Dealing with financial accounting can be tough, and sales return journal entries are no exception. In the UAE’s fast-paced business world, knowing how to handle these entries is key. It helps keep your financial records accurate.

A sales return journal entry is vital for tracking product returns and their impact on your finances. If customers return items because they’re faulty or don’t meet their expectations, you need to record these transactions carefully. This ensures your accounting is clear and correct.

Knowing your sales basics is important for managing these financial records. A detailed cash sales invoice sample makes it easier to record returns. It helps businesses track inventory changes and keep their finances in order.

Whether you run a small business or work in finance in Dubai or Abu Dhabi, getting the hang of sales return journal entries is essential. These entries not only show how you interact with customers but also give insights into product quality and customer happiness.

Grasping the details of sales return journal entries lets you make smart financial choices. It also helps you follow accounting rules in the UAE.

Read more: PDC Journal Entry

Fundamentals of Sales Return Journal Entry

Tracking sales returns is key for keeping your business’s financial records right. A sales return journal entry helps you record product returns in a systematic way. This keeps your accounting clear and accurate.

Importance of Recording Sales Returns

When customers return items, it’s important to record these transactions well. Knowing how to handle credit purchases and purchase return journal entries is vital for managing your finances.

💡 Handle Sales Returns with Smart Accounting

Keep your books error-free by recording sales returns, discounts, and VAT adjustments with mazeed accounting software.

Managing Financial Transactions in Business

In the intricate world of business, managing financial transactions and sales operations is paramount to success. Every company, regardless of its size, deals with a continuous flow of money, goods, and services, necessitating robust systems for tracking and reporting.

A fundamental aspect of this is the generation and processing of financial documents, such as an agent commission invoice, an agent commission invoice, and an agent commission invoice.

This document is crucial for compensating third-party representatives who facilitate sales, ensuring transparency and accountability in their earnings.

Impact of Discounts on Sales

When a customer makes a purchase, the transaction often involves various financial adjustments. For instance, an applied discount, an applied discount, and an applied discount can significantly alter the final price. This reduction is usually offered to incentivize sales or as part of a promotional strategy.

Managing Discount Expenses

Many businesses closely monitor their discount expense, as a significant discount expense can impact profit margins, making careful management of discount expense crucial.

Handling Purchase Invoices

Every purchase invoice received represents a financial obligation, and reconciling each purchase invoice against goods received is vital for accurate accounting. Processing a purchase invoice efficiently helps maintain strong vendor relationships.

Purchase Return Journal Entry

When goods are returned, a purchase return journal entry is necessary to adjust inventory and accounts payable. Creating a proper purchase return journal entry ensures the ledger reflects the correct financial position after the return.

Without a precise purchase return journal entry, discrepancies can arise.

Understanding Sales Basics

Understanding sales basics is fundamental for anyone involved in commerce, and mastering sales basics can significantly boost revenue. From lead generation to closing, sales basics underpin all successful transactions.

Recording in the Sales Day Book

Recording daily transactions in the sales day book is an essential step for financial accuracy. The sales day book provides a chronological record of all sales, and regularly reviewing the sales day book helps track performance and identify trends.

Read more: Accounts Receivable Journal Entry

Sales Return Journal Entry Examples

A sales return journal entry typically records the reversal of a previous sale.

Example 1: Simple Sales Return

A customer buys goods worth AED 1,000 on credit.

Later, the customer returns goods worth AED 200 due to defects.

| Account | Debit (AED) | Credit (AED) |

|---|---|---|

| Sales Return Account | 200 | |

| Accounts Receivable | 200 |

This entry reduces both the accounts receivable and the recorded revenue, keeping your books accurate.

Example 2: Sales Return with VAT

If the original sale included 5% VAT on the returned goods (AED 200), the entry would be:

| Account | Debit (AED) | Credit (AED) |

|---|---|---|

| Sales Return Account | 190 | |

| VAT Payable Account | 10 | |

| Accounts Receivable | 200 |

This ensures the VAT adjustment is reflected properly along with the returned goods.

Read more: VAT Accounting Entries: Input VAT in UAE

Key Components of a Sales Return Journal Entry:

Sales return entries have a few important parts:

- Detailed customer information

- Product identification

- Reason for return

- Original purchase date

- Refund or credit amount

Common Reasons for Sales Return Journal Entry:

Customers return items for many reasons:

- Defective merchandise

- Incorrect product specifications

- Size or color mismatch

- Shipping damage

- Customer changed their mind

Purchase Return Journal Entry

A purchase return journal entry is recorded when goods purchased on credit are returned to the supplier due to damage, defects, or incorrect delivery. This entry reduces both the purchase cost and the amount payable to the supplier.

Purchase Return Journal Entry (Credit Purchase)

Journal Entry:

- Debit: Accounts Payable

- Credit: Purchase Returns (or Purchase Returns & Allowances)

This entry decreases the liability to the supplier and records the return of goods.

Example of Purchase Return Journal Entry

A business returns goods worth AED 2,000 that were originally purchased on credit.

- Debit Accounts Payable: AED 2,000

- Credit Purchase Returns: AED 2,000

💡 A Smarter Way to Manage Your Accounting

mazeed combines smart accounting software with certified experts in one place to simplify your financial management from invoicing to tax return filing.

Documentation Requirements for Returns

Good Documentation is Key for Handling Sales Returns. You’ll Need to Keep:

| Document Type | Purpose | Retention Period |

| Original Receipt | Verify purchase details | Minimum 3 years |

| Return Authorization Form | Track return approval | 5 years |

| Refund/Credit Note | Record financial transaction | 7 years |

By following a structured approach to sales returns, you keep your finances clean and build trust with customers through clear processes.

Following the completion of a sale, the customer expects a comprehensive bill and receipt. This dual-purpose document serves as both proof of purchase and an itemized statement of the transaction, detailing the goods or services acquired and the amount paid.

For businesses that primarily deal in direct payments, managing cash sales invoice samples is essential. These samples provide a ready-to-use template for recording immediate revenue and streamline the process for quick transactions.

On the other hand, when a business acquires goods or services on credit, a credit purchase journal entry must be meticulously recorded. This entry acknowledges the liability incurred and ensures accurate financial reporting of outstanding debts.

Read more: What is Contra Entry?

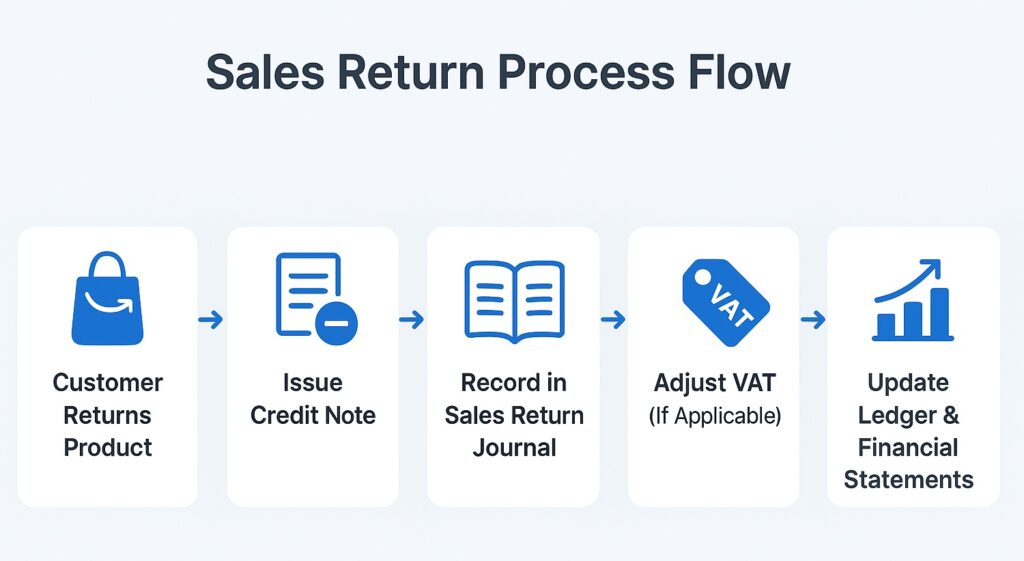

Recording Sales Return Journal Entry in Your Accounting System

Recording sales returns accurately is key to keeping your financial records right. Your sales day book is vital for tracking these transactions well. When a product is returned, you must have a clear way to document and process it in your accounting system.

Recording Sales Returns involves several important steps:

- Verify the purchase invoice details

- Calculate the applicable discount expense

- Record the applied discount

- Update inventory records

Tracking sales returns needs careful documentation. You should make a detailed entry that captures all important financial info. The entry should include:

- Original sale date

- Return date

- Product description

- Reason for return

- Refund or credit amount

Here’s how sales returns affect your financial records:

| Transaction Type | Account Impacted | Financial Effect |

|---|---|---|

| Product Return | Sales Revenue | Decrease |

| Discount Expense | Accounts Receivable | Adjustment |

| Inventory Update | Inventory Asset | Increase |

Pro tip: Create a consistent method for documenting sales returns. This ensures accuracy and makes financial reporting easier. Regularly checking your sales day book helps keep your accounting records clear and accurate.

“Accurate sales return documentation is the cornerstone of financial integrity.” Conclusion at sales return journal entry.

Understanding sales return journal entries is key for keeping your UAE business’s finances accurate. Good accounting practices help you track and manage sales returns well. This keeps your profits safe and your financial records clear.

How you handle agent commission invoices affects your business’s health a lot. Tracking sales returns helps you spot return patterns, check customer happiness, and make smart business choices. This precision keeps you in line with UAE’s accounting rules.

Having a clear process for sales return records helps your business stay financially sound. You’ll learn more about your sales, what customers like, and where you can get better. Seeing sales returns as useful data turns a problem into a chance for growth.

Don’t forget, keeping detailed records is more than just following rules. It’s a way to help your business succeed. Adopt these habits to build a strong financial system that helps you reach your goals in the UAE’s competitive market.

Is Sales Return Debit or Credit?

One of the most common questions is: is sales return debit or credit?

Sales return is always recorded as a debit.

