Running a business in the UAE means keeping up with constant changes in tax laws, digital regulations, and customer expectations. Between VAT filing, corporate tax compliance, and e-invoicing requirements, it’s no surprise that companies are turning to accounting software in UAE to simplify their financial management.

If you’re a business owner, entrepreneur, or finance manager, this guide will help you understand why accounting software is becoming essential in today’s UAE market, what features to look for, and how it keeps your business compliant and efficient.

Why Accounting Software Matters for UAE Businesses

The UAE is moving fast toward a fully digital economy. The government’s Digital Economy Strategy aims to double the contribution of digital sectors to the national GDP by 2031. As part of this transformation, financial operations are expected to be fully automated and integrated with government systems like the Federal Tax Authority (FTA).

Manual accounting is no longer practical. Errors, delays, and non-compliance can lead to costly fines. Modern accounting software in UAE helps businesses automate bookkeeping, generate FTA-compliant invoices, track expenses, and manage tax submissions, all in one place.

According to the UAE Ministry of Economy, over 94% of the country’s businesses are SMEs. These companies often lack dedicated finance teams, so using a smart accounting solution is the most efficient way to stay compliant without hiring additional staff.

E-Invoicing Will Make Accounting Software Mantaroy in UAE

The UAE’s move toward nationwide e-invoicing implementation means that using accounting software in the UAE will soon become more than just an efficiency choice, it will be a compliance requirement.

The Federal Tax Authority (FTA) has already announced that it is developing an e-invoicing system similar to the ones launched in Saudi Arabia and other GCC countries. Once rolled out, businesses will need to issue, validate, and store invoices electronically in a structured format that complies with FTA standards.

