In the ever-evolving realm of finance and taxation, the concept of Value Added Tax (VAT) is as multifaceted as it is indispensable. In the UAE, VAT is not a monolith but a tapestry woven with intricate exceptions and special cases that set the stage for a truly dynamic tax landscape. This article delves into the realm of UAE VAT exemptions, offering you an enlightening journey through the policies that exempt certain transactions from VAT. Whether it’s UAE VAT export, VAT on courier services in UAE, or VAT on overseas services, each exemption tells a unique story of fiscal strategy and regulatory finesse.

UAE VAT Exemptions

At its core, a VAT exemption is a provision that allows certain goods, services, or transactions to be exempt from the standard VAT charge. In the context of the UAE, UAE VAT exemptions are designed to promote specific sectors, facilitate international trade, and provide relief in areas where taxing might hinder economic activity.

- Legal Framework:

The UAE government, under the guidance of the Federal Tax Authority (FTA), has delineated a series of exemptions to ensure that the VAT system is both equitable and growth-oriented.

- Sector-Specific Benefits:

Some exemptions target sectors deemed critical for economic development, while others are crafted to enhance global competitiveness.

Read more at mazeed blog: How to choose the right chartered accountant?

Why Do UAE VAT Exemptions Matter?

VAT UAE exemptions play a pivotal role in:

- Promoting Exports:

For instance, UAE VAT export rules ensure that goods and services sold abroad are not subject to domestic VAT, making UAE businesses more competitive in the global market.

- Reducing Costs:

Exemptions such as VAT on courier services in UAE help reduce operational costs for businesses involved in logistics and distribution.

- Encouraging International Trade:

Exemptions on VAT on overseas services facilitate cross-border trade and investment by eliminating the double taxation of services rendered internationally.

These exemptions are not merely fiscal relief measures; they are strategic instruments that help balance revenue generation with economic growth.

UAE VAT Exemptions vs. Zero-Rated Supplies

One of the most common misconceptions in VAT compliance is the confusion between UAE VAT exemptions and VAT zero-rated supplies. While both seem to relieve businesses from VAT charges, they function very differently.

| Aspect | VAT Exemptions | Zero-Rated Supplies |

| Definition | Transactions not subject to VAT at all. No VAT is charged to the customer, and the supplier cannot reclaim VAT on related expenses. | VAT is charged at 0%, meaning the transaction is taxable but at a zero rate, allowing businesses to reclaim VAT on related costs. |

| Examples in UAE | Financial services, residential property rentals, local passenger transport. | Export of goods and services, international transport, certain healthcare and education services. |

| Input VAT Recovery | Not recoverable – Businesses cannot reclaim VAT on expenses related to exempt transactions. | Recoverable – Businesses can reclaim VAT paid on expenses related to zero-rated supplies. |

| Impact on Business | May increase costs as VAT on expenses cannot be recovered. | More favorable for businesses as they can claim back input VAT. |

| Tax Filing Complexity | Simpler, as VAT is not collected or reported for exempt supplies. | Requires proper documentation to justify zero-rating and claim input VAT. |

Try mazeed’s VAT Compliance Automation!

At mazeed, we brought you AI-powered accounting software and FTA-certified tax experts in one place.

All you need to do is to scan your invoices and our platform will automate VAT compliance from return to filing VAT return.

✓ VAT Registration & De-Registration

✓ VAT Return Filing

✓ Voluntary Disclosure

✓ Reconsideration & Waiver Requests

✓ VAT Refund Services

✓ VAT Audit Assistance

✓ VAT Health Check

Detailed Analysis of Key VAT Exemptions in the UAE

1. UAE VAT Export

UAE VAT export is one of the most critical exemptions available to businesses engaged in international trade. Under this provision, goods and services exported out of the UAE are not subject to VAT. This exemption is essential because it:

- Enhances Global Competitiveness:

By exempting exports from VAT, UAE businesses can offer more competitive pricing on the international stage.

- Promotes Trade:

Facilitates the flow of goods and services, contributing to a robust export sector.

- Simplifies Tax Administration:

Ensures that VAT is only collected on domestic consumption, aligning with international best practices.

The UAE government has designed this exemption to support the export industry, making it a cornerstone of the nation’s trade policy.

2. VAT on Courier Services in UAE

The logistics sector is the lifeline of commerce, and VAT on courier services in UAE reflects the government’s commitment to maintaining efficiency in this crucial industry. For businesses that rely on fast and reliable courier services, the exemption on VAT helps:

- Reduce Operational Costs:

Lower tax burdens mean more funds can be reinvested in the business.

- Increase Service Efficiency:

Encourages the use of professional courier services, ensuring that goods are delivered promptly without the added cost of VAT.

- Boost Small Business Growth:

Many small businesses depend on courier services for distribution, and an exemption ensures they are not overburdened by additional costs.

3. VAT on Overseas Services

For service providers operating on a global scale, VAT on overseas services is a significant exemption. This provision allows UAE-based companies to provide services to clients abroad without charging VAT, which is critical for:

- Avoiding Double Taxation:

Prevents the same service from being taxed twice in different jurisdictions.

- Enhancing Service Competitiveness:

Reduces the overall cost to the client, making UAE services more attractive in the international market.

- Fostering International Relationships:

Encourages cross-border collaborations and business expansion.

This exemption is a testament to the UAE’s forward-thinking approach in harmonizing domestic tax policy with the realities of global commerce.

Read more: How File VAT Return in UAE

Special Cases and Exceptions: When Standard VAT Rules Take a Backseat

While the primary VAT UAE exemptions are straightforward, there are several special cases where the application of VAT diverges from the norm. These scenarios are designed to address unique circumstances and ensure that the VAT system remains equitable and flexible.

Special Case 1: Education and Healthcare Services

In many jurisdictions, education and healthcare services enjoy VAT exemptions. In the UAE, similar provisions exist, where certain educational and healthcare services may be exempt from VAT to ensure these essential services remain affordable for the public.

Special Case 2: Financial Services

Financial services are complex in nature, and many of these services are exempt from VAT. In the UAE, certain financial transactions, including the management of investments and insurance services, may fall under VAT UAE exemptions to prevent the distortion of financial markets.

Special Case 3: Real Estate Transactions

Real estate transactions, particularly the sale of residential properties, often enjoy VAT exemptions. This special case is crucial for ensuring that the housing market remains accessible and does not become overburdened by additional taxes.

Read more: What is UAE Reverse Charge Mechanism in VAT

Strategies to Maximize Benefits from UAE VAT Exemptions

While understanding the rules is critical, leveraging UAE VAT exemptions to your advantage is equally important. Here are some strategies to ensure you maximize the benefits of these exemptions:

1. Stay Informed and Updated

- Regularly Monitor Regulatory Updates:

Subscribe to updates from the FTA and industry publications to stay ahead of any changes in VAT policies.

- Attend Workshops and Seminars:

Engage in professional development opportunities to understand the practical implications of UAE VAT exemptions and special cases.

2. Optimize Your Business Processes

- Integrate Advanced Accounting Software:

Use automated tools that support VAT compliance and help you apply the correct exemptions accurately.

- Implement Robust Record-Keeping Systems:

Maintain detailed records of transactions to support your claims for UAE VAT exemptions during audits or disputes.

3. Leverage Professional Expertise

- Consult with Tax Experts:

Engage with professionals who specialize in UAE VAT exemptions to tailor strategies that suit your business model.

- Partner with Comprehensive Financial Management Platforms:

Use platforms like Mazeed to streamline your VAT processes and ensure you capture every exemption applicable to your operations.

These proactive steps not only ensure compliance but also position your business to reap the full benefits of the VAT system.

Read more: Guide to UAE VAT Invoice Format

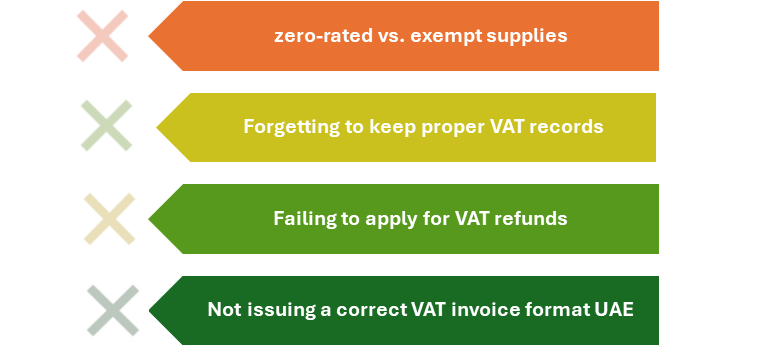

Common VAT Mistakes to Avoid in the UAE

Value Added Tax (VAT) compliance is a critical responsibility for businesses operating in the UAE. However, due to the complexities of VAT regulations, many businesses make errors that can result in penalties, fines, and even legal consequences. Understanding these common mistakes can help businesses navigate VAT compliance smoothly and avoid unnecessary financial losses.

In the intricate world of taxation, UAE VAT exemptions offer more than just regulatory relief—they provide a competitive edge. By understanding and strategically applying exemptions such as UAE VAT export, VAT on courier services in UAE, and VAT on overseas services, businesses can optimize their costs, improve cash flow, and enhance their international competitiveness.

This guide has explored the landscape of VAT exemptions and special cases, provided a detailed analysis, and offered actionable strategies to harness these benefits. Whether you’re in logistics, finance, real estate, or any other sector, these exemptions can transform the way you do business in the UAE.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official tax guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority