Understanding the cost of goods sold entry in trial balance is essential for companies that handle inventory and engage in product sales. This financial concept forms the backbone of accurate profit calculation, reliable financial reporting, and efficient procurement tracking.

In this comprehensive guide, we’ll delve into the full meaning of the cost of goods sold entry in trial balance, explain its interaction with procurement processes, provide examples, and show how companies like mazeed use technology to improve accounting accuracy.

What is Cost of Goods Sold (COGS)?

The cost of goods sold entry in trial balance refers to the total cost incurred by a company to produce the goods it has sold during a specific period. It includes expenses such as raw materials, direct labor, and factory overhead directly attributable to the manufacturing process. This cost is deducted from revenues on the income statement to determine gross profit.

Although COGS appears on the income statement, its computation relies on accounts listed in the trial balance. These may include inventory accounts, purchases, freight-in, and others, providing the data needed to calculate the cost of goods sold entry in trial balance. A correct entry ensures compliance with accounting standards and reflects the real costs of business operations.

💡 Manage COGS & Procurement with mazeed

Cut errors and save time by tracking inventory, COGS, and procurement seamlessly with mazeed accounting software.

Procurement Accounting Definition

To understand COGS, one must begin with procurement accounting definition. Procurement accounting involves the financial tracking and control of all transactions related to the acquisition of goods and services. It includes:

- Raising purchase requisitions

- Issuing purchase orders

- Confirming receipt of goods

- Receiving and processing invoices

- Making payments

Accurate procurement accounting definition allows for proper allocation of procurement expenses, ensuring that all costs are correctly recorded and contribute to the cost of goods sold entry in trial balance.

Read more: Budget vs Actual Report

Example: How COGS in Trial Balance is Calculated in UAE?

A UAE trading company has the following balances for the year:

- Opening Inventory (1 Jan): AED 40,000

- Purchases during the year: AED 100,000

- Freight-in (transportation): AED 5,000

- Closing Inventory (31 Dec): AED 30,000

Step 1: Apply the COGS Formula

COGS = Opening Inventory + Purchases + Freight-in − Closing Inventory

COGS = 40,000 + 100,000 +5,000 − 30,000

COGS = 115,000

Step 2: Trial Balance Entry

In the trial balance, you’ll see:

- Debit: Cost of Goods Sold (COGS) → AED 115,000

- Credit: Inventory (Closing balance) → AED 30,000

This debit entry for COGS ensures it will appear as an expense on the Income Statement, reducing gross profit.

Is Cost of Goods Sold a Debit or Credit in the Trial Balance?

Cost of goods sold is recorded as a debit in the trial balance.

This is because cost of goods sold represents an expense, and expenses normally carry a debit balance. When preparing the trial balance, cost of goods sold appears on the debit side along with other expenses.

So if you are asking whether cost of goods sold is debit or credit in the trial balance, the correct answer is debit.

What Is the Normal Balance of Cost of Goods Sold?

The normal balance of cost of goods sold is a debit balance.

Since cost of goods sold reflects the direct cost of producing or purchasing goods that were sold, it reduces profit. All expense accounts, including cost of goods sold, increase with debits and therefore have a debit normal balance.

Why Cost of Goods Sold Has a Debit Balance

Cost of goods sold has a debit balance because it represents:

- The cost of inventory sold during a period

- A reduction in gross profit

- An operating expense of the business

This is why cost of goods sold is always shown as debit, not credit, in accounting records and in the trial balance.

Closing Inventory Debit or Credit in the Trial Balance

Closing inventory is shown as a debit in the trial balance.

Inventory is an asset, and assets carry a debit balance. At the end of the accounting period, closing inventory is reported as a debit balance and is deducted from purchases when calculating cost of goods sold.

From Raw Material to Finished Product

The transition from raw material to finished product is a detailed process involving multiple cost stages:

- Purchasing raw materials: These are recorded in inventory.

- Using raw materials in production: Costs are transferred to work-in-progress accounts.

- Applying labor and overhead: These further increase the product’s value.

- Producing the final goods: All costs are moved into finished goods inventory.

