Running a trading company in the UAE means juggling imports, exports, supplier payments, multiple warehouses, and evolving tax requirements. As trade volumes and cross-border activity grow, manual bookkeeping becomes risky and slow. Using accounting software for trading helps automate critical finance operations, supports VAT and e-invoicing readiness, and gives clearer control of cash flow and margins.

If you want the full context on the benefits of automation, see our main guide, why you need accounting software in UAE.

The Trading Sector and the Digital Shift

Trade is a central pillar of the UAE economy. Recent reporting shows strong growth in non-oil trade volumes and continued investment in trade infrastructure, reflecting the UAE’s role as a regional logistics hub. This scale creates a need for accurate, real time financial systems that can handle high invoice volumes and cross-border transactions. See recent trade data and analysis published by Reuters and the UAE Ministry of Economy.

- Reuters summary of UAE non-oil trade growth.

- UAE Ministry of Economy open data about trade and economic indicators.

Why Trading Companies Need Modern Accounting Software?

Trading firms face accounting demands that are more complex than single-market retailers. Common challenges include:

- Handling multiple currencies and frequent foreign exchange adjustments.

- Managing supplier advances, letters of credit, and landed cost calculations.

- Tracking stock movements across warehouses and ports.

- Calculating cost of goods sold by batch, shipment or SKU.

- Preparing VAT on imports and dealing with reverse charge mechanisms where applicable.

Modern accounting software for trading centralizes these elements. It automates invoice recording, applies correct tax logic, maintains multi-currency ledgers, and produces audit-ready reports. That reduces the risk of human error and speeds up financial close processes, especially for companies that manage dozens or hundreds of invoices per day.

Accounting software for retail automates transaction capture, reconciles bank and POS records, tracks inventory costs, and prepares VAT reports in formats that reduce manual rework. The automation also frees time for owners and finance teams to focus on sales, margins, and growth.

💡 Your Accounting Made Simple

Save time and reduce errors with smart tools that keep your books accurate and compliant.

Key Capabilities to Look for

When choosing accounting software for trading, prioritize features that match trading workflows:

- Multi-currency and forex management with automatic exchange rate handling.

- Landed cost and COGS calculations that include freight, insurance and duties.

- Inventory movement tracking across multiple warehouses and locations.

- Supplier invoice matching and automated reconciliation to prevent duplicate payments.

- VAT and import tax handling configured for UAE rules.

- E-invoicing and integrations with accredited service providers when required by authorities.

- Real-time dashboards for cash flow, gross margin and aging analysis.

These features make trade accounting predictable and reduce time spent correcting records.

E-Invoicing in UAE and What It Means for Trading?

The UAE Ministry of Finance is implementing a national e-invoicing program to standardize invoice data, improve tax compliance, and enable real-time validation. The official MoF eInvoicing pages explain the objectives and technical approach, and they require invoices to be structured rather than unstructured documents. The government is also publishing accreditation requirements for e-invoicing service providers. See the Ministry of Finance eInvoicing overview and service provider accreditation pages for details.

Read more: E-Invoicing Implementation Timeline in UAE

For trading businesses that issue and receive large volumes of invoices, e-invoicing means two things. First, invoice formats and exchange processes will be standardized, which reduces manual handling. Second, trading firms will need accounting systems capable of generating and transmitting structured invoices and storing them in a compliant way. Early adoption of FTA or MoF ready software reduces implementation headaches when mandatory dates are announced.

What Automation Actually Delivers?

Global research and market studies describe consistent benefits from finance automation that are directly relevant to trading firms:

- The OECD’s report Tax Administration 3.0: Electronic Invoicing highlights how e-invoicing and digital tax tools improve compliance, reduce manual data entry errors, and streamline tax administration workflows. OECD

- Deloitte describes its Lights Out Finance™ concept, where AI and automated systems enable “touchless, end-to-end finance operations,” minimizing human intervention in processes like record-to-report and source-to-pay. Deloitte United Kingdom

- In Deloitte’s recent coverage of GenAI in finance, they show how artificial intelligence can transform the financial close process—automating reconciliation, verifying entries, and reducing close times. Deloitte United Kingdom

- Automation surveys (e.g. FlowForma’s finance automation overview) emphasize that automating repetitive tasks improves accuracy, speeds up processes, and reduces compliance risk. flowforma.com

Rather than claiming a specific percentage improvement for all trading businesses, use these sources to show that automation delivers faster processes, fewer manual corrections, and stronger audit trails. See OECD and Deloitte for broader studies, and the Billentis market reports for e-invoicing trends.

Benefits of Accounting Software for Trading Businesses

Here are the practical ways trading firms typically benefit after implementing capable accounting software for trading:

- Faster reconciliation and month end because invoices, payments and shipments are matched automatically.

- Improved cash flow visibility from consolidated receivables and payables dashboards.

- Lower compliance risk through consistent VAT handling and structured invoice records.

- Better margin control from accurate landed cost and COGS calculations.

- Reduced manual work for AP teams, allowing staff to focus on vendor negotiation and working capital optimization.

These are proven operational outcomes that come from replacing spreadsheets and manual journals with integrated, trading-aware accounting systems.

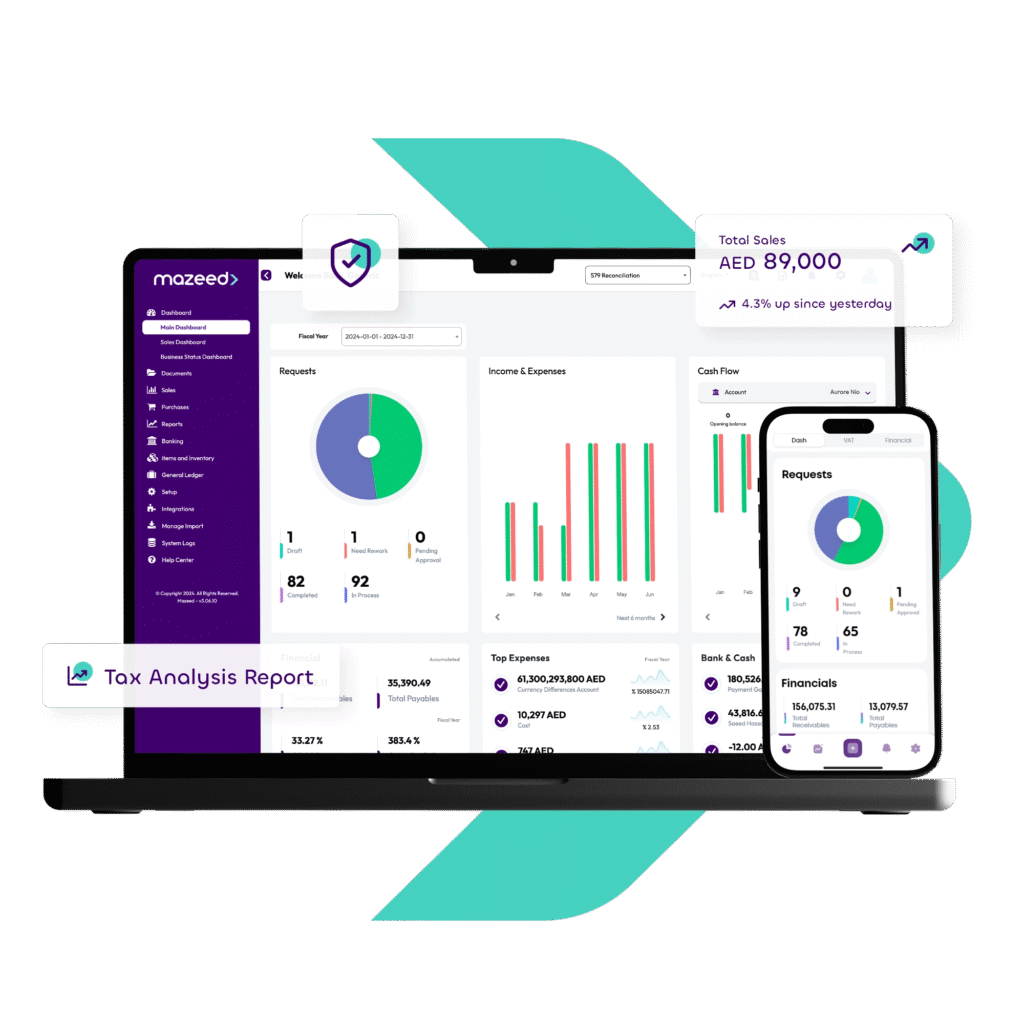

How mazeed Supports Trading Businesses?

mazeed’s accounting platform supports multi-currency ledgers, landed cost calculations, inventory across locations, and VAT-ready reporting. It is built to integrate with logistics and ERP systems so invoice, shipping and customs data feed into finance automatically. mazeed also helps trading companies prepare for e-invoicing by working with accredited e-invoicing service providers and following the Ministry of Finance guidelines.

Next Steps to Adopt Accounting Software for Trading

- Map current invoice volumes, currency exposure and warehouse locations.

- Choose software with multi-currency, landed cost and reconciliation features.

- Validate VAT and e-invoicing readiness with your vendor and tax advisor.

- Run a pilot on a single product line or warehouse and measure time saved.

- Roll out in phases and provide targeted training to AP and inventory teams.

Sources and Further Reading

- UAE Ministry of Finance, eInvoicing overview. UAE Ministry of Finance

- UAE Ministry of Finance, accreditation of e-invoicing service providers. UAE Ministry of Finance

- UAE Ministry of Economy open data and economic indices. Ministry of Education

- OECD, Tax Administration 3.0 and Electronic Invoicing. OECD

- Deloitte, articles and POV on finance automation and autonomous finance. Deloitte United Kingdom

- Billentis, e-invoicing market reports. exchange-summit.com

FAQs: Accounting Software for Trading in UAE

Which accounting software is mostly used in the UAE?

The best accounting software in the UAE includes mazeed accounting software, Tally, QuickBooks, and Zoho Books. mazeed is particularly popular among trading businesses for its automation, VAT compliance, and integration with invoicing and inventory management.

Which accounting software is best for sole traders?

For sole traders in the UAE, mazeed accounting software is an ideal choice as it simplifies bookkeeping, tracks expenses, manages invoices, and ensures VAT compliance, all in one platform. It’s designed for ease of use and affordability, perfect for individual entrepreneurs.

Which is the best software for accounting?

The best accounting software depends on business needs, but in the UAE, mazeed stands out for being fully FTA-compliant and tailored for local tax requirements. It combines automation, reporting, and expert support to make accounting effortless.

Which is the easiest accounting software to use?

mazeed accounting software and QuickBooks Online are considered among easiest to use. mazeed offers an intuitive dashboard, simplified transaction recording, and real-time financial reports, making it simple even for users without accounting experience.

What software do most accountants use?

mazeed is becoming increasingly preferred because it combines accounting, tax filing, and compliance tools designed for UAE businesses and trading operations.

Final Thoughts: Accounting Software for Trading

In the UAE’s fast-moving trading environment, accuracy and compliance are everything. Adopting reliable accounting software for trading helps businesses automate daily operations, stay ready for e-invoicing, and maintain full control over cash flow and profitability.

By combining digital tools with expert financial oversight, trading companies can meet today’s challenges and scale confidently across borders.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.