Imagine sipping your morning coffee not in traffic, but on your balcony, laptop open, numbers flowing, invoices reconciled, clients happy, and not a cubicle in sight.

This isn’t fantasy; it’s the life of a virtual bookkeeper. In an era where flexibility has become currency, knowing how to start a virtual bookkeeping business can be your gateway to freedom, income, and growth.

But it’s more than just balance sheets and spreadsheets, it’s a digital empire built on trust, precision, and knowing where every dollar is hiding.

With the rise of small business bookkeeping solutions, the world is shifting toward outsourcing, and the demand for virtual bookkeeping services is climbing. Whether you’re starting from scratch or pivoting from a traditional accounting role, this guide gives you every tool you need to not only start but thrive.

Read more: How To Start a Small Business in Dubai

Key Takeaways: How to Start a Virtual Bookkeeping Business in UAE

- Virtual bookkeeping is booming: driven by flexibility, cloud tech, and global demand for outsourced finance solutions.

- Modern bookkeepers need more than number skills: mastering cloud tools, communication, and data privacy is essential.

- Setting up legally is step one: register your business, choose a tech stack, and create clear service agreements.

- The right tools build your credibility: invest in cloud accounting software (like mazeed), document management, and scheduling apps.

- Clients won’t find you by accident: market with SEO, social media, and platforms like Upwork, LinkedIn, and Google My Business.

- Package your services and price with confidence: clarity wins trust and protects your time.

- Growth comes from visibility and trust: content marketing, referrals, and reputation are your long-term engines.

Why Businesses Rely on Virtual Bookkeeping Services?

Virtual bookkeeping has emerged not merely as a trend, but as a financial lifeline for modern businesses. The question isn’t whether businesses should hire remotely anymore; it’s why they haven’t already. From cash-strapped startups to agile mid-sized companies, the appeal is undeniable.

Unlike traditional models that require office space, in-person supervision, and rigid hours, virtual bookkeeping thrives on flexibility, cloud-based software, and results. It’s a streamlined solution that delivers real-time financial clarity, without the cost of cubicles or coffee machines.

A- Cost Efficiency:

Hiring a virtual bookkeeper eliminates the need for payroll taxes, benefits, and physical space. Businesses pay only for what they need, whether it’s a few hours a week or full-time support.

B- Access to Global Talent:

Virtual bookkeeping allows companies to tap into qualified professionals across time zones and borders.

C- Cloud Tech Ecosystem:

Tools like QuickBooks Online and mazeed Accounting Software have made remote collaboration seamless, even for small business bookkeeping solutions.

D- Focus on Core Growth:

Delegating the numbers allows business owners to shift focus to strategy, marketing, and innovation.

The demand is reflected in job boards, too: platforms like Upwork and FlexJobs list thousands of part time online bookkeeping jobs, making it an ideal career path for anyone seeking flexibility without compromising income.

If you’re wondering how to become a virtual bookkeeper, or how to be a virtual bookkeeper in a way that stands out, the opportunity has never been more vibrant, or more necessary. As businesses continue to digitize and streamline, virtual bookkeeping isn’t just the future. It’s the now.

Read more: Accounting Structure for Small Businesses

💡 Less Manual Work. More Happy Clients

mazeed accounting software helps virtual bookkeepers save time, stay sharp, and grow.

- Automate daily transactions

- Track and categorize expenses

- Generate real-time financial reports

- VAT & Corporate Tax compliance

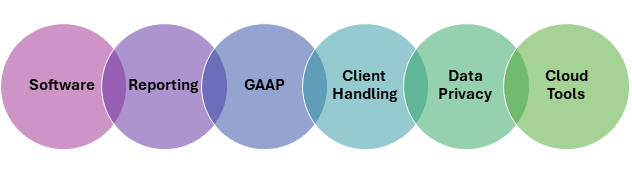

Core Skills Every Virtual Bookkeeper Must Master

Before you know how to become a virtual bookkeeper, pause for a self-audit, not of your bank account, but of your capabilities. You might be asking yourself how to start a virtual bookkeeping business in UAE, but a better first question is: do you have the skills that clients are willing to pay for, again and again?

Small business bookkeeping solutions demand more than just numerical literacy. They require sharp instincts, digital fluency, and the ability to translate financial confusion into actionable clarity. The modern virtual bookkeeper isn’t just a behind-the-scenes bean counter, they’re a trusted financial guide for entrepreneurs who often don’t speak the language of balance sheets.