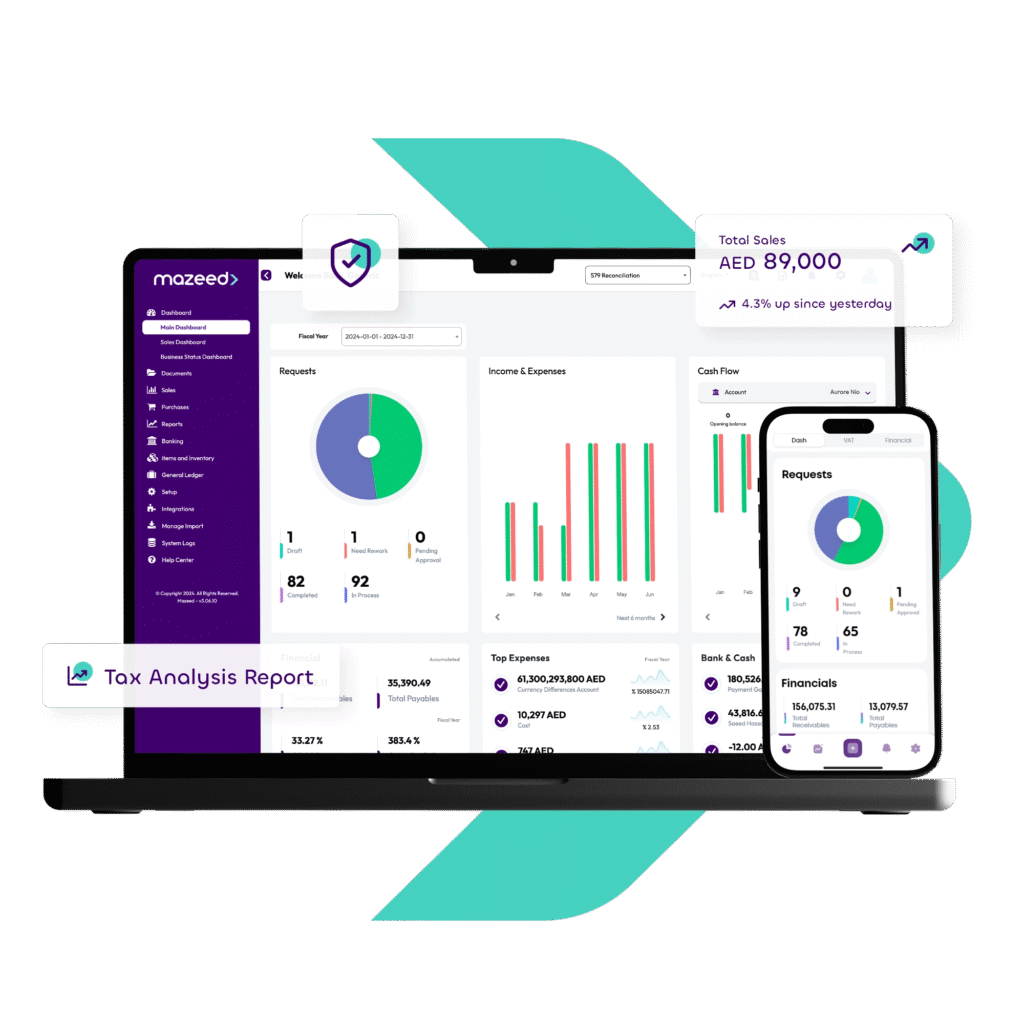

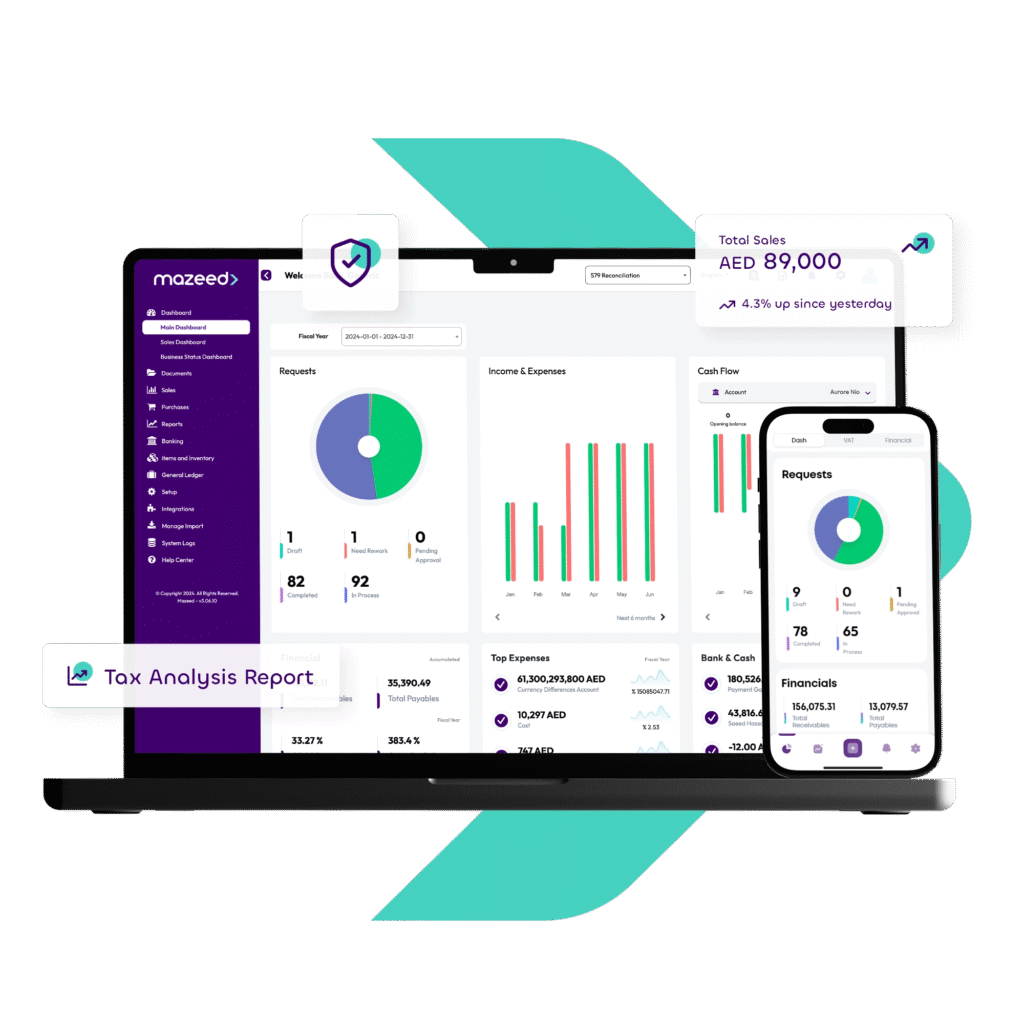

Modern accounting software automates the entire e-invoicing cycle, from creating compliant invoices to sending them securely to the FTA portal and archiving them digitally. Using a platform like mazeed, which is already FTA-compliant in the UAE, ensures your business stays ahead of regulatory changes while simplifying everyday accounting tasks.

Read more: E-Invoicing Implementation Timeline in UAE

💡 Simplify Accounting with Smart Software

Handle invoices, track expenses, and stay 100% tax compliant with mazeed accounting software!

