Understanding Dubai tourist tax can seem tough. But knowing its structure and rates helps you plan better. This guide will cover the key points of Dubai tourist tax. It aims to help you enjoy your trip without worrying about costs.

If you’re new to Dubai or a regular visitor, this article is for you. It will teach you about the Dubai tourist tax, tourism dirham tax Dubai, and Dubai hotel tourist tax. By the end, you’ll know how to handle these taxes easily. You’ll also get tips for a smooth and worry-free visit.

Understanding Dubai Tourist Tax and Its Implementation

When you visit Dubai, you might hear about the “Tourism Dirham Tax.” This tax is key to Dubai’s tourism and something visitors should know. Let’s explore this tax and how it works.

Read more: How to claim VAT Refund in UAE for Tourists?

What is tourism dirham tax Dubai?

The tourism dirham tax Dubai is a fee for those staying in Dubai’s hotels and other places to stay. It’s collected by the Dubai Department of Tourism and Commerce Marketing (DTCM). This tax helps improve Dubai’s tourism and keep its facilities top-notch.

When Did Tourist Tax Start in Dubai?

The Dubai tourist tax began in 2014. It was created to help fund Dubai’s growing tourism. Since then, it’s been a big part of visiting Dubai, helping make the city even better for tourists.

Legal Framework and Regulations

The tourist tax follows Dubai’s laws and has a clear legal base. Dubai Law No. 2 of 2014 sets out how the tax is collected and used. This ensures the tax is fair and helps both Dubai and its visitors.

Knowing about the tourist tax is important for visitors. It helps you plan and budget for your trip. Being informed makes your stay in Dubai smooth and enjoyable.