When a customer returns goods, the business reduces its revenue. Since sales normally has a credit balance, we debit the Sales Return account to reduce total sales.

Sales Return Is Dr or Cr?

Sales return is Dr (Debit).

It is never credited when goods are returned by a customer. The debit entry reduces net sales in the income statement.

Sales Return Account Is Which Type of Account?

Another common question is: sales return account is which type of account?

Sales return is a contra revenue account.

This means:

- It is related to revenue

- It reduces total sales

- It appears under the sales section in the income statement

- It has a debit balance

It is not an expense. It simply reduces revenue to show the correct net sales figure.

Goods Return by Customer Journal Entry

Many learners search for goods return by customer journal entry or goods returned by customer journal entry.

When a customer returns goods that were sold on credit, the journal entry is:

Entry:

Debit: Sales Return

Credit: Accounts Receivable

This entry reduces:

- Revenue (through Sales Return)

- The amount the customer owes

Example

A customer returns goods worth 1,000.

The journal entry will be:

Debit: Sales Return 1,000

Credit: Accounts Receivable 1,000

If the sale was originally in cash, then Cash is credited instead of Accounts Receivable.

Sales Return Ledger Under Which Group?

A common accounting classification question is: sales return ledger under which group?

Sales return ledger is grouped under:

Revenue Accounts or Contra Revenue Accounts

In most accounting software and manual systems, it appears:

- Under Sales

- As Sales Return or Return Inwards

- With a debit balance

It is not grouped under expenses or liabilities.

Which Balance Is Existed in Sales Return Account?

Another frequent question is: which balance is existed in sales return account?

Sales return account has a debit balance.

This is because:

- It reduces sales

- It is debited whenever goods are returned

- It offsets the credit balance of the Sales account

At the end of the period, total sales minus sales returns equals net sales.

Key Takeaways: Sales Return Journal Entries

- Purpose: Records returned goods to keep financial statements accurate and compliant.

- Impact: Adjusts sales revenue, accounts receivable/cash, inventory, and VAT where applicable.

- Entry Basics:

- Debit → Sales Return (reduces revenue)

- Credit → Accounts Receivable/Cash (reverses payment)

- Add VAT adjustment if applicable.

- Documentation: Keep original invoice, return authorization, refund/credit note for 3–7 years (UAE standard).

- Insights: Tracking returns reveals product issues, customer satisfaction trends, and improves decisions.

- Best Practice: Maintain consistent recording in the sales day book; reconcile regularly.

- Tools: Use accounting software (like mazeed) to simplify entries, discounts, VAT, and reporting.

FAQs: Sales Return Journal Entry

What is the journal entry of sales return?

The typical journal entry for a sales return is:

Debit: Sales Return (or Returns Inward) Account

Credit: Accounts Receivable or Cash Account

How do you record a sales return?

A sales return is recorded by reducing the revenue previously recognized. You debit the sales return account and credit either the customer’s account (if on credit) or cash/bank account (if paid in cash).

Is sales return a debit or credit?

Sales return is a debit because it reduces the company’s revenue and is treated as a contra-revenue account.

Is sales return a DR or CR?

Sales return is recorded as DR (debit) since it decreases total sales.

What is sales return?

A sales return occurs when a customer returns previously purchased goods due to defects, incorrect delivery, or other reasons, requiring a reversal of the original sales entry.

What account is sales return?

Sales return is recorded in a contra-revenue account called “Sales Return” or “Returns Inward,” which appears as a deduction from gross sales in the income statement.

What if sales return is more than sales in GSTR 1?

If sales returns exceed sales in GSTR-1, you report the excess return as a negative value or adjust it in future periods as per GST rules and file the necessary amendments in returns.

How to record a sales entry?

For a regular sale on credit:

Debit – Accounts Receivable

Credit – Sales Revenue

What is sales journal entry?

A sales journal entry records the revenue from selling goods or services, showing an increase in either cash or receivables and a corresponding increase in sales revenue.

What is revenue entry?

A revenue entry reflects income earned by the business, typically:

Debit – Cash or Accounts Receivable

Credit – Revenue (Sales)

Is sales a debit or credit?

Sales are recorded as a credit because they increase the business’s revenue and, in accounting, revenue accounts carry a credit balance.

Sales return debit or credit?

Sales return is recorded as a debit because it reduces the company’s sales revenue. Since sales are originally credited, any return is debited to reverse part of that income.

Is sales return debit or credit?

Sales return is debit. It reduces total sales revenue.

Sales return is Dr or Cr?

Sales return is Dr. It is recorded on the debit side of the journal entry.

Sales return account is which type of account?

It is a contra revenue account. It reduces total sales in the income statement.

What is the journal entry for goods returned by a customer?

Debit: Sales Return

Credit: Accounts Receivable

If the sale was cash, credit Cash instead.

Sales return ledger under which group?

It is placed under revenue accounts as a contra revenue account.

Which balance is existed in sales return account?

The sales return account has a debit balance.

True or False: Sales return increases revenue

False. Sales return reduces revenue.

True or False: Sales return has a credit balance

False. Sales return has a debit balance.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.