Timeline & Phases of Applying e-Invoicing in UAE

The rollout is phased so businesses have time to prepare.

| Phase | Business Type / Threshold | ASP Appointment Deadline | Mandatory Go-Live Date |

|---|---|---|---|

| Pilot / Voluntary Adoption | Selected taxpayers | — | 1 July 2026 (mazeed.com) |

| Phase 1 (Large Businesses) | Annual revenue ≥ AED 50 million | 31 July 2026 (ClearTax) | 1 January 2027 (comarch.com) |

| Phase 2 (Businesses < AED 50 million) | Medium / Small VAT-registered firms | 31 March 2027 (Sovos) | 1 July 2027 (Sovos) |

| Government Entities | All government bodies | 31 March 2027 (Sovos) | 1 October 2027 (Sovos) |

Key Features to Look for in Accounting Software

Before choosing your accounting system, focus on features that fit the UAE’s business and regulatory environment. Here are the essentials:

- FTA Compliance

The software must support VAT and corporate tax rules, generate compliant invoices, and simplify tax return preparation. - E-Invoicing Compatibility

Ensure the system can produce digital invoices, apply digital signatures, and share data directly with the FTA once the integration phase is live. - Automation

Automate daily transactions, bank reconciliations, and report generation. Automation can reduce human error and save hours of manual work. - Cloud Access

A cloud-based system allows you to manage accounts anytime, anywhere, which is ideal for today’s mobile workforce. - Multi-Currency and Multi-Branch Support

Especially useful for trading, retail, and e-commerce businesses operating across regions. - Real-Time Reporting

Access dashboards that give instant visibility into cash flow, revenue, and expenses for better decision-making. - Integration with Other Tools

Your accounting platform should connect easily with POS systems, e-commerce platforms, and CRMs.

Choosing a solution that offers all these capabilities ensures your business stays one step ahead of upcoming digital mandates.

Read more: Basic Tools of Accounting in UAE

FTA, VAT, and Corporate Tax Compliance in the UAE

Since VAT was introduced in 2018 and Corporate Tax in 2023, compliance has become a major concern for businesses of all sizes. The FTA regularly issues guidelines and deadlines that every registered entity must follow.

Using accounting software in UAE simplifies this process. It helps you:

- Record every taxable transaction automatically.

- Generate VAT return reports in FTA-approved formats.

- Track deductible expenses and taxable income for Corporate Tax.

- Prepare for audits with transparent digital records.

With e-invoicing coming soon, these systems will also ensure invoices are validated and shared with the FTA in real time, removing the risk of manual filing errors.

10 Industries That Need Accounting Software the Most in UAE

Almost every business can benefit from using accounting software, but some industries rely on it more heavily due to complex operations or transaction volumes.

1- Retail and POS

Retailers handle thousands of daily transactions. Integrated accounting software for retail connects with POS systems, tracks inventory, and produces VAT-ready invoices.

2- E-Commerce

Accounting software for e-commerce stores is crucial for managing multiple payment methods and handling frequent refunds. Automated accounting syncs orders, expenses, and VAT calculations seamlessly.

3- Restaurants and Cafés

Accounting software for restaurants deals with high daily sales and supplier payments. Accounting tools track food costs, staff expenses, and branch performance in real time.

4- Construction and Contracting

Contractors manage multiple projects, invoices, and material costs. Project-based accounting software for construction provides accurate job costing and profitability tracking.

5- Trading and Distribution

Wholesalers and distributors depend on inventory management and supplier tracking. accounting software for retail helps manage cash flow and purchase orders efficiently.

6- Professional Services and Freelancers

Invoicing clients, tracking time, and monitoring expenses are much easier through self-employed accounting software.

7- Real Estate and Property Management

Recurring invoicing, maintenance costs, and rent collection can all be managed from one dashboard with the right accounting software for real estate.

8- Healthcare and Clinics

Healthcare accounting software simplifies patient billing, supplier expenses, and VAT exemption tracking for specific services.

9- Manufacturing

From raw materials to finished products, manufacturers need accounting software for manufacturing companies for real-time insights into production costs and margins.

10- Accounting and Auditing Firms

These firms handle multiple clients and need accounting software for accounting firms for secure access, automated reporting, and compliance tracking.

Across all these industries, e-invoicing is becoming a shared priority. Choosing an FTA-ready accounting solution today ensures you’ll meet future digital invoicing requirements without disruptions.

Read more: Is Your Accounting Software UAE Ready?

💡 Your Accounting Made Simple

Save time and reduce errors with smart tools that keep your books accurate and compliant.

