Managing post-dated cheques in the UAE is all about precision. Whether you’re dealing with property leases in Dubai or paying suppliers in Abu Dhabi, these cheques affect your cash flow early on. Proper accounting for PDC transactions keeps your records accurate and in line with local rules, and understanding the pdc journal entry is key.

This guide makes tracking issued and received cheques easy with real examples. You’ll see how to handle a security deposit cheque for a Sharjah warehouse lease or manage payments to Ajman vendors. We use scenarios from Emirates businesses to make accounting simple, focusing on the crucial pdc journal entry.

Why does this matter? Good PDC management helps predict your funds, which is key in UAE contracts with staggered payments. By matching your books with cheque dates, you get better budgeting insights and can negotiate with vendors more effectively. Every accurate pdc journal entry contributes to this financial clarity.

We’ll show you how to account for PDCs in simple steps, without complicated terms. You’ll learn to make records that pass audits and avoid mistakes like premature revenue or missed liabilities. These skills are vital for keeping cash flow healthy in Dubai’s fast market, especially when making a pdc journal entry.

Understanding PDC in UAE Business Transactions

Post-dated cheques (PDC) are key in UAE business, like buying big items such as property or cars. When you give a PDC, you promise the money will be there on the date set by UAE Federal Law No. 18 of 1993. Dubai Courts deal with over 500,000 cheque cases every year, showing how important they are in keeping deals, and each transaction necessitates a proper pdc journal entry.

But, bouncing a pdc journal entry is serious in the UAE. If your cheque doesn’t go through, you could face criminal charges and financial losses. Banks like Emirates NBD and Abu Dhabi Commercial Bank have strict rules for PDCs. They check the dates and make sure the account has enough money. This rigor underscores the importance of the initial pdc journal entry.

Real estate companies like Emaar use PDCs for payments. It helps both sides – buyers get their property without paying all at once, and sellers get a promise of payment. PDCs are more than just bank tools; they are a legal way to secure deals in the UAE, always accompanied by a corresponding pdc journal entry.

Make sure your PDCs follow Central Bank rules. Check that the cheque details match the contract, and keep records of when you issued them. Knowing about PDCs in finance can help you avoid mistakes, and correctly recording each pdc journal entry is fundamental. For regular payments, think about using digital options like ADIB’s SmartPay, but keep PDCs for important deals. A precise pdc journal entry is always necessary.

In Dubai’s business world, knowing how to handle PDCs is a big plus. Keep track of due dates and talk to the other party if you need to change anything. Doing this well can make you more reliable in a market where PDCs are the top choice for safe deals. This reliability starts with a solid pdc journal entry for every transaction.

Read more: Accrual Accounting Journal Entries

PDC Journal Entry Template

| Date | Voucher No. | Particulars | Debit (AED) | Credit (AED) | Remarks / PDC No. |

|---|---|---|---|---|---|

| dd-mm-yyyy | #### | PDC Issued / Received | PDC #, Bank Name |

Example PC Entries

1- When issuing a PDC (for supplier payment):

| Date | Voucher No. | Particulars | Debit (AED) | Credit (AED) | Remarks / PDC No. |

|---|---|---|---|---|---|

| 01-10-2025 | JV-001 | Accounts Payable | 10,000 | PDC #123, HSBC | |

| PDC Payable (Liability) | 10,000 |

2- When receiving a PDC (from customer):

| Date | Voucher No. | Particulars | Debit (AED) | Credit (AED) | Remarks / PDC No. |

|---|---|---|---|---|---|

| 01-10-2025 | JV-002 | PDC Receivable (Asset) | 15,000 | PDC #456, ENBD | |

| Accounts Receivable | 15,000 |

3- When PDC is cleared (by bank on due date):

| Date | Voucher No. | Particulars | Debit (AED) | Credit (AED) | Remarks / PDC No. |

|---|---|---|---|---|---|

| 15-10-2025 | JV-003 | Bank Account | 15,000 | PDC #456 Cleared | |

| PDC Receivable (Asset) | 15,000 |

PDC Cheque Meaning

At its core, PDC cheque meaning revolves around a cheque where the drawer specifies a future date for payment. This means the cheque cannot be presented for payment before the date written on it. This simple yet highly effective mechanism allows for a significant degree of financial planning and commitment that immediate cheques do not offer.

