Have you ever stopped asking: are your company’s financial systems truly working for you, or are they holding you back? In today’s fast-paced business world, managing money and data should be smooth, not complicated. Yet, many accounting setups feel rigid and hard to change. Their data acts like a locked vault, instead of a helpful flow of information.

But what if there was a smart way to make these systems flexible and responsive? A design principle that could transform rigid processes into dynamic ones? This idea, crucial for modern finance, is Service-Oriented Architecture, or SOA.

This article will guide you. We’ll explore what is SOA in accounting, explain its different sides, and show how it can solve common financial challenges, making your business more efficient.

What SOA in Accounting Really Means

The full form of SOA in accounts is the Statement of Account. The term SOA in accounting can mean two different things, depending on the context. It’s important to understand both to fully grasp its role in finance.

The Traditional Statement of Account (SOA)

For a long time, and still in many cases, the full form of SOA in accounts referred to the Statement of Account. This is a detailed record of transactions between two parties over a specific time.

- Purpose of SOA:

It gives a clear, step-by-step summary of money owed (debits) and money paid (credits), including invoices and payments. This helps everyone keep track and makes sure records match.

- Key Information about SOA:

It usually includes the starting balance, a list of transactions with dates and descriptions, payments made, and the final balance.

- Why SOA is Needed:

Using a clear SOA template helps avoid confusion, settles disagreements, and keeps accurate records for both customers and suppliers. This traditional SOA meaning accounting focuses on clear financial communication and tracking past activities.

Read more: Accounting Standards in UAE

💡 Smarter Accounting with mazeed

Get real-time insights, fast reports, and full tax compliance with mazeed Accounting Software.

- Save time

- Reduce Costs

- Avoid Mistakes.

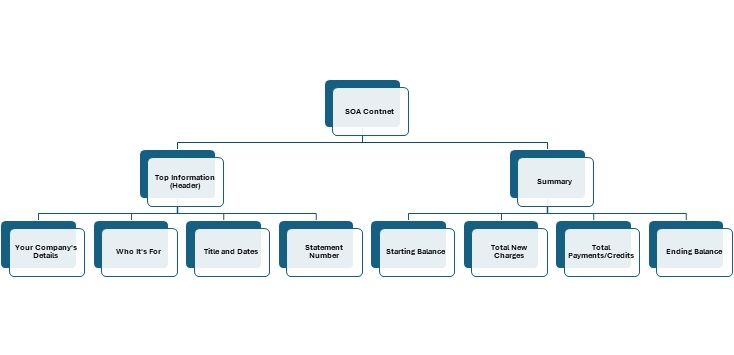

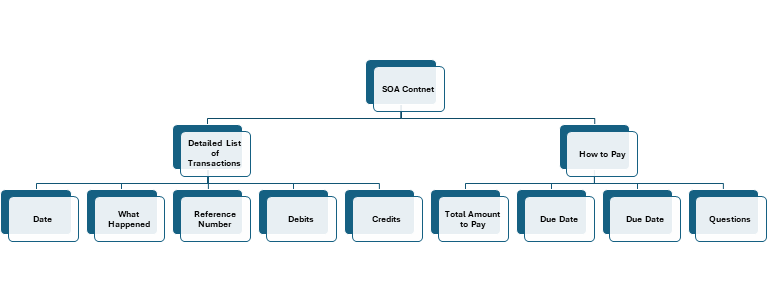

What’s inside a Statement of Account?

When we talk about the content of an SOA full form in accounting, we’re looking at all the parts that make up this important financial paper. It’s designed to give a clear picture of money owed or paid between two companies or people over a set time. It answers the question: what is SOA in accounting supposed to show?

Read more: Accounting Structure for Small Businesses

SOA Template Showing a Customer’s Account:

This table is a basic SOA template. It shows how financial interactions happen over time. A strong SOA template like this is key for good financial relationships. The basic SOA meaning accounting in this sense is about clear transaction reports.

| Date | Description | Reference No. | Debits ($) | Credits ($) | Balance ($) |

| 2025-06-01 | Starting Balance | 3,200.00 | |||

| 2025-06-07 | Invoice #INV-2025-003 | PO-4570 | 950.00 | 4,150.00 | |

| 2025-06-12 | Payment Received | Pymt-125 | 1,500.00 | 2,650.00 | |

| 2025-06-18 | Invoice #INV-2025-004 | PO-4571 | 600.00 | 3,250.00 | |

| 2025-06-25 | Credit Note #CN-002 | 100.00 | 3,150.00 | ||

| 2025-06-30 | Ending Balance | 3,150.00 |

How SOA Powers Your Financial Operations

Are your financial teams struggling with outdated systems? Do manual tasks slow down reporting and create errors? Modern accounting often faces challenges like data being stuck in separate systems, long reconciliation processes, and slow reports. SOA in accounting, specifically as Service-Oriented Architecture, offers powerful solutions to these common problems.

1- Better Data and Accuracy

By centralizing main accounting jobs into reusable services, SOA full form in accounting greatly lowers the risk of data not matching across different systems. For example, one “Customer Details” service means all parts of your company use the same, correct customer information. This consistency is vital for accurate financial reports and clear audit trails, making the SOA meaning accounting stronger for reliable data.