1- Accounting Software Proficiency:

Become fluent in platforms like QuickBooks Online, Xero, and mazeed Accounting Software. These are the cornerstones of virtual bookkeeping, and clients will expect seamless navigation.

2- Reconciliation and Reporting

Bank feeds, credit card statements, invoices, your job is to make them all sing in harmony. Clients rely on you to generate accurate reports, identify trends, and flag red flags before they escalate.

3- Understanding of GAAP (Generally Accepted Accounting Principles)

Even if you’re not a CPA, a solid understanding of GAAP helps you remain compliant and credible, especially when working with American clients.

4- Communication and Client Handling

Remote work doesn’t mean invisible work. Clients expect updates, summaries, and the occasional Zoom session. Learn to explain finances without jargon, clarity is your selling point.

5- Data Privacy Awareness

Financial data is sensitive. Knowing how to secure and store data responsibly builds trust and gives you a competitive edge in the crowded virtual bookkeeping space.

6- Adaptability to Cloud Tools

From Google Workspace to Slack, Trello, and Dropbox, you’ll need to be comfortable in digital environments where collaboration happens asynchronously.

Read more: Is Your Accounting Software UAE Ready?

How to Start a Virtual Bookkeeping Business in UAE?

Knowing how to start a virtual bookkeeping business in UAE is more than a Google search and a Zoom account.

Behind every successful virtual bookkeeping practice is a legal, operational, and strategic infrastructure that signals credibility to clients and supports long-term scale.

To offer small business bookkeeping solutions that clients trust, you must first build a virtual foundation that runs lean, looks legitimate, and works flawlessly.

Whether you’re planning to offer part time online bookkeeping jobs to freelancers or take on clients yourself, your journey to become a virtual bookkeeper begins with a structured setup.

Step-by-Step Blueprint:

| Step | Action | Purpose |

| 1 | Select a Legal Structure (LLC or Sole Proprietor) | Essential for liability protection and taxation |

| 2 | Register Your Business Name & Domain | Ensures brand ownership and professional presence |

| 3 | Open a Business Bank Account | Keeps financial records clean and separated |

| 4 | Purchase Liability Insurance | Protects you legally, especially in virtual bookkeeping |

| 5 | Obtain Business Licenses (as required) | Some states or countries require registration |

| 6 | Choose Your Tech Stack | The heartbeat of your virtual bookkeeping workflow |

| 7 | Write Contracts & Engagement Letters | Outlines services, fees, and confidentiality clauses |

Tools for Professional Virtual Bookkeepers

How to start a virtual bookkeeping business in UAE? To run a successful a virtual bookkeeping business, your greatest asset, aside from your expertise, is your tech stack. When you’re learning how to start a virtual bookkeeping business in UAE, you’ll quickly realize that technology isn’t just a support system… it is the business.

1. Cloud Accounting Software

This is the heart of every virtual bookkeeping setup.

- QuickBooks Online: Industry standard with robust features, ideal for most U.S. clients.

- mazeed Accounting Software: Cost-effective, especially attractive to startups and tech-savvy clients.

| mazeed is the first accounting software in the UAE with on-demand professional services. Simply scan your invoices, and the platform will handle the rest, from recording daily transactions to filing tax returns. |

2. Document Management

Part of knowing how to be a virtual bookkeeper is organizing chaos into order.

- Hubdoc / Dext: Automates the collection and categorization of receipts and statements.

- Google Drive / Dropbox: Share folders and manage permissions easily.

- PDF Editors (Adobe, SmallPDF): For clean, professional document handling.

3. Scheduling & Communication

Strong client relationships are built on communication and visibility.

- Zoom / Google Meet: For monthly check-ins, walkthroughs, or onboarding calls.

- Calendly: Clients book time with you without back-and-forth emails.

- Slack or WhatsApp Business: Keep communication clear and centralized.

4. Task & Time Management

If you’re handling multiple clients, or subcontracting via part time online bookkeeping jobs, organization is everything.

- Trello / ClickUp / Asana: Keep deliverables, checklists, and deadlines under control.

- Toggl / Harvest: Track hours and assign them to specific clients or services.

5. Payments & Invoicing

How to start a virtual bookkeeping business in UAE? you must collect what it earns, without friction.

- FreshBooks / Wave: User-friendly invoicing for small firms.

- Stripe / PayPal Business: Secure payment processing that clients already trust.

- Melio / Wise: Great for managing international or vendor payments.

How to Find Bookkeeping Clients Online? (Even with Zero Network)

So your business is set up, your software stack is humming, and your skills are sharp. But now comes the million-dollar question, how to find bookkeeping clients online when you don’t know a single business owner?

