Managing your business finances in the UAE is all about clear, professional documents. A statement of account sample is your guide to making these important financial records.

These documents give a full view of your customer relationships. They list all sales, payments, and what’s owed in one place. Your clients get a clear picture of their financial dealings with you.

Whether you have a small shop in Dubai or a big company in Abu Dhabi, you need solid financial records. Professional account summaries help keep your customers happy and your books tidy.

This guide will teach you how to make effective customer statements. You’ll find useful templates, step-by-step guides, and tips for UAE businesses. With the right tools and knowledge, your financial record-keeping will get better.

What is a Statement of Account Sample?

A statement of account is a key financial document for businesses. It acts as a financial communication bridge between you and your business partners. It’s vital for maintaining professional relationships with customers, suppliers, or banks in the UAE.

In the diverse business environment of the UAE, these statements are essential. They help track payments, manage credit terms, and ensure smooth operations.

Read more: Accounting Standards in UAE

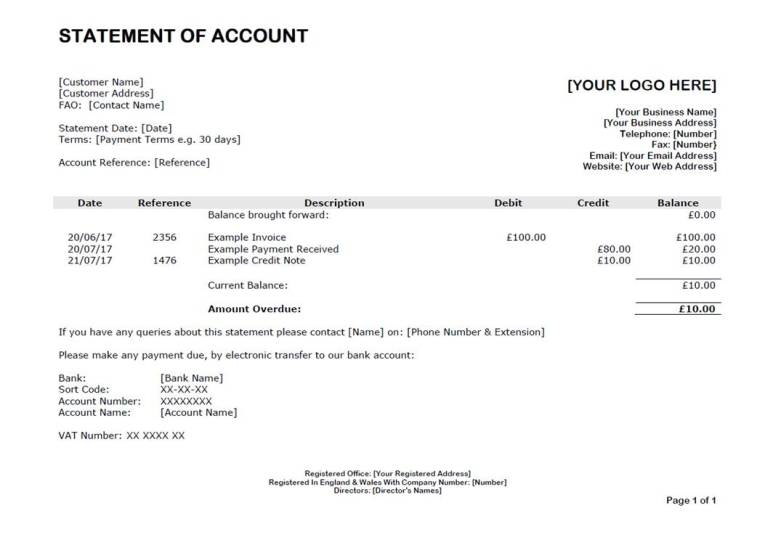

Free Statement of Accounting Template

Key Differences from Other Financial Documents

Many business owners get confused with other financial documents. The table below highlights the main differences:

| Document Type | Primary Purpose | Time Coverage | Payment Status |

| Statement of Account | Summary of all transactions | Multiple periods | Shows outstanding balances |

| Invoice | Request for payment | Single transaction | Creates new debt |

| Receipt | Proof of payment | Single payment | Confirms payment made |

| Bank Statement | Account activity summary | Monthly periods | Shows account movements |

💡 Keep Your Records Error-Free

Create professional statements of account, track balances, payments, and overdue amounts automatically with mazeed accounting software.

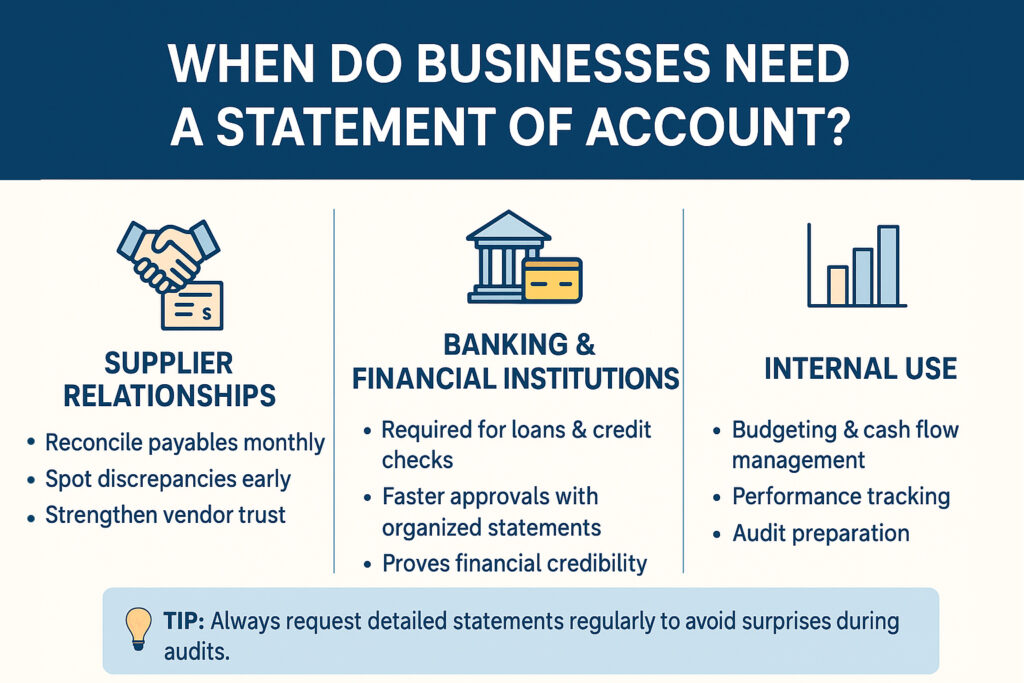

When Do You Need a Statement of Account in Business?