How Accounting Software Saves Time and Improves Accuracy

A good accounting system doesn’t just replace spreadsheets; it transforms how you manage your finances. Businesses using automated solutions in the UAE report up to 70% fewer manual errors and 40% faster month-end closing, according to PwC Middle East.

Automation handles repetitive tasks like invoice generation, data entry, and reconciliations, freeing teams to focus on analysis and strategy. Real-time reporting also helps detect issues early, improving financial health and compliance.

Accounting Software Impact on Buiness Performance

Switching to accounting software isn’t just about convenience, it’s about measurable results. Businesses across the UAE and beyond are seeing tangible improvements in productivity, accuracy, and profitability.

1- Save Time and Work Smarter

According to a Zoho survey, 88% of accountants save up to 10 hours per week by using cloud accounting software instead of manual spreadsheets. Automating tasks like bank reconciliation, invoicing, and reporting frees up valuable hours for strategic work.

2- Faster Payments and Healthier Cash Flow

A Billtrust report found that companies automating accounts receivable processes reduce their Days-to-Pay by over 40%, accelerating cash flow and improving liquidity, making it a key advantage for SMEs in fast-moving markets like the UAE.

3- Fewer Errors, Better Compliance

Human errors in accounting can be costly. A Gartner study shows that companies embracing accounting technology experience up to 75% fewer financial errors. This not only strengthens financial accuracy but also supports compliance with FTA regulations and future e-invoicing requirements.

4- Improved Productivity and Cost Efficiency

Automation can dramatically speed up financial cycles. Studies show that automated bookkeeping and smart accounting systems can shorten month-end closings from 10–12 days to just 3–5 days (MSME Strategy). Businesses also save significantly on labor and error correction costs, leading to faster ROI.

5- The Power of AI in Accounting

The integration of AI and automation in accounting has proven to deliver real efficiency gains. Research by Vintti found that businesses using AI-driven accounting tools reduce time spent on repetitive tasks by up to 72% and improve financial accuracy by 65%.

6- Revenue Growth and Business Expansion

Cloud accounting software doesn’t just cut costs, it drives growth. In the same Zoho survey, 70% of businesses reported up to 40% year-over-year revenue growth after implementing automation, thanks to better financial visibility and faster payment collection.

Read more: 9 Best Accounting Software Dubai

FAQs: Accounting Software in UAE

What is the most commonly used accounting software?

The most commonly known accounting software includes mazeed, QuickBooks, and Wave. These platforms are popular for their ease of use, features, and integration and invoicing tools.

What are the three types of accounting software?

The three main types of accounting software are:

1- Spreadsheet software such as Excel, used for manual accounting.

2- Commercial off-the-shelf software like QuickBooks or Mazeed, offering automation and reporting.

3- ERP systems, which integrate accounting with other business operations.

What are the 7 types of accounting?

The seven types of accounting are: financial accounting, managerial accounting, cost accounting, tax accounting, forensic accounting, government accounting, and auditing. Each type focuses on different financial management and reporting aspects.

Which software is best for accounts?

The best software depends on your business type and size. For UAE-based businesses, mazeed Accounting Software is a top choice because it ensures 100% tax compliance, manages daily transactions, and provides real-time financial reports.

Is ERP an accounting software?

ERP is broader than accounting software. It integrates multiple business functions, such as accounting, inventory, HR, and sales, into a single system, while accounting software focuses specifically on financial management.

Is Excel an ERP tool?

No, Excel is not an ERP tool. It is a spreadsheet program used for data entry, calculations, and reporting. While it can handle basic accounting tasks, it lacks automation and compliance features offered by ERP or accounting software.

What is another name for accounting software?

Accounting software is also known as bookkeeping software or financial management software, as it helps record, manage, and analyze a business’s financial transactions.

What is ERP and CRM?

ERP manages internal business operations like accounting, HR, and inventory. CRM focuses on managing relationships and interactions with customers, including sales and service processes.

Final Thoughts

The UAE’s financial landscape is evolving rapidly, and automation is at the heart of that change. Whether you’re a startup or an established company, choosing the right accounting software in UAE is no longer a luxury; it’s a necessity.

With upcoming e-invoicing requirements, expanding tax regulations, and increasing competition, a smart accounting platform keeps you compliant, efficient, and ready for growth.

mazeed Accounting Software combines automation with expert tax and financial support, ensuring your business is 100% ready for the UAE’s digital future.

Start your journey toward effortless compliance and smarter financial management today.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.