Running a business in Dubai’s fast-paced market demands more than ambition it requires precision in managing every dirham. Imagine tracking expenses with handwritten ledgers like merchants did decades ago. Today, modern solutions blend tradition with innovation, giving you clearer control over cash flow and growth.

Core systems like digital ledgers and tax management platforms act as your financial compass. They simplify payroll processing, automate invoice tracking, and provide real-time insights into project budgets. For UAE entrepreneurs, these resources aren’t just helpful—they’re vital for navigating VAT regulations and competitive profit margins.

Think of an essential accounting textbook as your playbook for avoiding costly errors. Whether you’re handling import/export transactions in Jebel Ali or managing a startup in DIFC, the right basic tools of accounting turn complex data into actionable strategies. Cloud-based systems now replace bulky spreadsheets, letting you approve payments from your phone during meetings at Emirates Towers.

By mastering planning tools in management accounting, you’re not just balancing books, you’re forecasting opportunities. In a city where 80% of businesses face cash flow challenges, adopting these methods ensures your venture thrives amid Dubai’s economic dynamism. Ready to transform numbers into your most strategic asset?

Read more: Accounting Standards in UAE

Mastering the Basic Tools of Accounting in UAE

Managing a Dubai startup or an Abu Dhabi trading firm? Knowing accounting tools is like having a GPS for your finances. Let’s see how combining old methods with new tech makes a strong system for UAE companies.

Tired of manual accounting? Try mazeed Accounting Software

Automate your tasks with ease, so you can organize your finances and enjoy life.

- Precision You Can Trust

- Effortless Integration

- On-Demand Certified Accounting Experts

Essential Manual Basic Tools of Accounting

Even though digital solutions are popular, 43% of UAE SMEs use physical books too. Here’s why old methods are important:

When tackling a complex bookkeeping question, the first step is often to consult an expert. Sometimes, a bookkeeping question can reveal underlying inefficiencies, prompting the need for a more robust system. Addressing each bookkeeping question thoroughly is crucial for accurate financial records. This is where a skilled ERP consultant becomes invaluable. An experienced ERP consultant can guide businesses through the implementation of integrated systems, ensuring all financial data flows seamlessly. Finding the right ERP consultant can transform a company’s operational efficiency.

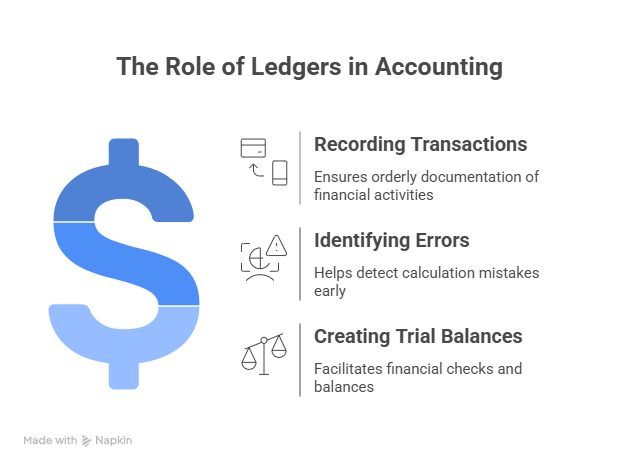

1. Ledgers and Trial Balances: Your Financial Foundation

Imagine a Dubai bakery using a leather-bound ledger for daily sales. The basic tools of accounting in UAE is great for:

- Recording transactions in order

- Finding calculation mistakes early

- Creating trial balances for checks

Pro tip: Comparing monthly trial balances helps spot errors before VAT filing issues.

For anyone serious about mastering the fundamentals, an essential accounting textbook is indispensable. Every accounting student needs an essential accounting textbook to grasp core concepts. I’ve always found that an essential accounting textbook provides the foundational knowledge for understanding complex financial statements. Speaking of foundations, understanding the ledger and trial balance is paramount. The meticulous detail in the ledger and trial balance forms the backbone of financial reporting. Any discrepancy in the ledger and trial balance can indicate an error that needs immediate attention.

Read more: 9 Best Accounting Software Dubai

2. Financial Statements: Tracking Profit & Loss

Manual profit/loss statements help you understand every dirham. A Sharjah café owner found out:

“Writing numbers by hand showed us exactly where we wasted 12% on unnecessary supplies last quarter.”

💡 Simplify Accounting with Smart Software

Ditch manual ledgers, track finances & stay Tax-ready with mazeed accounting software.

Modern Digital Solutions

UAE businesses now handle 68% more transactions digitally than five years ago. Here’s what’s changing:

1. Basic Tools of Accounting in UAE

Many businesses rely on modern accounting platforms that help with:

- Scanning Arabic receipts that match local formats

- Automatic VAT calculations that comply with FTA rules

- Real-time collaboration with accountants anywhere in the UAE

Case Study: A Dubai logistics company reduced invoice processing time by 40 hours per month using modern digital accounting tools.

Choosing the best accounting tool for small businesses can be a game-changer. The right solution should:

- Fit specific business needs and budget

- Empower owners to make informed decisions

- Go beyond basic record-keeping

- Provide insights for forecasting and strategic growth

When leveraged properly, accounting tools for business decision-making become more than just a compliance tool—they turn into a driver of growth.

