If you’re running a business in the UAE, understanding the VAT late payment penalty UAE is crucial to avoid hefty fines. Missing VAT payment deadlines can quickly become expensive due to the escalating penalties imposed by the Federal Tax Authority (FTA).

In this guide, we’ll explain everything you need to know about the VAT late payment penalty UAE, the VAT late submission penalty, common mistakes businesses make, and proven strategies to stay compliant. By the end, you’ll have a clear roadmap to protect your business from unnecessary costs and reputational damage.

What Is VAT in the UAE?

The UAE introduced Value Added Tax (VAT) on January 1, 2018, at a standard rate of 5%. This consumption tax applies to most goods and services, and businesses act as collectors of the tax on behalf of the government.

Here are the key points about VAT in the UAE:

- Standard VAT rate: 5% on most goods and services.

- Zero-rated VAT (0%): Exports, international transportation, certain medical and educational services, and the first supply of residential real estate.

- Exempt supplies: Financial services, local passenger transport, and bare land.

- Mandatory registration: Businesses with taxable revenue exceeding AED 375,000 annually.

- Voluntary registration: Available for businesses earning between AED 187,500 and AED 375,000 annually.

VAT is ultimately borne by consumers, but businesses are responsible for collecting it, filing VAT returns, and paying the tax to the FTA.

Read more: How to Prepare a VAT Audit Report in UAE?

What Is VAT Late Payment Penalty UAE?

A VAT late payment penalty UAE is a financial fine imposed on businesses that fail to pay their VAT liabilities by the deadline specified by the FTA.

VAT payment is usually due 29 days after the end of the tax period. Missing this deadline triggers penalties, which increase the longer the payment remains outstanding.

Failing to pay VAT on time can lead to:

- Legal action in severe cases.

- Financial loss due to escalating fines.

- Administrative issues such as additional inspections or audits.

- Reputational damage with clients, suppliers, and regulators.

💡 Stay Ahead of VAT Deadlines!

Avoid penalties with smart VAT tracking, timely reminders, and accurate filing, all with mazeed accounting software.

VAT Late Payment Penalty Structure in the UAE (2025)

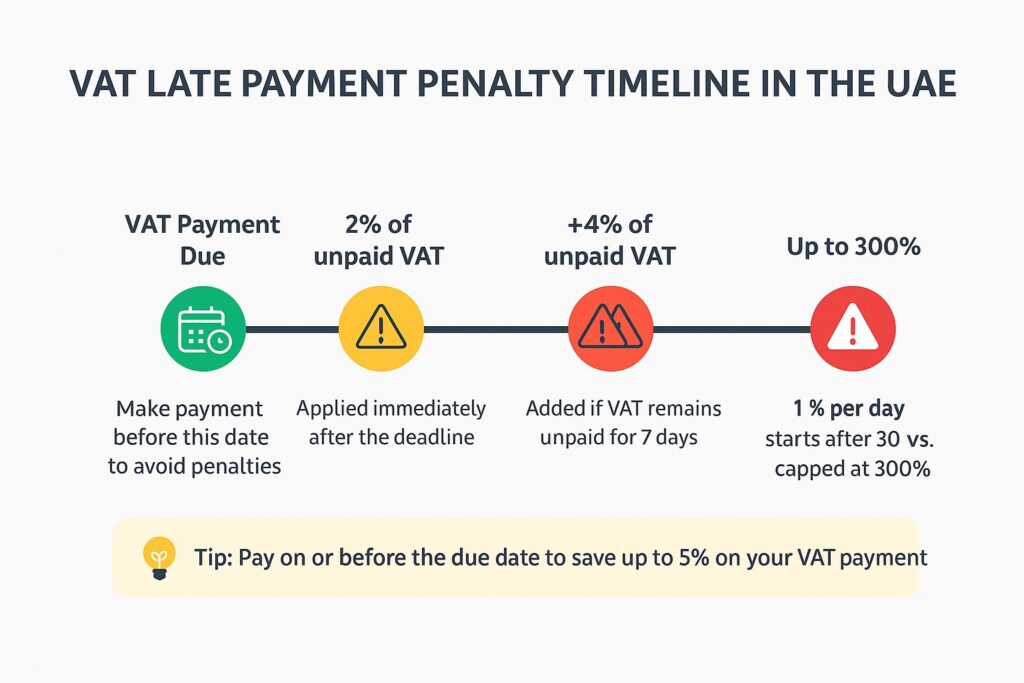

The VAT late payment penalty UAE is progressive, which means the fines increase with each delay stage. Here’s how it works:

1- Immediate Penalty:

A 2% penalty is applied to the unpaid VAT amount immediately after the due date.