For instance, a business in Dubai might issue a PDC cheque to a supplier for goods received today, but with the understanding that the payment will clear in 60 days. This provides the business with immediate access to the goods while giving them time to generate the necessary funds from their own sales cycle.

Read more: What is Contra Entry?

PDC Cheque

From a financial management standpoint, PDCs serve multiple purposes across the UAE’s diverse sectors. They can act as a form of short-term credit, a reliable guarantee for future payments (common in rental agreements and property dealings), or a crucial mechanism to regularize cash flows for businesses.

For companies in Abu Dhabi dealing with recurring expenses, large project installments, or even consumer financing, staggering payments through PDC cheque arrangements can significantly ease liquidity pressures.

This flexibility makes them an attractive and widely accepted option for various commercial agreements, from rent payments in bustling urban centers to vehicle loan installments and large-scale project financing.

PDC Meaning Bank

The PDC meaning bank perspective is equally vital in the UAE context: local banks are legally bound not to process these cheques until the specified date. This adherence to the dated instruction adds a crucial layer of security and predictability to the transaction for all parties involved.

This means you can be assured that a cheque marked for, say, August 15, 2025, won’t be cashed prematurely. This legal backing safeguards both the drawer by preventing early debiting of their account and the payee by providing a firm commitment for a future payment.

Read more: Depreciation Entry for UAE Businesses

PDC Meaning in Finance

The PDC meaning in finance extends significantly beyond just a payment instrument; it represents a commitment, a firm promise of future payment, which can be strategically factored into a company’s cash flow forecasts and overall financial planning. This strategic aspect underscores the immense importance of a robust financial management system that can effectively track and manage PDCs, both incoming and outgoing, across different Emirates. Proper management helps maintain healthy liquidity and aids in anticipating and avoiding unexpected financial shortfalls, which is key in the fast-paced UAE market.

PDC Issued Journal Entry

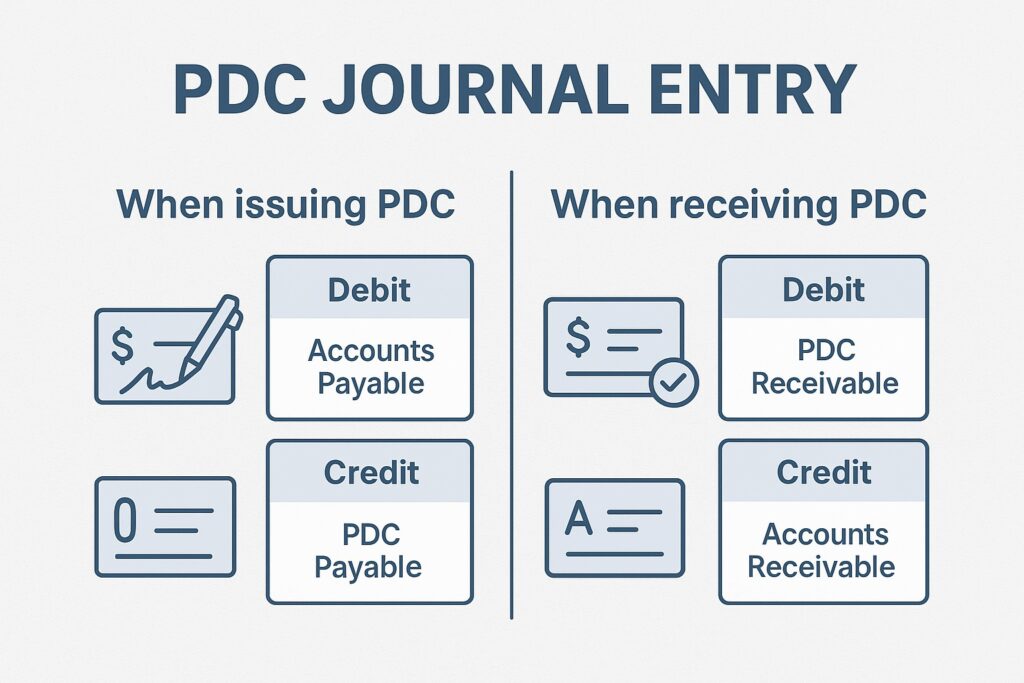

The accounting treatment of PDCs is where much of the complexity lies, and it’s essential for accurate financial reporting. When a company issues a PDC cheque, it’s crucial to remember that the cash has not yet left the bank account. Therefore, a standard cash disbursement entry would be inaccurate at this point. Instead, the accounting reflects a change in the nature of the liability.