Read more: Accounting Structure for Small Businesses

2. ERP Systems: Why Access ERP Dominates UAE Markets

Access ERP is used by 1 in 3 UAE manufacturing firms. It’s good for:

| Feature | Benefit |

| Arabic/English VAT reports | Meets FTA audit requirements |

| Inventory tracking | Reduces warehouse costs by 18% |

| Multi-branch support | Manages 5+ locations seamlessly |

A UAE retail chain closed month-end 22% faster after using Access ERP.

Choosing the Basic Tools of Accounting for UAE Businesses

Choosing basic tools of accounting in the UAE is tricky. You need to meet legal rules and your business needs. We’ll look at how to find the right fit for your company’s size, industry, and growth.

In the realm of management, management accounting planning tools are indispensable. Effective management accounting planning tools help allocate resources efficiently and set realistic goals. The right management accounting planning tools can significantly improve a company’s strategic direction. The digital age has also brought forth a wealth of online accounting tools. Many businesses are now relying on online accounting tools for their daily operations. The accessibility of online accounting tools has revolutionized how small businesses manage their finances.

Read more: Is Your Accounting Software UAE Ready?

Key Selection Criteria

UAE businesses face special challenges. These include Federal Tax Authority audits and bilingual reports. Your tools must handle these well.

1. VAT Compliance: Non-Negotiable for UAE Operations

FTA-approved software keeps up with VAT rates and prepares for audits. Make sure your tools can handle reverse charge mechanisms. A Dubai retailer paid AED 42,000 in penalties last year for VAT errors.

2. Arabic/English Bilingual Support

Your software should switch easily between languages for all financial documents. Check Arabic numeral formatting early. A Sharjah ERP consultant warns: “Bilingual mistakes can harm trust with suppliers and complicate customs.”.

Finally, while management accounting focuses internally, financial accounting tools are geared towards external reporting. Reliable financial accounting tools ensure compliance and transparency. The accuracy of financial accounting tools is critical for investors and stakeholders. Both financial accounting tools and planning tools in management accounting serve distinct but equally important purposes. Mastering planning tools in management accounting can lead to improved operational efficiency, while robust planning tools in management accounting ensure future success.

Read more: Statement of Accounts: SOA in Accounting

💡 A New Way to Manage Accounting in UAE

mazeed combines smart accounting software with certified experts to help businesses manage their accounting, Tax, compliance & financial growth with ease.

Implementation Roadmap with Basic Tools of Accounting in UAE

Switching to new systems needs a solid plan. Dubai SMEs follow a tested approach:

1. Step 1: Migrate Data Securely

Use UAE-certified IT partners to move your data. They can avoid common mistakes like:

- Date format mismatches (DD/MM vs MM/DD)

- Currency conversion errors for pre-2018 AED transactions

- Duplicate entries from manual spreadsheets

2. Step 2: Train Your Team Effectively

Hold hands-on workshops during Ramadan’s shorter days. For tools like Access ERP, focus on:

- Real-time cash flow dashboards

- Multi-branch consolidation features

- Automated profit margin calculations

One Abu Dhabi logistics company saw a 73% boost in report accuracy after training.

Choosing the right accounting tools is key for your business to succeed in Dubai’s free zones or Abu Dhabi’s mainland. Whether you’re solving a book keeping question or looking at management accounting tools, your decisions affect financial clarity and follow the rules.

Modern tools like Access ERP make UAE businesses run smoother, handling tasks from VAT to payroll. Use these with manual checks for balance, like when preparing for Corporate Tax changes.

Check if your systems can adapt to new rules, work with local banks, and grow with your business. Need help? Get our free VAT-compliance checklist to check your processes.

Smart companies use management accounting tools to plan for the future. They can predict changes in emirates or adjust supply chains. With the right digital tools and strategic thinking, your business can move forward with confidence in the UAE’s changing economy.

FAQs: Basic Tools of Accounting in UAE

What are the 5 basic accounts in accounting?

The 5 basic accounts in accounting are: Assets, Liabilities, Equity, Revenue, and Expenses. These categories form the foundation of the double-entry system.

What kind of tools do accountants use?

Accountants use ledgers, trial balances, financial statements, spreadsheets, ERP systems, and cloud accounting software to manage and analyze financial data.

What are the 5 basic principles of accounting?

The 5 basic principles are: Revenue Recognition, Matching, Cost, Objectivity, and Full Disclosure. They guide accurate and consistent financial reporting.

What are the 4 types of accounting?

The 4 main types are: Financial Accounting, Managerial Accounting, Cost Accounting, and Tax Accounting. Each serves a different business purpose.

What are the 4 C’s of accounting?

The 4 C’s stand for Clarity, Comparability, Consistency, and Credibility. They ensure accounting information is reliable and useful for decision-making.

What are the 5 main parts of accounting?

The 5 main parts are: Recording, Classifying, Summarizing, Analyzing, and Reporting financial transactions.

What is the 3 type of account?

The 3 traditional types of accounts are: Real Accounts, Personal Accounts, and Nominal Accounts. They help classify transactions properly.

What is a journal entry?

A journal entry is the record of a financial transaction showing debits and credits in chronological order, used as the first step in accounting records.

What is GAAP in accounting?

GAAP stands for Generally Accepted Accounting Principles. It is the standard framework of rules and practices for financial reporting in the U.S.

What is a balance sheet?

A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time, reflecting its financial position.

What is IFRS in accounting?

IFRS stands for International Financial Reporting Standards. It provides global accounting guidelines used in more than 140 countries.

What is CPA?

CPA means Certified Public Accountant. It’s a professional designation for accountants who pass the CPA exam and meet licensing requirements.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.