2- Additional Penalty (7 Days Late):

A further 4% penalty is added if the tax remains unpaid seven days after the due date.

3- Daily Penalty (1 Month Late):

A 1% daily penalty accrues on the outstanding amount starting one month after the due date.

The daily penalty continues to accumulate until it reaches a maximum of 300% of the unpaid VAT.

Read more: UAE VAT Invoice Format?

Example of VAT Late Payment Penalty in UAE:

If a business owes AED 50,000 in VAT and fails to pay on time:

- Day 1 after due date: 2% = AED 1,000 penalty.

- Day 7 after due date: Additional 4% = AED 2,000 penalty.

- After 1 month: Daily 1% = AED 500 per day until payment or until the penalty hits 300% of AED 50,000.

This progressive structure highlights why prompt VAT payment is crucial to avoid escalating costs.

VAT Late Submission Penalty

The VAT late submission penalty applies when businesses file their VAT returns after the due date, regardless of whether they have paid their VAT liability.

- AED 1,000 for the first late submission.

- AED 2,000 for repeated late submissions within 24 months.

It’s important to note that both the VAT late payment penalty UAE and the VAT late submission penalty can apply simultaneously if a business misses both filing and payment deadlines.

VAT Payment Deadlines in the UAE

Businesses in the UAE are assigned either monthly or quarterly VAT filing schedules, depending on their turnover:

- Quarterly Filing: Most SMEs file their VAT returns every three months.

- Monthly Filing: Businesses with higher turnover are often required to file every month.

VAT returns and payments are due by the 28th day of the month following the tax period.

If the deadline falls on a weekend or a public holiday, the payment should be made on the last working day before the due date.

Other VAT Violations and Penalties in the UAE

The VAT late payment penalty UAE is just one of many penalties businesses may face for non-compliance. Here’s a quick overview of other common violations:

| VAT Violation | Penalty Amount |

|---|---|

| Failure to Register for VAT | AED 10,000 |

| Late Submission of VAT Return | AED 1,000 (first offense), AED 2,000 (repeat offense) |

| Failure to Maintain Proper Records | AED 10,000 – AED 50,000 |

| Failure to Issue Tax Invoice or Credit Note | AED 5,000 per missing document |

| Submission of Incorrect Tax Return | AED 3,000 – AED 5,000 |

| Not Displaying Prices Inclusive of VAT | AED 15,000 |

| Failure to Submit Required Records to the FTA | AED 20,000 |

Avoiding these violations is essential to maintain a good standing with the FTA and to keep operational costs low.

Read more: How to File VAT Return in UAE ?

Common Reasons for Late VAT Payment in the UAE

Businesses often miss VAT deadlines due to preventable issues. Some of the most common reasons include:

A- Cash Flow Problems:

Businesses may not have enough funds available to pay VAT on time due to delayed payments from clients or high operating expenses.

B- Accounting Errors:

Miscalculations in VAT liability or incorrect data entry can delay payments.

C- Lack of Awareness:

New or small business owners may not fully understand VAT deadlines and obligations.

D- System Failures:

Technical issues with the FTA’s e-Services portal or internal accounting software can also cause delays.

Read more: What Is Reverse Charge Mechanism in VAT?

Real-Life Scenario: How Penalties Escalate

Imagine a medium-sized retailer that owes AED 75,000 in VAT but delays payment for two months:

- Day 1: 2% penalty = AED 1,500

- Day 7: Additional 4% penalty = AED 3,000

- Day 30 onwards: 1% daily penalty = AED 750 per day

By the end of the second month, the penalties could easily exceed AED 15,000, on top of the original VAT liability.

This example shows why ignoring VAT deadlines can quickly become a major financial burden.

💡 A Smarter Way to Stay 100% VAT Compliant

mazeed combines smart accounting software with certified tax experts to handle VAT returns, payments, and compliance stress-free.

VAT Fines Discount in the UAE

To support businesses facing penalties, the FTA offers two main discount programs:

- Penalty Redetermination Scheme:

Businesses can have 70% of past fines waived by paying only 30% of the original amount, provided they meet compliance requirements. - Early Payment Discount:

A 5% discount applies if the VAT liability is paid within 15 days of the due date.

These initiatives reduce the financial impact of penalties and encourage prompt compliance.

How to Avoid VAT Late Payment Penalty UAE

Avoiding the VAT late payment penalty UAE is entirely possible with proper planning and systems in place. Here’s how:

- Know Your Deadlines: Mark all VAT filing and payment dates on your calendar.

- Use Reliable Accounting Software like mazeed: Simplify VAT calculations and reminders to minimize errors.

- Maintain Accurate Records: Keep detailed records of all taxable supplies and input VAT.

- Review Returns Carefully: Double-check your VAT return before submission to ensure accuracy.

- Pay Early When Possible: Take advantage of the FTA’s 5% early payment discount.

- Seek Expert Guidance: Work with certified tax consultants to stay compliant with ever-changing VAT regulations.

The Impact of Non-Compliance on Your Business

Failing to comply with VAT regulations doesn’t just lead to financial penalties:

- Damaged Reputation: Clients and suppliers may lose trust.

- Operational Disruptions: Repeated violations may trigger FTA audits.

- Legal Consequences: Significant unpaid VAT may lead to legal action.

Staying compliant is crucial for both financial stability and long-term business growth.

Final Thoughts

The VAT late payment penalty UAE is designed to encourage timely compliance with tax laws. However, missing payment or filing deadlines can result in steep fines that escalate quickly, including the 2%, 4%, and 1% daily penalties that can reach 300% of the unpaid amount.

To protect your business from unnecessary costs and maintain good standing with the Federal Tax Authority, make compliance a priority. By understanding deadlines, leveraging technology, and seeking professional guidance, you can avoid both the VAT late payment penalty UAE and the VAT late submission penalty.

FAQs: VAT Late Payment Penalty UAE

What is the penalty for late payment of VAT?

In the UAE, the penalty for late payment of VAT includes a fixed penalty of AED 1,000 for the first violation and AED 2,000 for repeated violations within 24 months. Additionally, a daily penalty of 4% on the unpaid tax amount applies after the due date, plus 1% monthly thereafter.

What happens if my VAT is filed late?

If VAT is filed late, penalties apply even if the payment is made on time. The Federal Tax Authority (FTA) may impose a fixed fine for late filing and calculate interest on unpaid tax amounts.

How can I remove VAT penalty in UAE?

VAT penalties can only be removed by submitting a reconsideration request to the FTA. The request must provide valid reasons and supporting documents proving that the delay was due to acceptable circumstances.

How to appeal VAT late payment penalty?

To appeal a VAT late payment penalty, you must file a reconsideration request within 20 business days of receiving the penalty notice. Submit all relevant documents and explanations through the FTA’s e-Services portal.

How to remove VAT penalty points?

Penalty points cannot be removed automatically; you need to file a reconsideration request to the FTA and justify why the penalty should be waived or reduced.

What is the interest rate for late payment of VAT?

The interest rate for late payment of VAT in the UAE includes 4% monthly on the unpaid amount starting from the due date, along with an initial fixed fine for the delay.

What is a VAT penalty point?

A VAT penalty point refers to a fine or infraction recorded by the FTA against a business for failing to comply with VAT regulations, such as late filing or late payment.

Is there VAT on late payment charges?

Yes, late payment charges are considered part of the taxable amount if they are linked to taxable supplies, and therefore may be subject to VAT.

How do I calculate late payment interest?

To calculate late payment interest, apply the FTA’s penalty rates: a fixed fine (AED 1,000 or AED 2,000 for repeat offenses), plus 4% monthly interest on the unpaid tax amount starting from the day after the due date.

What is a reasonable late payment fee?

A reasonable late payment fee is one that aligns with the FTA’s guidelines, typically including the fixed penalty and the daily/monthly percentage charged on overdue amounts.

How much interest can I charge for late payments?

Businesses can charge late payment interest according to their payment terms, but the FTA’s statutory rates for VAT late payments are fixed and must be followed.

What is the difference between a missed payment and a late payment?

A missed payment occurs when no payment is made at all by the due date, while a late payment refers to paying after the deadline but eventually settling the due amount. Both may incur penalties under UAE VAT law.

Disclaimer: This publication is for informational purposes only and should not be considered professional or legal advice. While we strive for accuracy, we make no guarantees regarding completeness or applicability. mazeed, its members, employees, and agents do not accept or assume any liability, responsibility, or duty of care for any actions taken or decisions made based on this content. For official guidance, please refer to the UAE Ministry of Finance and the Federal Tax Authority.