The PDC issued journal entry typically involves debiting the relevant expense or asset account (e.g., Purchases, Accounts Payable) and crediting a “Post-Dated Cheques Issued” or “Cheques Payable (PDC)” account. This temporary liability account signifies that while the commitment to pay exists, the actual cash outflow is deferred.

For example, if a construction company purchases building materials for AED 50,000 and issues a pdc journal entry, the PDC issued journal entry would not immediately reduce the bank balance. This meticulous approach ensures that the financial statements accurately reflect the company’s true liquidity position at any given point.

PDC Cheque Received Journal Entry

Conversely, when a company receives a PDC cheque in the UAE, the funds are not immediately available. It would be erroneous to debit the cash or bank account directly. Instead, the PDC cheque received journal entry typically involves debiting an “Accounts Receivable (PDC)” or “Post-Dated Cheques Received” account and crediting the relevant revenue or asset account (e.g., Sales Revenue, Accounts Receivable).

This temporary asset account represents the future inflow of cash. For example, if a trading company sells goods worth AED 20,000 and receives a PDC, the PDC cheque received journal entry would create a temporary asset, acknowledging the impending cash collection. This careful distinction is vital for maintaining accurate cash flow statements and balance sheets, providing a clearer picture of future liquidity.

Experience a streamlined and automated approach to VAT services in the UAE with mazeed. We help businesses navigate the complexities of VAT through:

- VAT Registration: Let us seamlessly guide your business through the VAT registration process, ensuring full compliance with all regulatory requirements from day one.

- VAT Returns Preparation: We take the burden off your shoulders by accurately preparing and submitting your VAT returns promptly, drastically reducing potential penalties and errors.

- VAT Consultancy: Access expert insights and tailored solutions for your most complex VAT issues. We translate regulations into actionable advice.

- VAT Training and Awareness: Strengthen your team’s capabilities with our comprehensive VAT training programs, fostering a culture of knowledge and compliance within your organization.

Reconciliation and Implications for UAE Businesses

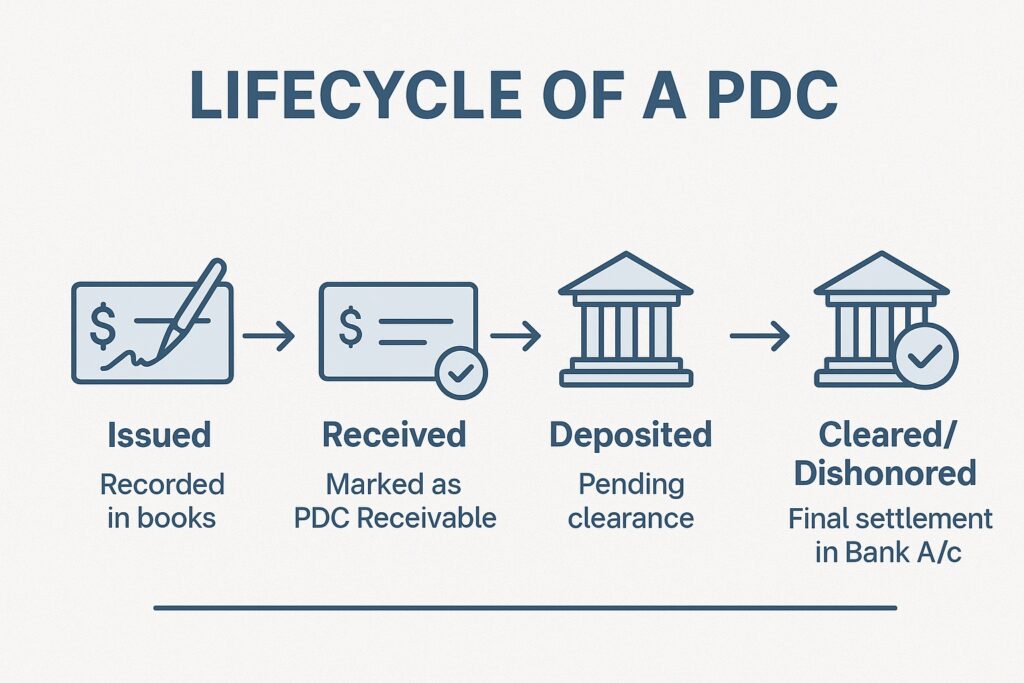

The reconciliation of PDCs is another critical aspect in the UAE’s business environment. As the post-date approaches and then passes, the nature of the PDC changes from a deferred instrument to a current one. For an issued PDC, on the due date, a subsequent entry would be made to reverse the “Post-Dated Cheques Issued” account and finally credit the bank account, reflecting the actual cash outflow.