Business owners often need statements of account for specific reasons. These documents act as vital communication bridges with financial partners. Knowing when to use them is key to keeping business relationships strong and operations smooth.

Each situation requires a unique approach and serves a specific purpose in your business.

A- Supplier Relationships

Managing supplier accounts means tracking your payables carefully. You’ll need a sample supplier statement of account to reconcile your records. This helps spot any issues early on.

Smart business owners check supplier statements every month. This ensures accurate records and keeps vendor relationships strong. You can also use these documents for budgeting and managing cash flow.

When managing accounts payable, it’s crucial to maintain accurate records and reconcile them regularly with your vendors.

A key tool in this process is the supplier statement of account. Businesses often need to formally request this document, and having a well-crafted request for supplier statement of account sample letter can streamline the communication.

This letter should clearly identify your company, the period for which the statement is needed, and your supplier account number.

Upon receiving the sample supplier statement of account, you can then cross-reference it with your internal purchase records to identify any discrepancies.

If you don’t receive these statements automatically, drafting a request for supplier statement of account sample letter becomes a regular task, as a detailed sample supplier statement of account is invaluable for confirming balances and preparing for audits.

B- Banking and Financial Institutions

Banks need detailed statements for loan applications and credit checks. Your financial institution will ask for these during account reviews or audits. Organized statements make approval faster and show your business’s credibility.

Use banking statements for internal financial analysis too. They help track your business’s performance and spending habits.

Read more: Accounting Structure for Small Businesses

Essential Components of a Professional Statement of Account

Creating a professional statement of account form needs focus on key elements. These elements make your document clear and follow the law. Each part has a special role in keeping your business and clients in sync.

A full statement of account form has four main parts. These parts work together to give a full view of account details. They make sure your document meets business standards and is useful for communication.

1- Transaction Details and Descriptions

Transaction details are the core of your statement of account form. List each transaction in order with dates, numbers, and clear descriptions. Include invoice numbers and other IDs.

Use separate columns for debit and credit amounts. Keep a balance column that updates with each transaction. This makes it easy for customers to follow their account and check charges.

2- Balance Information and Payment Terms

Balance info should be in a summary format. Show the opening balance, total charges, payments, and current amount owed. Break down overdue payments by time, like current, 30 days, 60 days, and over 90 days.

Include payment terms, due dates, and accepted methods. Mention late fees or interest if there are any. This part encourages on-time payment and sets clear expectations.

| Component | Required Information | Purpose | UAE Compliance Notes |

| Header Details | Company logo, name, address, contacts | Establishes credibility and contact info | Include business registration number |

| Account Summary | Customer details, account number, credit terms | Identifies account relationship | Use Arabic and English for local clients |

| Transaction History | Dates, descriptions, reference numbers, amounts | Shows detailed account activity | Include VAT details where applicable |

| Balance Summary | Opening balance, charges, payments, current balance | Provides payment status overview | Display amounts in AED currency |

How to Create Your Statement of Account Sample?

Creating a detailed statement of account has six main steps. These steps help you go from the beginning to the end. They make sure your document looks professional and is accurate with financial details. Each step connects to the last one, making the process smooth and saving time and reducing mistakes.

1. Gather Required Information

First, collect all the data you need. You’ll need customer contact info, account numbers, and addresses. Also, get your transaction records from your accounting system or by hand.

Make a checklist with previous balances, payment history, and any unpaid invoices. Collecting documents early prevents delays and makes sure you don’t miss anything. Keep all your data in one place for easy access.

2. Choose Your Format and Template

Pick the best format for your business and what you can do. You can use Excel, accounting software, or word processors. Look for a statement of account sample doc to start with.

Look at different templates to see which fits your industry best. Using professional templates saves a lot of time and keeps your statements looking the same. Choose formats that you can easily change to fit your business.

3. Input Account Details

Put in all the customer info in the header section. Include your company info, customer name, address, and account numbers. Add the statement period and when you made it.

Make sure all contact info is right. Right details avoid delivery problems and keep your clients happy.

4. Calculate Balances and Totals

After each transaction, calculate the running balance. Start with the opening balance, add new charges, subtract payments, and find the closing balance. If needed, include an aging analysis.

5- Review and Finalize

Do a thorough check of your statement before sending it out. Look at all the numbers, check the customer info, and make sure it looks professional. Use your statement of account sample doc as a guide.

Print a test copy to check the layout and how easy it is to read. Checking everything carefully prevents expensive mistakes and keeps your reputation good in the UAE market

Read more: Accrual Accounting Journal Entries.

Statement of Account Sample Templates and Examples

Well-designed statement templates save time and ensure consistency in all your financial documents. These templates give you the structure to create professional statements fast. You can adjust each template to fit your business needs and industry standards.

The right statement of account sample helps you avoid common mistakes and missing information. Professional templates include all essential elements and have clear formatting. This makes your statements look polished and communicate well with clients and suppliers.

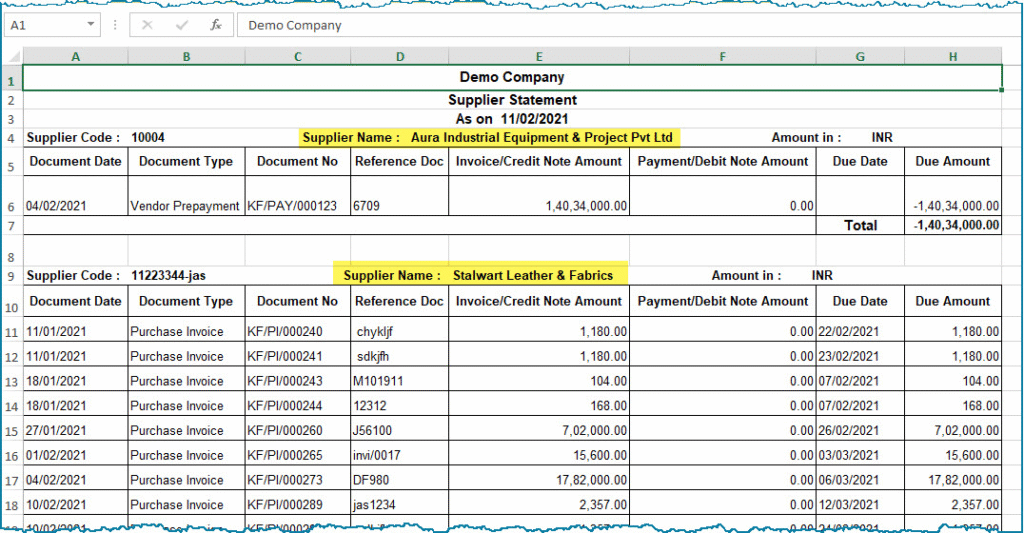

Supplier Account Statement Examples

Supplier statements offer a different view on account relationships. They help you know what to expect when asking for statements from vendors. The format usually includes purchase orders, delivery dates, and payment status for each transaction.

When you get a statement of account sample from suppliers, look for detailed transaction descriptions and aging information. This helps you manage cash flow and keep good vendor relationships. Supplier formats often include more detailed product or service descriptions than customer statements.

💡 New Way for Financial Management

mazeed combines accounting software with on-demand expert support in one place. All you need is to scan your invoices, and we’ll do the rest.

Best Practices for UAE Business Requirements

In the UAE, you must follow specific rules for statement of account form documents. These rules ensure your financial documents meet local standards.

The UAE has its own set of rules for financial statements. Knowing these rules helps you keep good relations with clients and suppliers.

A- Local Compliance and Legal Requirements

UAE law requires accurate financial records in certain formats. Your statement of account form must have the right details and follow local guidelines.

Different emirates have different rules for business documents. Dubai and Abu Dhabi have stricter rules than others. Always check with local authorities for specific rules in your area.

You must keep financial records for at least five years. Electronic records are okay, but they must meet UAE digital signature standards.

B- Professional Standards and Formatting

The UAE values formal presentation and detail. Your statement of account form should meet these professional standards.

| Requirement Category | UAE Standard | Key Details | Compliance Level |

| Language | Arabic/English | Both languages accepted | Mandatory |

| Currency Display | AED Primary | Foreign currency with conversion | Required |

| VAT Information | Separate Line Item | Include TRN number | When Applicable |

| Digital Signatures | UAE Standards | Approved certification only | Optional |

Professional formatting means using formal letterheads and consistent date formats. The UAE prefers DD/MM/YYYY for dates.

Read more: Basic Tools of Accounting in UAE.

How to Request and Use Supplier Statement of Account Sample Letters?

Getting statements from suppliers is easy if you know how. Good communication keeps your business relationships strong. It also makes sure you get the financial info you need.

It’s important to know what to ask for and how to ask it. This makes your requests clear and professional.

1- Writing Professional Request Letters

Your request for supplier statement of account sample letter should be clear. Start with your company details and account number. Then, state the time period you need covered.

Be polite but direct in your request. Explain why you need the statement. This could be for reconciliation, audit, or bookkeeping. It helps suppliers understand the urgency and respond quickly.

| Request Method | Response Time | Best For | Follow-up Required |

| 2-3 days | Routine requests | Minimal | |

| Phone call | Same day | Urgent needs | Email confirmation |

| Written letter | 5-7 days | Formal documentation | Phone follow-up |

| Online portal | Instant | Regular suppliers | None |

2- Following Up on Statement Requests

Wait three business days before following up. Send a friendly reminder that references your original message. Include your account details again to help them.

If you don’t get a response, try calling. Emails can get lost. A quick phone call shows you’re serious.

3- Using Access Bank Statement of Account Code

Access Bank customers can use the Access Bank Statement of Account Code for quick requests. Dial the USSD code on your phone for instant access. This method works 24/7 and doesn’t need internet.

You can also log into Access Bank’s online platform to download statements. This saves time and gives you quick access to your financial records.

Key Takeaways: Statement of Account Sample

You now have everything you need to make professional financial documents for UAE businesses. The statement of account sample templates and guidelines in this guide will change how you handle customer and supplier talks.

Your business’s success relies on clear financial talks. Every statement of account you make helps build trust with partners. It shows you’re serious about being open. These documents are key to strong business ties in the Emirates.

Start using these tips right away. Pick the template that matches your business best. Whether you’re working with Dubai suppliers or Abu Dhabi customers, keeping your documents consistent will make you stand out.

Remember, being accurate is more important than being fast. Always double-check your documents before sending them out. Your focus on details shows your business’s professionalism and gains trust from others.

Investing in good financial documents will help your cash flow and cut down on disagreements. Your clients will thank you for being clear, and your accounting team will appreciate the organized way you handle financial records.

1. How do you write a simple delivery note?

A simple delivery note should include the seller’s details, the buyer’s details, the date, a description of the goods delivered, quantities, and a signature line. Keep the format clear and professional so it can act as proof of delivery. Many businesses also add a unique document number for easy tracking.

2. How do I create a delivery note in Word?

Open Microsoft Word, choose a blank document or use an invoice/delivery template, and structure it into sections: company logo, customer information, delivery details, item list in a table, and a signature area. Save it as a reusable template for future deliveries.

3. What should a delivery note include?

A delivery note usually includes:

– Seller’s name and address

– Buyer’s name and address

– Date of issue

– Delivery note number

– List of items delivered (description and quantity)

– Reference to the related invoice or purchase order

– Space for receiver’s signature

4. How to make a delivery note in Excel?

In Excel, create a table with columns for item description, quantity, and remarks. Add your company header, customer details, and delivery note number. Excel makes it easy to auto-calculate totals or copy data from an invoice sheet. Save the file as a template for repeated use.

5. How to make a delivery sheet?

A delivery sheet is similar to a delivery note but is used for multiple deliveries in one trip. Include: route details, driver’s name, vehicle number, customer addresses, list of items for each delivery, and signature space for each customer. Excel or Google Sheets is commonly used.

6. How do I create a note in Excel?

In Excel, right-click a cell, select Insert Comment (older versions) or New Note (newer versions), then type your text. Notes are useful for reminders or clarifications about cell data.

7. Can I add notes to an Excel formula?

Yes. You cannot embed notes inside the formula itself, but you can:

Add a cell note/comment on the same cell.

Use the N() function inside a formula for non-calculated text, e.g., =SUM (A1:A5) + N ("Sales total"). The note won’t affect the calculation.

8. How to use Excel for note taking?

You can use Excel for structured note taking by creating columns for categories, dates, or topics. Alternatively, use cell comments/notes to annotate data. However, for long-form notes, Word or OneNote may be more efficient.

9. How to create a note in Microsoft Word?

In Word, use the Insert → Comment feature to add a note linked to specific text. For free-form notes, create a text box in the margin. Comments are especially useful in collaborative editing.

10. How to make a note sheet?

A note sheet is simply a blank or lined template for jotting down ideas. In Word, insert a table or ruled lines. In Excel, use rows and columns as structured sections for meeting notes, to-dos, or tasks.

11. What is the Microsoft tool to make notes?

The main Microsoft tool for note-taking is OneNote. It’s part of Microsoft 365 and allows free-form notes, digital notebooks, drawing, audio, and syncing across devices. For quick inline notes, you can also use Word comments or Excel notes.

12. How do I put a note on words?

In Microsoft Word, highlight the word or phrase, go to Review → New Comment, and type your note. The note will appear in the margin as a comment balloon, making it easy to review or collaborate.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.