For freelancers in the UAE, managing invoices, expenses, taxes, and payments can be complex and time-consuming. Using self-employed accounting software simplifies those tasks, ensures VAT and corporate tax compliance, and gives freelancers more time to focus on their core skills.

Freelancing in the UAE: Key Facts & Context

- The UAE has over 100,000 licensed freelancers, working in fields such as tech, media, education, healthcare and sustainability. Entrepreneur

- The “Talent-On-Demand 2024” report by Outsized shows that freelancer registrations in the MENA region increased 78 % over the past year, indicating strong demand and growth in the independent workforce. Unravel

- Freelancers in the UAE can earn up to AED 3,600 per day (around USD 1,000), depending on skill, experience, and project complexity. Unravel

These trends show the value freelancers bring and highlight the need for tools that handle financial details reliably.

Why Freelancers Need Accounting Software?

Freelancers have specific accounting needs:

- Tracking income from many clients, often varying rates.

- Keeping records of business-related expenses, travel, equipment, software subscriptions.

- Handling VAT obligations when turnover exceeds thresholds.

- Preparing for corporate tax or registering as legal entities.

- Generating professional invoices quickly and maintaining good cash flow.

Without software, freelancers often spend too much time on spreadsheets, risk missing tax deadlines, or under-pricing because they don’t factor in business expenses properly.

💡 Your Accounting Made Simple

Save time and reduce errors with smart tools that keep your books accurate and compliant.

Key Features of Good Accounting Software for Freelancers

When choosing self-employed accounting software, these features matter:

- Simple invoicing tools with customizable templates.

- Expense tracking and categorization.

- Integration with bank account or payment platforms for auto-reconciliation.

- VAT-compliant invoicing when required.

- Reporting for profit and loss, cash flow forecasts.

- Ability to export data for tax filing.

- Mobile access for working on the go.

VAT Compliance & Legal Requirements for Freelancers in UAE

Freelancers must understand legal and VAT and e-invoicing obligations:

- If a freelancer’s annual taxable turnover exceeds AED 375,000, VAT registration becomes mandatory. For turnover between AED 187,500 and AED 375,000, voluntary registration is possible. ClearTax

- Freelancers must issue invoices that contain required elements (supplier details including TRN if VAT-registered, description of services, VAT amount if applicable). Keeping accurate records (invoices, receipts) is required for audits. ClearTax

- Corporate tax rules (if and when applicable based on profit thresholds) require clear income reporting and expense documentation. The Law Reportes

Read more: E-Invoicing Timeline in UAE

Software that automates invoice creation, tracks expenses, and stores digital records will reduce the risk of non-compliance and penalty.

What Existing Research Says About Automation Benefits

There is limited published quantitative research specifically about self-employed accounting software in UAE, but available studies and articles point to the following benefits:

- Improved income visibility and faster receipt of payments because invoices are more professional and consistently issued.

- Reduced administrative time: freelancers report spending less time on invoice follow-ups when their accounting software helps automate reminders.

- Better cash flow forecasting and budgeting when expenses are tracked properly.

- Lower risk of VAT-errors and penalties thanks to automatic VAT calculations.

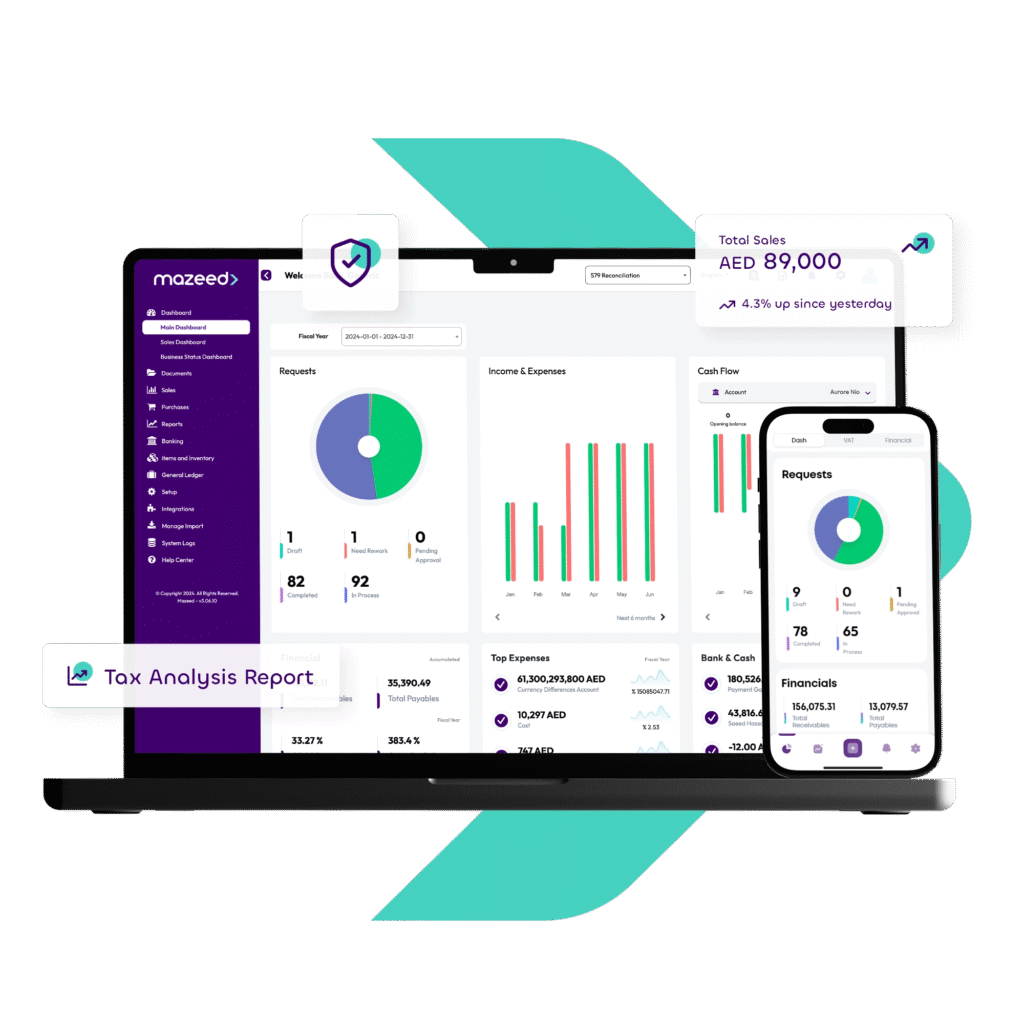

How mazeed Supports Self-Employed Professionals

mazeed offers features that address freelancers’ needs:

- Create and send professional, VAT-compliant invoices.

- Track expenses, receipts, and categorize business costs.

- Generate profit & loss and cash flow reports in real time.

- Mobile access so you can manage finances on the go.

- Integration with payment gateways for easier reconciliation.

Using self-employed accounting software like mazeed can transform freelancing from juggling numbers to focusing on your craft.

FAQs: Self-Employed Accounting Software in UAE

Which accounting software is mostly used in the UAE?

In the UAE, popular accounting software includes mazeed and QuickBooks. mazeed is gaining rapid adoption due to its features, Arabic interface, local team, and full compliance with UAE VAT and Corporate Tax regulations.

Which accounting software is best for a sole trader?

For sole traders in the UAE, mazeed is a good choice because it combines accounting software with expert support, simplifying daily accounting tasks and tax filing. It’s cost-effective and ideal for small business owners managing finances independently.

What is the alternative to QuickBooks Self-Employed?

A strong alternative to QuickBooks Self-Employed in the UAE is mazeed, offering simplified bookkeeping, VAT and Corporate Tax filing, and real-time financial insights, all designed for freelancers and small businesses.

What is the best accounting software for freelancers?

mazeed is highly recommended for freelancers in the UAE as it provides all-in-one accounting, invoicing, and tax compliance tools with no complex setup required. It also integrates with local payment systems and supports multi-currency transactions.

What is the best accounting software for beginners?

Beginners prefer mazeed because of its user-friendly interface and features that eliminate manual entries. It’s designed for business owners with no accounting background, helping them stay compliant effortlessly.

Which ERP is mostly used in UAE?

In the UAE, commonly used ERP systems include SAP, and Oracle NetSuite. mazeed accounting software is designed for accounting, tax, and inventory all in one system, tailored for local compliance.

Can I use Excel for making tax digital?

Excel can help with recordkeeping, but it’s not compliant with the UAE’s digital tax filing requirements. Businesses must use FTA-compliant accounting software like mazeed to ensure compliance with VAT and Corporate Tax laws.

What’s the best tax software for self-employed?

mazeed is one of the best tax software solutions for self-employed individuals in the UAE. It simplifies tax calculations, generates FTA-compliant invoices, and simplifies filing VAT and Corporate Tax returns.

How to make MTD in Excel?

Excel alone cannot directly submit MTD (Making Tax Digital) reports. To comply, you need bridging software or an integrated accounting solution like mazeed, which simplifies digital tax submissions in line with UAE regulations.

What is the cost of easy office income tax software?

Prices for income tax software vary depending on features. mazeed offers a free package and free trial on affordable packages starting from AED 99 per month, covering accounting, VAT filing, and corporate tax filing.

Key Takeaways: Self-Employed Accounting Software in UAE

Using self-employed accounting software is now essential for freelancers in the UAE. Here’s what to remember:

- Time saver: Automating invoicing and expense tracking can cut admin time by up to 70%, based on general digital productivity studies such as McKinsey’s Digital Transformation Report.

- Compliance ready: Freelancers whose annual turnover exceeds AED 375,000 must register for VAT — and software helps meet FTA invoicing standards.

- Cash flow visibility: Clear dashboards show income, expenses, and profit in real time.

- Future proof: With the UAE’s upcoming e-invoicing system, digital tools will soon become mandatory for VAT-registered professionals. (Ministry of Finance – e-Invoicing Initiative)

- Professional edge: Consistent, branded invoices and timely reminders help build trust and speed up payments.

In short, accounting software gives freelancers confidence and control over their business finances, letting them focus on what really matters — their work.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.