2- Faster Adaptability

The way SOA in accounting is built makes it incredibly flexible. New financial products, changing regulations, or quick shifts in business plans can be handled very fast. Instead of a costly, long overhaul of a big, single accounting system, companies can just add new services or change existing ones without stopping everything. This quick adaptability shows what is SOA in accounting brings to a competitive market.

3- Saving Money and Boosting Returns

Because services within an SOA setup can be reused, it directly leads to big cost savings. You spend less on developing and maintaining systems because you’re using what’s already there instead of building it again. This means new financial projects get started faster and your IT investments pay off more. The financial case for SOA in accounting is very strong.

4- Smoother Business Processes

SOA full form in accounting helps connect many services to create smooth, automated business workflows. For instance, the entire process from taking an order to getting paid can be automated. This involves linking services for order checks, invoice creation, credit checks, and payment processing. This smart, efficient flow highlights the operational power of what is SOA in accounting.

5- Stronger Compliance and Easier Audits

With clear services handling specific financial tasks, it becomes much easier to track and check every transaction. Each service can be designed to follow rules, and detailed records provide clear, unchangeable audit trails. This simplifies following regulations and strengthens internal checks. It shows another key benefit of the full form of SOA in accounts.

💡 mazeed Adapts with Your Business!

Simplify daily accounting tasks, cut down on errors, and stay ready for audits. mazeed brings everything together:

- Bookkeeping

- Reporting

- Tax Management

Real Examples and SOA Template

The ways to use SOA full form in accounting are wide-ranging. They cover almost every part of financial management, providing a flexible backbone for optimized processes.

Let’s look at how an SOA template might work for automated revenue recognition:

- Contract Management Service: Gathers and stores contract details, including how revenue should be recognized over time.

- Event Trigger Service: Finds important events (like delivering goods or finishing a project step) that signal when revenue can be recorded.

- Revenue Calculation Service: Figures out the exact revenue amount to record based on contract terms and triggered events.

- Journal Entry Creation Service: Makes the correct accounting entries for revenue recognition.

- General Ledger Posting Service: Posts these entries to the main accounting ledger, updating financial records.

- Reporting Service: Pulls recognized revenue data to create financial statements and analysis reports.

This example clearly shows how what is SOA in accounting can automate and standardize even the most complex accounting jobs.

The Evolution of SOA in Accounting Documentation

While the fundamental purpose of the Statement of Account remains constant, its form and delivery methods are continuously evolving with the march of digital transformation. The traditional paper statement is increasingly giving way to more dynamic and integrated solutions, further enhancing the power of SOA in accounting.

The future of the Statement of Account lies in its seamless integration into digital ecosystems like what mazeed accounting software provides. This involves:

Electronic Delivery:

Moving away from paper to email, secure portals, or direct system-to-system exchanges for the SOA template. This reduces costs, enhances speed, and improves environmental sustainability.

Real-time Accessibility:

Providing customers and vendors with access to online portals where they can view their Statements of Account in real-time, anytime, anywhere. This empowers self-service and reduces inquiries.

Integration with ERP and CRM Systems:

Automatically generating and updating SOAs directly from enterprise resource planning (ERP) and customer relationship management (CRM) systems. This ensures data consistency and reduces manual efforts, truly embodying the efficiency of what is SOA in accounting can achieve.

Interactive Statements:

Future SOA templates might include interactive elements, allowing users to drill down into transaction details, filter by date ranges, or even initiate payments directly from the statement view.

Despite these technological advancements, the core SOA meaning in accounting – that of transparent and accurate financial summation – will endure. The full form of SOA in accounts will continue to represent this essential financial document, simply delivered and managed with greater digital sophistication.

Read more: How to Prepare a VAT Audit Report in UAE?

FAQs about SOA in Accounting

What does SOA stand for in accounting?

In accounting, SOA stands for Statement of Accounts, a summary document showing the financial transactions between a business and a customer over a specific period.

What is SOA finance?

SOA in finance refers to a Statement of Accounts that provides a detailed overview of invoices, payments, credits, and outstanding balances, helping businesses manage receivables and track customer payments.

What does SOA stand for?

SOA generally stands for Statement of Accounts in finance and business contexts, but it may have other meanings in different industries, such as “Service-Oriented Architecture” in IT.

Is SOA an invoice?

No, an SOA is not an invoice. It is a consolidated record that lists multiple invoices and payments, offering a full view of the financial relationship with a client.

What is SOA in bookkeeping?

In bookkeeping, an SOA is a reconciliation tool used to ensure that the company’s records match those of customers or vendors by listing all relevant transactions.

What is an example of a SOA record?

An SOA record might include invoice numbers, dates, amounts, payment dates, credit notes, and the current outstanding balance between the parties involved.

What is the purpose of a SOA record?

The primary purpose of an SOA is to inform clients or vendors of their current account status, track due payments, and confirm financial accuracy between parties.

When must an SOA be provided?

An SOA is usually sent monthly or on request, especially when there are unpaid invoices, disputes, or for end-of-month account reconciliation.

What is a SOA document?

A SOA document is a formal statement that summarizes all financial transactions over a period, typically issued to a client or supplier to confirm account balances.

What is the SOA on all transactions?

The SOA on all transactions refers to a cumulative record of all invoiced, paid, credited, and pending transactions for a specific client account.

Is a SOA record mandatory?

While not legally required in all jurisdictions, SOA records are considered best practice for transparent accounting and are often requested for audit or reconciliation purposes.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority