisors

- UAE Residential Market Report, 2025-2030, Mordor Intelligence. Mordor Intelligence

- UAE Commercial Real Estate Market, Mordor Intelligence. Mordor Intelligence

- VAT rules on real estate, UAE – The National / official FTA clarifications. The Nationa

- Real estate holding companies VAT and tax guidance, CSPZone. cspzone.com

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.