Proven Tactics:

| Platform | Action |

| Website | SEO blog, service pages, testimonials |

| Optimized headline, weekly posts, direct outreach | |

| Upwork/Fiverr | Client-centric profiles and service descriptions |

| YouTube/Webinars | Video series on bookkeeping basics |

| Referral Partnerships | Collaborate with CPAs and agencies |

Build a personal brand. Be visible. Learn the basics of SEO so your website answers the question: how to start a virtual bookkeeping business in UAE that converts.

Read more: Accounting and Bookkeeping Services in UAE

Virtual Bookkeeping Paying Rates

If you’ve made it this far in your journey to how to start virtual bookkeeping business, congratulations, you’re already ahead of most.

But one crucial decision still stands between you and profitability: pricing. And here’s the truth, many skilled professionals know how to become a virtual bookkeeper, and they can do it, only to undervalue themselves into exhaustion.

Start with packages. Be clear. How to start Virtual bookkeeping is all about clarity, pricing should follow suit.

| Service | Average Monthly Rate |

| Basic Bookkeeping | $300–$500 |

| Full-Service Bookkeeping | $600–$1,500 |

| CFO Advisory | $1,500+ |

💡 mazeed for Virtual Bookkeepers

From invoicing to tax filing, mazeed gives virtual bookkeepers the tools they need to serve more clients and grow their businesses.

- 100% FTA-Compliance

- Faster Process

- Mobile Accounting App

How to Market for a Visual Bookkeeping Business?

You’ve set up your business. You’ve learned how to start a virtual bookkeeping business in UAE. You’ve even landed a few clients. Now what? You market yourself, not just as another virtual assistant with a calculator, but as the go-to virtual bookkeeper businesses trust to organize their chaos, calm their fears, and simplify their finances.

Your Marketing Checklist:

- SEO-optimized website with keywords like how to start virtual bookkeeping business and become a virtual bookkeeper

- Lead magnets: downloadable checklists, free consultations, webinars

- Google My Business profile to appear in local searches

- Email newsletter with value-driven tips

Repetition builds recognition. Keywords like virtual bookkeeping, how to be a virtual bookkeeper, and small business bookkeeping solutions should echo across your marketing touchpoints.

FAQs about How to Start a Virtual Bookkeeping Business in UAE

How much does it cost to start your own bookkeeping business?

Starting a virtual bookkeeping business can cost as little as $500 to $2,500, covering essentials like software subscriptions, website setup, business registration, and marketing tools.

How much can you make virtual bookkeeping?

Virtual bookkeepers typically earn between $25 to $60 per hour. Experienced professionals or those serving niche industries can make $70,000+ annually.

How to start a freelance bookkeeping service?

The quick answer on how to start a virtual bookkeeping business is to start by learning bookkeeping basics or getting certified, choose your target niche, set up your business legally, pick cloud accounting software, build an online presence, and start marketing to potential clients.

How to get clients as a virtual bookkeeper?

Clients can be found through networking, joining freelancer platforms, using LinkedIn, content marketing, referrals, or partnering with accountants or small business consultants.

How much to charge clients as a bookkeeper?

Rates vary based on experience and services but generally range from $300 to $1,000 per month per client, or hourly rates from $25 to $60+.

How to start remote bookkeeping?

Set up secure cloud accounting software (like QuickBooks Online and mazeed), use encrypted file-sharing platforms, manage communication via email or Zoom, and deliver services digitally from anywhere.

How to start bookkeeping side hustle?

Start small with part-time hours, use free tools or trial software, offer services to local businesses, and gradually build a client base while improving your skills.

Is it hard to become a virtual bookkeeper?

It’s not hard if you’re willing to learn. With access to online courses, certifications, and user-friendly software, many people launch bookkeeping businesses within a few months.

Can I start a bookkeeping business with no experience?

Yes, many start with no prior experience by taking online bookkeeping courses, using tutorials, and practicing with demo software to build confidence and credibility.

Can you self teach bookkeeping?

Yes, bookkeeping can be self-taught through free or paid online resources, courses, YouTube tutorials, and hands-on practice with accounting software.

How do I get my first client as a bookkeeper?

Reach out to friends, local small businesses, or post your services on platforms like Upwork, Fiverr, and Facebook groups. Referrals and testimonials help establish trust.

Is bookkeeping profitable?

Yes, bookkeeping is a profitable and scalable business with low overhead costs, consistent demand, and the potential to serve clients remotely worldwide.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority