Running a restaurant or café in the UAE is exciting, but it also comes with financial challenges. Between managing daily sales, tracking ingredients, handling suppliers, and staying VAT-compliant, the financial side of running a food business can quickly become overwhelming. That’s where accounting software for restaurants steps in.

With the right tools, restaurant owners can automate bookkeeping, monitor cash flow in real time, and keep track of every expense, from the coffee beans to the monthly supplier invoices.

The Growing F&B Market in the UAE

The UAE’s food and beverage (F&B) industry is one of the fastest-growing in the region, valued at over AED 141 billion in 2024 and projected to grow steadily with the rise of delivery apps and dine-in experiences. According to Mordor Intelligence, the UAE restaurant market continues to expand due to the country’s strong tourism and high digital adoption rates.

As this sector grows, so does the complexity of managing multiple sales channels, inventory fluctuations, and tax reporting, making accounting software for restaurants more essential than ever.

Read more: Why You Need Accounting Software in UAE?

Why Restaurants Need Accounting Software

Running a successful restaurant is not just about great food—it’s about numbers, margins, and consistency. Here’s why implementing accounting software for restaurants can make a big difference:

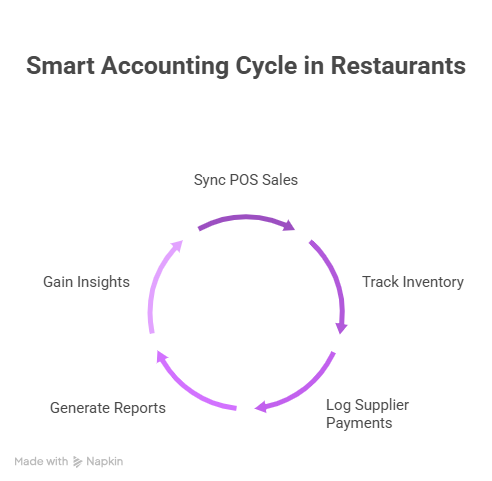

- Automates Daily Sales Entries: Automatically imports sales from POS systems and delivery platforms like Talabat or Zomato.

- Tracks Expenses and Inventory: Monitors ingredient costs, wastage, and supplier invoices in real time.

- Manages Payroll: Keeps staff payments and gratuities organized with automated salary calculations.

- Simplifies VAT Filing: Automatically calculates VAT on dine-in and delivery sales and generates tax-ready reports.

- Improves Profitability: Offers real-time dashboards showing top-selling items, cost per dish, and overall profitability.

💡 Simplify Accounting with Smart Software

Handle invoices, track expenses, and stay 100% tax compliant with mazeed accounting software!

Key Features to Look for in Restaurant Accounting Software

When choosing an accounting system for your restaurant or café, make sure it includes features designed for the food industry:

- Integration with POS systems and online ordering apps

- Inventory and cost tracking per menu item

- Recipe-based costing to calculate profit margins

- Multi-branch management for franchise or chain owners

- Automated financial reporting for better decision-making

- VAT and e-invoicing compliance with UAE FTA

E-Invoicing in the UAE and Why It Matters

The UAE’s Federal Tax Authority (FTA) has announced the upcoming e-invoicing system, which will make digital invoices mandatory for all registered businesses, including restaurants and cafés.

This means that every F&B business will soon need FTA-compliant accounting software to issue, verify, and store electronic invoices. According to the UAE E-Invoicing Timeline, the rollout will take place in phases between 2025 and 2027, giving restaurants a limited window to prepare.

By adopting an FTA-compliant accounting solution early, restaurant owners can ensure a seamless transition and avoid last-minute compliance stress.

Benefits of Accounting Software for Restaurants

Using accounting software for restaurants delivers real outcomes.

- The UAE restaurant management software market is projected to grow from USD 179.8 million in 2024 to USD 500 million by 2030, indicating strong demand and adoption.

- Approximately 60% of restaurant operators report improved efficiency as a result of automation.

- Around 70% of operators believe AI can help cut wastage by about 25% in food and service operations.

- Accounts Payable (AP) automation helps restaurants speed up invoice processing, reduce manual errors, and improve financial transparency.

- In the UAE, businesses using AI-driven accounting tools report improved data accuracy and faster financial reporting for VAT compliance.

These benefits show that accounting software for restaurants isn’t just a cost center—it becomes a key driver of profitability, efficiency, and compliance for restaurant operations in the UAE.