Read more: How to get Golden Visa in UAE

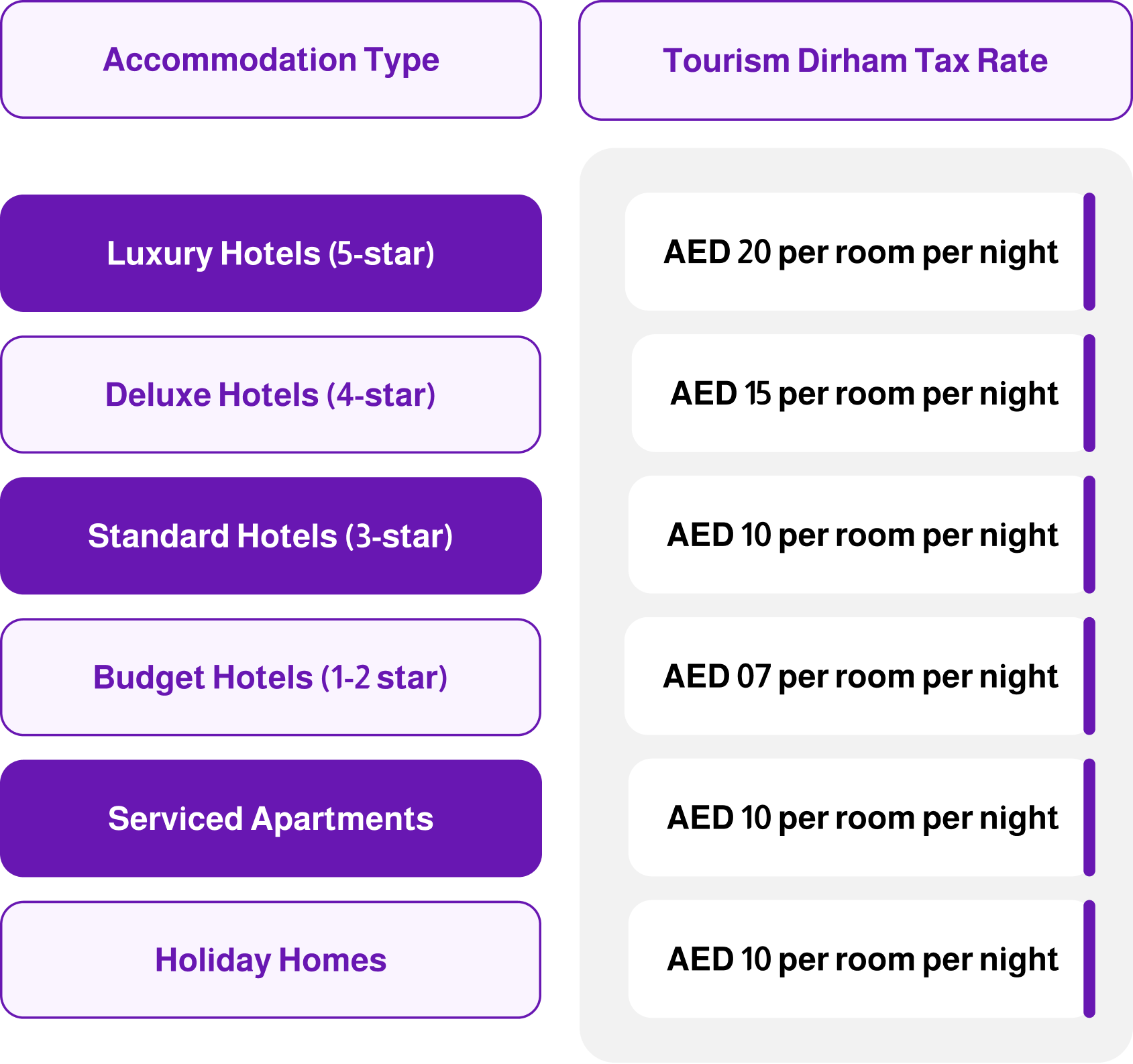

Dubai hotel tourist tax Rates and Categories

When you visit Dubai, knowing the Dubai hotel tourist tax rates is key to planning your trip. The tourism dirham tax, or Dubai hotel tourist tax, is a nightly fee for all guests. It’s set by the Dubai government.

The tax rates change based on where you stay. Here’s a simple guide to help you understand:

The tourism dirham tax is extra on top of your room rate and other fees. It’s a rule for all visitors, no matter how long they stay or why they’re there.

“The tourism dirham tax is an essential component of Dubai’s efforts to develop and maintain its world-class tourism infrastructure.”

Knowing the Dubai hotel tourist tax rates helps you plan your trip better. This way, you can enjoy your time in Dubai without worrying about money.

Will the tourist tax be present in 2024?

Yes, the UAE continues to implement a tourism tax in 2024. However, the specific structure and rates can vary based on several factors:

Tourist Tax:

- Not all emirates levy a tourist tax.

- The tax amount depends on the hotel category.

For instance, in Dubai, the “Tourism Dirham” ranges from AED 7 to AED 20 per night per room, varying by hotel category.

Value Added Tax (VAT):

- The UAE’s standard VAT rate is 5%.

- This tax applies to most goods and services, including hotel services.

Federal Tax:

- An additional 10% federal tax is imposed on services and high-level services.

- This tax is typically included in the bill when paying for services at hotels and restaurants.

Municipal Fee:

- Each emirate sets its own municipal fee, which is a percentage of the basic service price.

- The fee can range up to 7% of the room rate, depending on local regulations.

Abu Dhabi Tourist Tax

Abu Dhabi tourist tax, Department of Culture and Tourism – Abu Dhabi (DCT Abu Dhabi) has extended the waiver of fees for issuing, distributing, and marketing event tickets in the emirate to further stimulate growth in the tourism sector. Event organizers will be exempt from paying the 10% tourism fee on tickets sold until December 31, 2024.

His Excellency Saleh Mohammed Al Geziry, Director General of Tourism at DCT Abu Dhabi, stated: “Abu Dhabi’s year-round calendar of events consistently attracts visitors from around the world.

The extension of the tourism fee waiver until the end of the year is part of our strategy to accelerate growth and provide ongoing support to our event partners and organizers, who are essential to the emirate’s tourism and entertainment landscape.”

Read more about Gold tax in UAE!

How to Calculate and Pay Your Tourism Tax in Dubai

Understanding Dubai tourist tax can be tricky, but it’s manageable with the right info. Let’s explore how to figure out and pay your tax.

Payment Methods and Deadlines

You can pay the Dubai tourism tax in several ways, like cash, cards, or mobile apps. The tax is usually collected by your hotel or rental place.

Remember, you have 14 days after checking out to pay the tax. If you miss this deadline, you might face penalties. So, pay your tax before leaving the UAE.

Tax Calculation Examples

The tax is based on your room rate and how long you stay. Here are some examples to make it clearer:

- At a 5-star hotel for 3 nights at AED 500 per night, your tax is AED 45 (AED 15 per night).

- At a 3-star hotel for 2 nights at AED 300 per night, your tax is AED 12 (AED 6 per night).

- In a short-term rental for 5 nights at AED 200 per night, your tax is AED 20 (AED 4 per night).

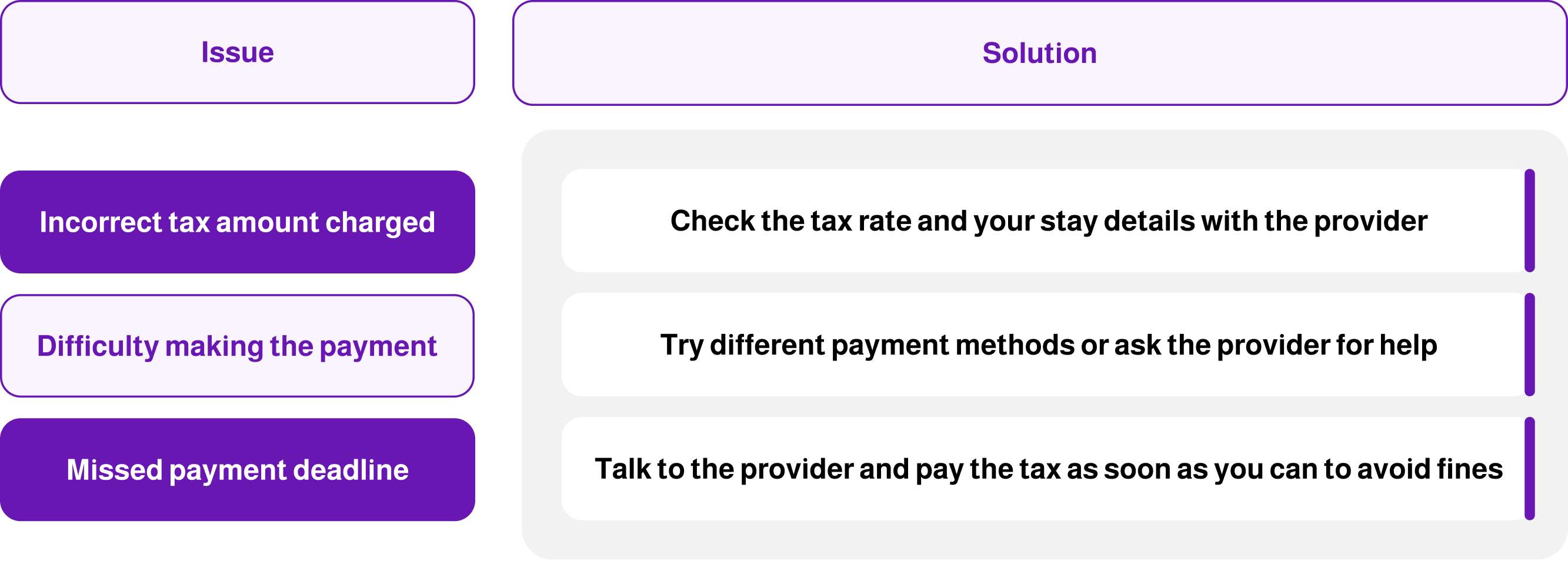

Common Payment Issues and Solutions

Even though the tax is simple, some travelers might run into problems. If you’re having trouble, ask your hotel or rental for help. They can walk you through the process and solve any issues.

Knowing about Dubai tourist tax and following the rules makes your stay easier. Paying your tax is not just a legal thing. It also helps the tourism industry grow.

The Dubai tourist tax, also known as the Tourism Dirham, is key to Dubai’s top-notch tourism. By paying this tax, you help support Dubai’s hospitality industry. This ensures visitors have a great time.

Keep in mind, tax rates and how you pay can change based on your stay. Make sure you know the rules and plan your payments. This way, you avoid any trouble or fines.

Read More: How to Register for VAT in UAE in 2025 | Step-by-Step Guide

Automate Your Tax Compliance with mazeed!

| We’re the first in region to provide AI-powered accounting software with FTA-certified experts in one place. How it Works? All you need is to scan your invoices and let the platform automate your tax compliance from VAT to Corporate Tax. ✓ FTA & IFRS Compliant ✓ Up to 60% Faster Process ✓ Up to 85% Less Cost |

FAQs about Dubai Tourist Tax

Do tourists have to pay tax in Dubai?

Yes, tourists in Dubai are required to pay certain taxes, including the Tourism Dirham Fee, which is charged per room, per night on hotel stays, as well as a 5% Value Added Tax (VAT) on most goods and services such as dining, shopping, and entertainment.

Does Dubai have tourist tax refund?

Dubai does not offer a refund for the tourist tax (Tourism Dirham Fee) paid on accommodations. However, tourists can claim a VAT refund on eligible purchases made at approved retailers, which can be processed at designated airport counters before departure.

What is the tax in Dubai for foreigners?

Foreigners visiting Dubai are subject to a tourism fee known as the Tourism Dirham Fee, which ranges from AED 7 to AED 20 per night depending on the hotel’s rating, as well as a 5% VAT on most goods and services. In addition, hotels may include municipality and service charges, but there is no personal income tax for tourists in Dubai.

What is the tourist tax charge in Dubai?

The tourist tax charge in Dubai, officially called the Tourism Dirham Fee, is a nightly fee that ranges from AED 7 to AED 20 per room depending on the type of accommodation, and it is collected by the hotel or licensed rental operator at check-in or check-out.

What is the Dubai Tourist Tax?

The Dubai Tourist Tax, commonly known as the Tourism Dirham Fee, is a small fee charged per room, per night, on hotel accommodations and short-term stays in Dubai. The amount varies depending on the hotel’s rating and is collected to support tourism infrastructure in the city.

How much is the tourist tax in Dubai?

The tourist tax in Dubai ranges from AED 7 to AED 20 per room, per night, based on the classification of the hotel or accommodation.

Is the Dubai Tourist Tax included in the hotel booking price?

In most cases, the tourist tax is not included in the initial booking price and is charged separately at check-in or check-out. Always confirm with the accommodation provider to avoid surprises.

Who has to pay the Dubai Tourist Tax?

All tourists and visitors staying in hotels, hotel apartments, guesthouses, and holiday homes in Dubai are required to pay the tourism fee. This applies regardless of nationality or visa type.

Are there any exemptions from the Dubai Tourist Tax?

Currently, there are no exemptions for the Dubai Tourist Tax. Every guest staying in eligible accommodations is required to pay, including UAE residents booking local stays.

Does the tourist tax apply to Airbnb or short-term rentals in Dubai?

Yes. Licensed holiday homes and short-term rentals, including Airbnb properties, must charge the tourism dirham fee to guests, as mandated by the Dubai Department of Economy and Tourism.

How is the Dubai Tourist Tax calculated for longer stays?

The tax is calculated per room, per night, for a maximum of 30 consecutive nights. Stays beyond 30 nights are not subject to additional charges.

Is the tourist tax refundable if I cancel my stay?

If you cancel your reservation before check-in, and no stay occurs, the tourist tax is usually not charged. However, if your cancellation policy includes charges, the fee might still apply. Check with your hotel for specific terms.

What is the purpose of the Dubai Tourist Tax?

The tourist tax helps fund tourism-related projects, infrastructure development, and international marketing efforts to enhance Dubai’s global appeal as a tourist destination.

Where can I find more information about Dubai’s Tourism Dirham Fee?

You can visit the official website of Dubai’s Department of Economy and Tourism for the latest updates and regulations regarding the tourism fee at https://www.dubaidet.gov.ae/.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official tax guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.