When the finished goods are sold, the cost moves from inventory to the income statement under COGS. This chain illustrates how costs flow from raw material to finished product, culminating in the cost of goods sold entry in trial balance.

Procure to Pay Accounting Entries

The procure to pay accounting entries refer to journal entries made at every stage of the procurement process:

- Recording a purchase order

- Logging goods receipt

- Booking invoice receipt

- Making vendor payments

Each of these steps must be meticulously tracked. Failing to record these procure to pay accounting entries accurately can lead to distorted financial data, which in turn affects the cost of goods sold entry in trial balance. Automated accounting systems are especially helpful in this context.

Role of the Accounting Officer in Procurement

An accounting officer in procurement is the professional responsible for ensuring that procurement transactions are accurately recorded and comply with accounting principles. Their duties include:

- Auditing procurement documents

- Coordinating with vendors and supply chain teams

- Ensuring that invoices and payments are recorded promptly.

The accuracy and diligence of an accounting officer in procurement are instrumental in ensuring reliable procurement accounting and minimizing errors in the cost of goods sold entry in trial balance.

Read more: Inventory and Stock Difference

Understanding Procurement Accounts Payable

Procurement accounts payable represent outstanding liabilities for procurement transactions. These include unpaid supplier invoices and are key to evaluating an organization’s current obligations. In the trial balance, they play an important role by:

- Providing a snapshot of short-term liabilities

- Supporting accrual-based accounting

- Assisting in cash flow forecasting

Incorrect or delayed updates in procurement accounts payable can lead to an inaccurate cost of goods sold entry in trial balance, affecting financial decisions and reporting.

How Procurement Accounting Influences COGS

The reliability of the cost of goods sold entry in trial balance is directly tied to the quality of procurement accounting. Efficient systems ensure:

- Accurate matching of costs to specific products

- Real-time tracking of inventory value

- Valid entries in procure to pay accounting workflows

Without precise procurement accounting, companies risk underreporting or overreporting COGS, which can lead to compliance issues and misinformed decision-making.

Read more: The Chart of Accounts for SaaS Company

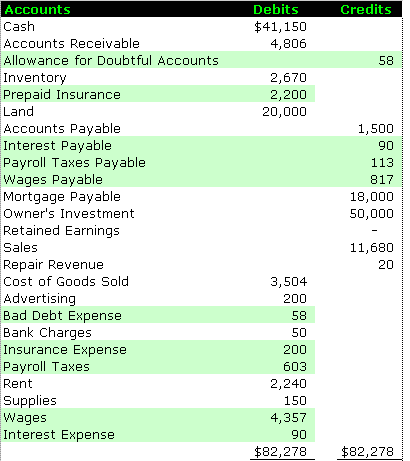

Example of Adjusted Trial Balance

Why mazeed for COGS?

Companies such as mazeed demonstrate how modern technology can improve procurement and accounting efficiency. mazeed incorporates smart procurement systems to manage the full lifecycle from raw material to finished product, automate procure to pay accounting entries, and empower every accounting officer in procurement.

mazeed’s platform enhances visibility into procurement accounts payable and ensures accurate, timely cost of goods sold entry in trial balance. By integrating procurement data with financial systems, mazeed supports companies in achieving both compliance and performance. Additionally, mazeed offers real-time dashboards for procurement insights, ensures alignment with financial planning, and supports scalable operations for growing businesses.

💡 New Way for Financial Management

We combine accounting software with certified experts to streamline procure-to-pay, accounts payable, and COGS reporting with confidence.

Common Mistakes to Avoid

Here are several errors businesses must avoid:

- Incorrect classification of expenses — Avoid mixing indirect costs with direct costs in COGS.

- Failure to reconcile inventory regularly — This can lead to major distortions in reported profits.

- Omitting stages in procure to pay — Every procure to pay accounting entry matters.

- Poor documentation by accounting officers — Proper oversight ensures procurement accuracy.

- Mismanagement of procurement accounts payable — Late or missing invoices skew financial outcomes.

- Manual tracking of inventory costs — This is prone to errors that affect the cost of goods sold entry in trial balance.

- Insufficient communication between procurement and finance — A clear channel ensures that entries are timely and complete.

Read more: Oil and Gas Accounting Methods in UAE

Best Practices for Accurate COGS Reporting

- Conduct monthly stock takes to validate inventory.

- Implement real-time accounting systems.

- Train every accounting officer in procurement on compliance and reporting.

- Categorize expenses clearly in procurement systems.

- Perform regular audits on procure to pay accounting entries.

- Use integrated ERP solutions to tie together procurement and accounting.

- Align COGS calculation methods with business goals.

These practices will improve the accuracy of the cost of goods sold entry in trial balance and foster confidence in financial reports.

The cost of goods sold entry in the trial balance is a key metric that influences profitability, tax reporting, and strategic decisions.

To ensure accuracy, companies must integrate strong procurement accounting frameworks—defined as the systematic process of recording, monitoring, and analyzing financial activities related to the purchasing of goods and services—understand the transformation from raw material to finished product and maintain detailed procure-to-pay accounting entries. Empowered by modern systems and well-trained accounting officers in procurement, organizations can reduce errors and improve transparency in their financial operations

Through platforms like mazeed, businesses gain not only operational efficiency but also financial precision, ensuring that procurement accounts payable are accurately tracked and reflected in the cost of goods sold entry in the trial balance.

FAQs: Cost of Goods Sold Entry in Trial Balance

How to record cost of goods sold in trial balance?

In the trial balance, Cost of Goods Sold (COGS) is recorded on the debit side as an expense. It reduces gross profit.

What is the entry for cost of goods sold?

The journal entry is:

Debit: Cost of Goods Sold (COGS)

Credit: Inventory or Purchases

Is COGS a debit or credit in trial balance?

COGS is always shown as a debit in the trial balance because it is an expense account.

How do I record the cost of goods sold?

To record COGS:

Debit COGS (expense)

Credit Inventory (asset reduction)

What are COGS called today?

COGS is commonly called “Cost of Sales” or “Cost of Revenue” in modern financial statements.

What is the journal entry for goods sold?

If goods are sold for cash:

– Debit Cash

– Credit Sales Revenue

– Debit COGS

– Credit Inventory

Is COGS an expense?

Yes, COGS is an operating expense that reflects the direct cost of producing or purchasing goods sold during a period.

What is the double-entry for sales of goods?

The double-entry is:

– Debit Cash/Accounts Receivable

– Credit Sales Revenue

– Debit COGS

– Credit Inventory

What is the journal entry for sold goods?

The journal entry is twofold:

Record revenue: Debit Cash/Accounts Receivable, Credit Sales Revenue.

Record expense: Debit COGS, Credit Inventory.

What is the formula for COGS?

The formula is:

COGS = Opening Inventory + Purchases – Closing Inventory

11. What are the three golden rules of accounting?

1- Debit what comes in, Credit what goes out (Real Accounts).

2- Debit the receiver, Credit the giver (Personal Accounts).

3- Debit expenses & losses, Credit incomes & gains (Nominal Accounts).

What is a sales journal entry?

The sales journal entry is:

Debit Cash/Accounts Receivable

Credit Sales Revenue

Is cost of goods sold debit or credit?

Cost of goods sold is debit because it is an expense account.

Is cost of goods sold a debit or credit in trial balance?

Cost of goods sold appears as a debit in the trial balance.

Cost of goods sold debit or credit in trial balance?

Cost of goods sold is recorded on the debit side of the trial balance.

Does cost of goods sold have a debit or credit balance?

Cost of goods sold has a debit balance.

Is cost of goods sold a credit or debit?

Cost of goods sold is a debit, not a credit.

Cost of goods sold is debit or credit in trial balance?

Cost of goods sold is debit in the trial balance.

What is the normal balance of cost of goods sold?

The normal balance of cost of goods sold is debit.

Is closing inventory debit or credit in trial balance?

Closing inventory is debit because it is an asset.

Is cost of goods sold debit or credit? True or False

True. Cost of goods sold is a debit because it is an expense account.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.