How mazeed Supports Restaurants and Cafés

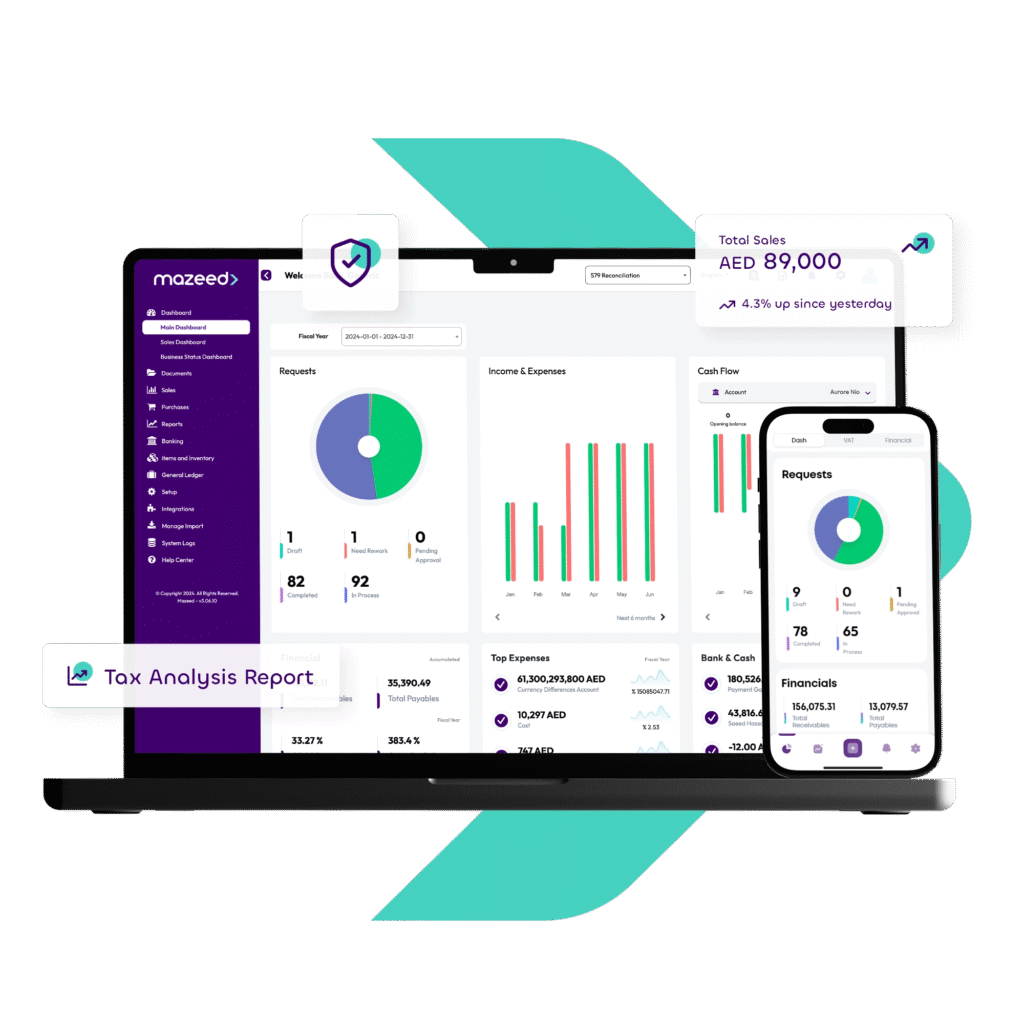

mazeed’s FTA-compliant accounting software is built for the UAE market and tailored to restaurant operations. It integrates with POS systems, automates VAT-ready invoicing, tracks costs, and delivers real-time financial reports—all while keeping compliance effortless.

Key benefits:

- Connects with restaurant management system RMS & cloud POS

- Tracks sales, inventory, and supplier payments automatically

- Ensures 100% VAT and e-invoicing compliance

- Reduces accounting costs by up to 85%

- Includes a dedicated tax accountant for ongoing support

FAQs: Accounting Software for Restaurants in UAE

What type of accounting is used in restaurants?

Restaurants use cost accounting and financial accounting to track expenses, manage inventory, and measure profitability. This includes recording sales, purchases, wages, and food costs to analyze performance and control margins.

What is the best accounting method for restaurants?

The accrual accounting method is generally best for restaurants, as it records income and expenses when they are earned or incurred, not when cash changes hands. This method provides a more accurate picture of profitability and cash flow.

Which software is best for restaurants?

The best software for restaurants in the UAE combines billing, inventory, and accounting features. Mazeed Accounting Software stands out because it integrates with POS systems, tracks ingredient-level inventory, and automates VAT filing.

What’s the best accounting software for restaurants?

mazeed Accounting Software is among the top choices in the UAE for restaurant accounting. It automates daily transactions, generates real-time financial reports, and helps businesses stay 100% VAT-compliant.

How to do bookkeeping for restaurants?

Bookkeeping for restaurants involves recording all sales, purchases, payroll, and expenses daily. Using an accounting software like mazeed simplifies the process by syncing POS data, automating expense tracking, managing supplier payments, and generating profit reports in real-time.

Key Takeaways: Accounting Software for Restaurants in UAE

For restaurants and cafés in the UAE, staying profitable means staying organized. As the F&B industry embraces digital transformation and e-invoicing becomes mandatory, adopting accounting software for restaurants is no longer a choice, it’s a necessity.

It’s time to simplify operations, cut costs, and gain full financial control through automation.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.