Similarly, for a received PDC, on its due date, the “Accounts Receivable (PDC)” account would be credited, and the bank account would be debited as the funds are collected and cleared. This systematic process ensures that the financial records are continually updated to reflect the true financial standing of the entity.

The implications of PDCs extend beyond mere accounting entries, particularly in a market known for its strict legal framework regarding cheques. From a risk management perspective, while PDCs offer flexibility, they also carry inherent risks. A PDC cheque can bounce if the drawer’s account does not have sufficient funds on the due date, leading to significant legal and financial repercussions under UAE law, including potential criminal charges in serious cases of cheque dishonor. This necessitates extremely careful due diligence when accepting PDCs, especially from new or unverified clients.

Conclusion

In conclusion, the post-dated cheque is more than just a piece of paper; it’s a sophisticated financial instrument with significant implications for accounting, cash flow management, and risk within the UAE. From the initial PDC cheque meaning as a future-dated payment instruction to its critical role in facilitating commercial transactions, understanding PDCs is indispensable for businesses thriving in the Emirates. The precise application of the PDC issued journal entry and the PDC cheque received journal entry ensures financial transparency and accuracy. Whether from the perspective of the PDC meaning bank or the broader PDC meaning in finance, these instruments require careful handling and meticulous record-keeping to fully harness their benefits while mitigating their inherent risks in the dynamic UAE market.

FAQs: PDC Journal Entry

What is post-dated cheque journal entry?

A post-dated cheque (PDC) journal entry records a cheque issued or received with a future date. Since the cheque cannot be cashed until that date, it is treated as a contingent asset or liability rather than an immediate cash transaction.

What is PDC in accounting?

PDC stands for Post-Dated Cheque. It is a cheque issued with a date later than the current date. In accounting, it represents a promise of payment, not actual payment, until the date mentioned on the cheque.

How to make a journal entry for prepaid expenses?

When a business pays in advance for services or goods, the amount is recorded as a prepaid expense (asset).

Example: Paid AED 12,000 for 12 months’ insurance in January.

How to make a PDC entry in Tally?

In Tally ERP/Prime, a PDC is entered using the Post-Dated Voucher feature:

Enable “Use Post-Dated Cheques” in F11 → Accounting Features.

Record the voucher (Payment/Receipt/Journal) with the cheque date in the future.

Tally will park the entry under PDC until the date arrives, after which it automatically updates ledgers.

What is the journal entry for a cheque issued?

When a cheque is issued (dated today), the entry is:

Dr. Accounts Payable / Expense Cr. Bank

This reduces the bank balance immediately.

How to account for post-dated checks?

Post-dated checks are recorded as Bills Receivable (for cheques received) or Bills Payable (for cheques issued) until the cheque date. They are not treated as cash or bank transactions until maturity.

How to handle post-dated checks?

Received PDCs → Record under “Bills Receivable (PDC)” until cleared.

Issued PDCs → Record under “Bills Payable (PDC)” until presented.

On maturity, transfer to Bank or Cash ledgers.

What is PDC?

PDC stands for Post-Dated Cheque, a cheque dated for a future period. It cannot be uncashed before the written date. It acts as a deferred payment instrument.

Are post-dated checks current assets?

Yes, PDCs received can be classified as current assets, but under “Bills Receivable” instead of “Cash/Bank” until their maturity.

Are post-dated checks accounts receivable?

Yes, when received, PDCs are considered a form of accounts receivable. They represent an amount due from customers but are not yet cash equivalents.

Is a VAT refund a current asset?

Yes. A VAT refund receivable from the tax authority is a current asset, since it represents money expected to be received within a short period (usually less than a year).

Why is petty cash called petty cash?

The term “petty” comes from the French word petit (meaning “small”). Petty cash refers to a small amount of money kept on hand for minor, everyday expenses (e.g., stationery, travel, snacks).

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.