Keeping up with tax system changes can be tough. In Dubai, where business is booming, understanding tax laws is key, A tax agent in Dubai offers the expertise you need. They help both big companies and new startups navigate tax rules.

Imagine combining your business skills with a business tax advisory tailored for the UAE, This partnership ensures you follow the rules and saves money, It’s more than just meeting tax requirements; it’s about having a financial guardian.

| mazeed makes your taxes easy, We use smart tools and expert tax advisors to help you with everything from registering your business to filing your annual taxes.

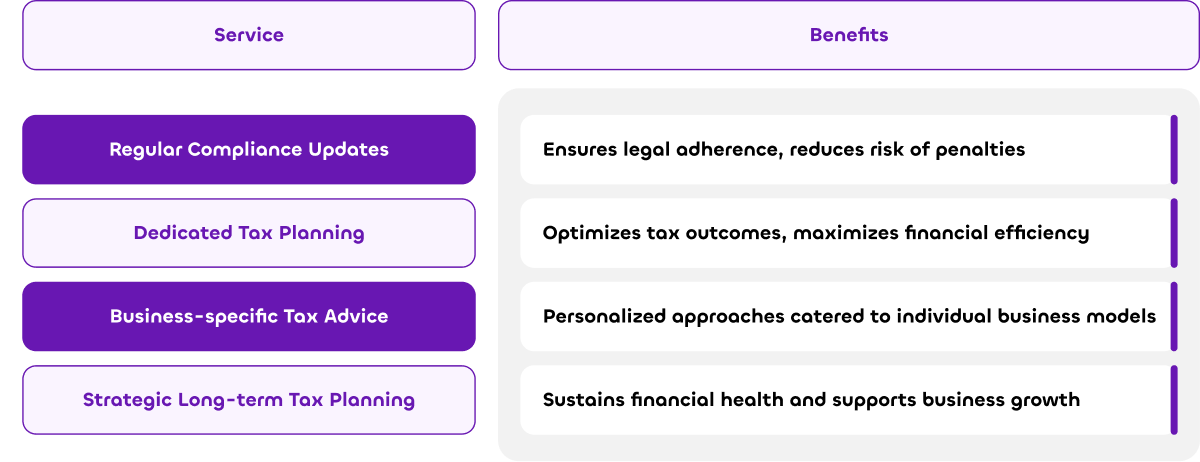

Here are some of the things we can help you with:

|

1- Expertise and Knowledge of Tax Legislation in Dubai

In Dubai’s fast-changing economy, having a registered tax agent is key for success and following the law. It’s hard to keep up with local tax rules, That’s why a tax consultant’s help is so valuable.

2- Staying Abreast with the Latest Tax Laws

It’s important to know the latest tax law changes. A skilled tax consultant near me makes sure your business follows these updates, This keeps your finances safe and avoids fines.

This knowledge is crucial for both big and small businesses. It helps them stay on the right track financially.

3- Understanding Complex Tax Regulations

Dubai’s tax rules, especially in places like DIFC and DMCC, can be tricky. A registered tax agent knows these rules well. They help businesses understand their tax duties.

This knowledge is key to avoiding problems and making the most of tax benefits. It’s all about finding the right balance for your business.

4- Personalized Tax Strategies for Your Business

Every business in Dubai is different, Its size, what it does, and more affect its tax needs. A good tax consultant creates plans that fit your business perfectly.

These plans help you save money and plan for the future, They make sure you’re following the law while also finding ways to save.

How a Tax Agent in Dubai Can Save You Time and Money?

In Dubai’s fast-paced business world, getting a tax agent Dubai can be a smart move. Many businesses don’t realize how much a tax expert can help. They ensure you follow tax laws and find ways to save money.

- Efficiency in Tax Handling: tax agents Dubai know all about local tax laws. They handle your taxes fast and well. This lets you focus on growing your business.

- Strategic Tax Planning: Tax agents help plan your taxes to fit your business. They make sure you only pay what you should. Their advice can avoid big problems and save you money.

- Deft Navigation of Regulatory Policies: Tax agents are experts at understanding tax laws. They’re crucial when laws change. They keep your business up to date and compliant.

Cost Savings via Tax Optimization: You might wonder how hiring a tax agent saves money. Here’s a simple example.

