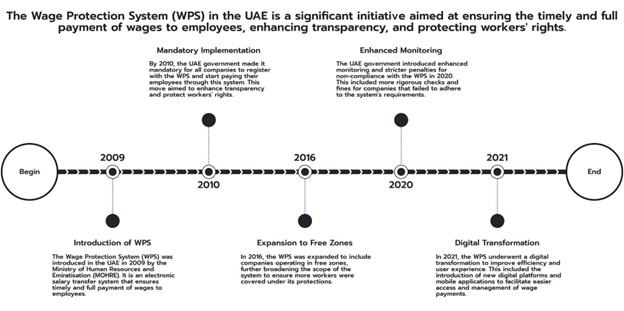

The Wage Protection System (WPS) is an electronic salary transfer system developed by the Central Bank of the United Arab Emirates in collaboration with the Ministry of Human Resources and Emiratisation (MOHRE). This system ensures timely and accurate wage payments to employees working in the private sector. Understanding what is WPS in UAE is essential for both employers and employees, as it streamlines salary disbursements and promotes compliance with labor laws.

Understanding What is WPS in UAE

The WPS system in Dubai and across the UAE is designed to safeguard workers’ rights by ensuring that salaries are paid through approved financial institutions. If you’re wondering what is WPS in UAE, it is a mechanism that requires all private sector employers to pay their employees through a regulated process.

By ensuring that salaries are processed electronically, the UAE government aims to enhance financial transparency and protect employees from potential wage exploitation. The implementation of WPS has significantly reduced salary-related disputes and provided workers with a sense of security regarding their earnings.

WPS Full Form in UAE

The WPS full form in UAE stands for Wage Protection System, which mandates that salaries be transferred electronically through UAE-approved banks, exchange houses, or financial institutions. This ensures transparency and prevents wage-related disputes. The wage protection system was introduced to address issues of delayed payments and non-payment of wages that were previously common in various sectors.

WPS Meaning in Salary

The WPS meaning in salary is straightforward—it refers to a legally structured method for processing payroll payments through an electronic system. Employers must register for Wage protection system and comply with its regulations to avoid penalties.

Through the Wage protection system, employees receive their salaries on time, which enhances financial stability. The system benefits expatriate workers who rely on their monthly wages to support families back home. Delays in salary payments can disrupt financial plans, but the Wage protection system ensures a structured and reliable payment mechanism.

WPS Full Form in Salary

The WPS full form in salary is also Wage Protection System, which ensures that employees receive their wages on time as per their contract agreements. Employers who fail to comply with WPS regulations may face fines or restrictions. The introduction of the WPS has made it easier for authorities to track wage violations and take corrective measures promptly.

How Does the WPS System in Dubai Work?

The WPS system in Dubai operates by linking employers, employees, financial institutions, and MOHRE. Here’s a step-by-step breakdown of how the WPS system functions:

- Employer Registration: Companies must register with MOHRE and subscribe to an approved WPS agent, such as a bank or exchange house.

- Salary File Submission: Employers prepare and submit a Salary Information File (SIF) containing employee wage details.

- Processing and Transfer: The approved WPS agent processes the salary and transfers it to employees’ bank accounts or payroll cards.

- MOHRE Monitoring: The Ministry monitors wage payments to ensure compliance and prevent delays or underpayments.

Understanding what is WPS in UAE helps businesses operate legally while ensuring employees receive fair compensation.

Read more: Last Date of Work | Final Working Day Details in UAE

Wage Protection System Compliance and Legal Requirements

To comply with WPS UAE regulations, businesses must:

- Pay salaries on time as per employment contracts.

- Use only UAE-approved banks and financial institutions.

- Submit a complete Salary Information File (SIF) to MOHRE.

- Ensure accurate payments, avoiding discrepancies.

- Provide employees with proper documentation of salary payments.

- Maintain records of all transactions to prove compliance.

Employers who fail to adhere to the Wage protection system requirements may face legal actions, including fines and business license suspension. The government regularly audits payroll records to ensure that all companies comply with Wage protection system guidelines. Repeated violations can lead to severe consequences, including blacklisting from MOHRE and restrictions on business operations.

WPS Salary Meaning for Employees

For employees, the WPS salary meaning refers to the assurance of receiving their wages on time and through an official, government-monitored system. This protects them from wage-related disputes and ensures financial security.

Through WPS, workers can also track their salary transactions and raise complaints in case of irregularities. This system provides a safety net against exploitation, particularly for low-income workers who depend entirely on their salaries for daily expenses. Additionally, Wage protection system ensures that salary deductions, if any, are documented and authorized, preventing unauthorized wage cuts.

Benefits of the WPS System

The WPS system offers several benefits, including:

- Enhanced transparency in salary payments.

- Protection of employee rights through wage monitoring.

- Reduction in wage-related disputes, ensuring workplace harmony.

- Improved business credibility, as compliance with Wage protection system regulations demonstrates financial responsibility.

- Stronger government oversight, ensuring labor laws are upheld.

- Improved financial inclusion, as all employees receive bank accounts or payroll cards, allowing them to access modern banking services.

- Better financial planning for employees, as they can manage their income through banking services, savings accounts, and direct transfers.

Employers and employees must understand what is WPS in UAE to ensure compliance and benefit from the system’s advantages.

Consequences of Non-Compliance with WPS UAE

Companies failing to adhere to WPS UAE regulations may face:

- Fines and penalties ranging from AED 1,000 to AED 50,000 per violation.

- Suspension of business operations if salaries are not paid for an extended period.

- Legal action from employees, leading to further financial liabilities.

- Blacklist from MOHRE, preventing them from hiring new employees or renewing visas.

- Public reputation damage, which can affect customer trust and business partnerships.

To avoid these consequences, employers must prioritize timely and accurate salary payments under the WPS system in Dubai and the broader UAE. Businesses should also stay updated on WPS regulations to avoid unintended violations.

Read more: Resignation Letter UAE [Detailed Guide]

WPS UAE: A Step Towards Financial Stability

The UAE has long been a global hub for expatriate workers, and the WPS UAE plays a crucial role in maintaining trust between employers and employees. By ensuring a structured payroll system, the WPS strengthens the country’s labor market and enhances worker satisfaction.

The introduction of Wage protection system has also influenced other Gulf countries to implement similar wage protection mechanisms, showcasing the UAE’s leadership in labor rights and financial governance. The system is continuously updated to adapt to new financial technologies and compliance requirements, ensuring that workers receive the best protection possible.

The Wage Protection System (WPS) is a crucial framework that regulates salary payments in the UAE. Knowing what is WPS in UAE allows businesses to comply with labor laws and employees to receive timely wages. By adhering to WPS UAE requirements, both employers and workers benefit from a structured and transparent wage system. The WPS system in Dubai and across the UAE plays a pivotal role in safeguarding employee rights and maintaining financial integrity within the job market.

With its robust structure, the WPS enhances employer accountability and provides employees with wage security. Understanding what is WPS in UAE and its impact ensures a stable and reliable salary payment process for all workers in the country.