Investing in a tax agent Dubai can save you a lot of money. In Dubai’s fast business scene, having a tax expert is key to success.

Benefits of Hiring a Tax Agent in Dubai

key benefits of working with a registered tax agents dubai, They know the local tax laws well, making them a crucial partner for businesses and individuals, They help with following the latest rules, creating tax plans that fit your needs, and understanding Dubai’s tax laws.

Finding a ‘tax agent near me’ is a big step towards keeping your business safe and healthy. Their knowledge gives you peace of mind. It also saves you time and money, letting you focus on growing your business.

We believe that a registered tax agent is a must-have for a strong financial plan. Working with a tax expert in Dubai helps you meet tax requirements easily, It also opens up chances for saving and improving efficiency. Choosing a tax agent is a smart move for your business’s future and ensures wise tax decisions.

Business tax advisory

mazeed’s tax consulting team offers you the optimal solution, We understand your challenges and provide you with:

- Experienced tax experts: Our team has extensive experience in taxation and helps you make informed decisions.

- Customized solutions: We provide tailored tax solutions to meet your specific business needs.

- Full compliance: We ensure your compliance with all tax laws and regulations.

- Save time and money: We simplify tax procedures and reduce costs.

Don’t let taxes hinder your business growth. Contact us today for a free consultation.

Revolutionize Your Tax Process with mazeed

Tired of the Tax Hassle? Let us automate your tax journey, from registration to annual returns.

How it Works:

- Effortless Data Entry: Simply scan and upload your invoices. Our platform does the rest, extracting data and automating your VAT and Corporate Tax compliance.

- Expert Guidance: Our FTA-certified tax agents optimize your tax strategy, ensuring you pay the least amount possible.

- Real-Time Insights: Get instant access to financial reports, empowering you to make informed decisions.

- Peace of Mind: Our platform guarantees compliance, saving you time and protecting you from penalties.

Why Choose mazeed to registered tax agent in dubai?

- Efficiency: Automate your accounting and tax processes.

- Expertise: Benefit from our FTA-certified tax agents.

- Security: Your data is safe and secure.

- Compliance: Rest assured, we handle all your tax needs.

- Insights: Make data-driven decisions with real-time reports.

Ideal for:

- Business Owners: Streamline your operations and focus on growth.

- Accountants & Freelancers: Boost efficiency and accuracy.

- Accounting Firms: Enhance your services and reduce costs.

Tax consultant near me with mazeedTired of the Tax Hassle? Let us automate your tax journey, from registration to annual returns.Almoosa Business Centre – Umm Hurair Rd – Oud MethaDubai – United Arab Emirates – +971 565 472 460Talk to a Certified Consultant Experience the Mazeed Difference Today! |

FAQs

What are the benefits of hiring a tax agent in Dubai?

A tax agent in Dubai can help a lot. They make sure you follow UAE tax laws, They also explain complex tax rules and offer advice for your business.

By reducing your taxes legally, they improve your finances. This lets you relax and focus on growing your business.

How can a tax advisor near me help my business stay updated with tax legislation changes?

Working with a local tax advisor keeps you informed, They know the latest tax laws. This keeps your tax strategy up-to-date, avoiding penalties.

It ensures your business follows current laws.

In what ways can a registered tax agent offer personalized tax strategies?

A registered tax agent creates plans just for you, They consider your business, industry, and goals. This makes a strategy that fits your needs.

It’s better than a general plan because it’s made for you.

Why is it indispensable to understand complex tax regulations in Dubai?

Understanding tax laws is crucial, It prevents mistakes and helps you save on taxes. A tax consultant can guide you through these laws.

They help you follow the rules and find ways to save.

How does a tax agent in Dubai save me time?

A tax agent handles all your tax needs, This saves you time. You can use this time for other important business tasks.

Can hiring tax agents in Dubai lead to monetary savings for my business?

Yes, tax agents can save you money, They know how to find deductions and credits. They can also help reduce your taxes legally.

This can improve your business’s finances.

What makes a tax agent a key component of my financial strategy in Dubai?

A tax agent is key for your financial plan, They guide you through tax laws. They help you save money and follow the law.

They tailor advice to your business, making it more efficient.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official tax guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.